One of the blog’s key themes is that you can get rich through disciplined investing in stocks and learning how to avoid the short-term traps that keep us from earning our fair share of market returns. Owning stocks is supposedly the easiest way to build wealth – buy a basket of ETF’s or mutual funds, turn off CNBC, don’t check your balances, and add money to your account whenever you have extra long-term cash.

If only.

Because markets are volatile, money matters are emotional, and we’re not built to handle financial stress, sticking to the basics becomes difficult. One short-term trap is recency bias, and while we’re seeing it play out right now in many ways, the decision by some investors to ignore international stocks is my focus here.

Recency bias in investing occurs when investors place a heavy emphasis on things that just happened and ignore history. Expecting Tesla stock to keep going up forever because it’s been on a tear, or that a market that’s struggling will continue to do so are two examples. This takes us to international stocks.

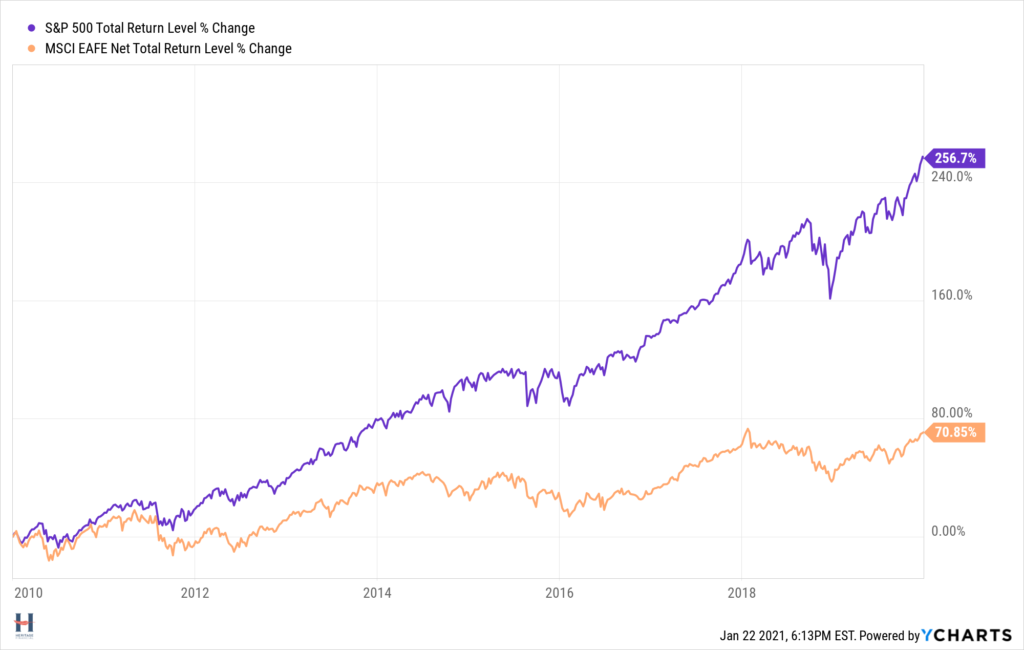

In the decade that just ended (2010 – 2019), U.S. Stocks (S%P 500) returned 256.7%, and international stocks (MSCI ACWI) returned only 70.85%. Investors took notice and ignored international stocks.

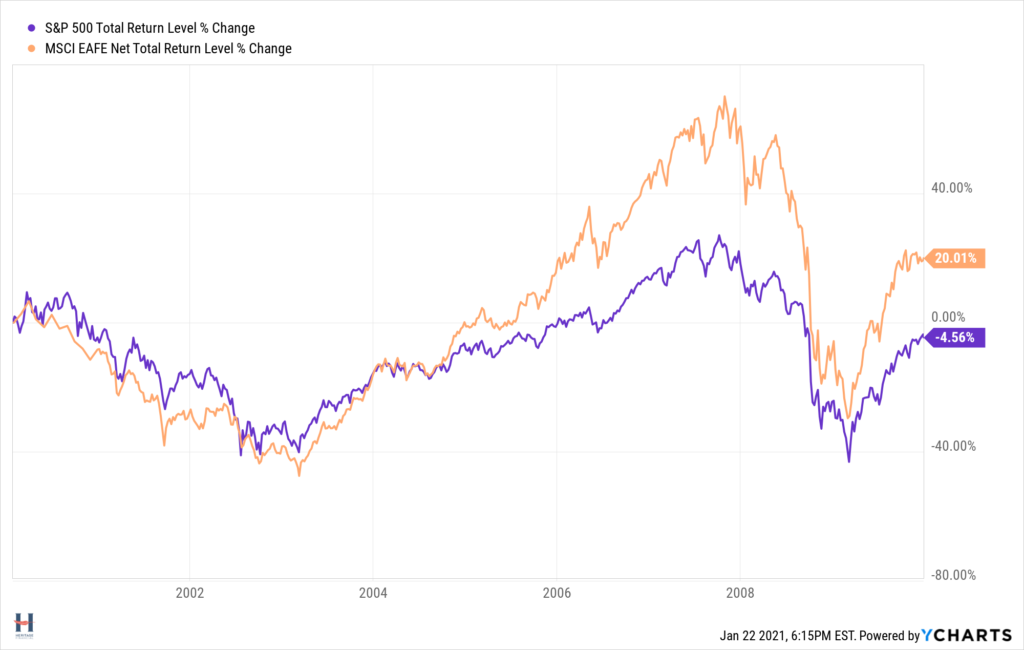

However, the decade prior (2000 – 2009) was a different story as you can see in this chart. U.S. stocks were negative and you made money internationally.

Chasing performance gets you in trouble. Diversify and hold because diversification always leads to winners and losers. And you need to stick with the losers for the sake of your plan

Investing in international stocks makes sense for other reasons as well. The Vanguard team just wrote a white paper about this. Check it out for the full read. Their main points are:

- International stocks are cheaper than U.S. stocks . As such, you should expect higher returns.

- Adding international stocks smoothes out returns, and they identify a sweet spot at about 35%.

- International investing allows you to own some great companies like Toyota, Novartis, Alibaba, etc.

- International dividend yields are higher.

______________________________________________________________________________________________________________________

Further Reading: 5 Reasons to Believe in Emerging Markets Stocks