I prefer to avoid politics in my client conversations and personal finance content. You risk ticking people off with a topic that’s not very relevant to their finances anyway. But ignoring it this week feels forced, so here are my brief election thoughts before getting into the possible financial implications.

The Election

I can’t recall the last time I was so wrong about something like I was in thinking that Vice President Harris would win the electoral college big. My theory was that President Trump was more well-known so undecideds and independents would break her way, and she’d receive overwhelming female support.

I’ve had better theories.

The Vice President won the female vote, but by about half as much as President Biden. She did well with independents, but again not as well as the Democrats did in 2020 (and independent turnout was eight percentage points higher). President Trump grew his voter base, so undecideds (and others) swung his way, while Vice President Harris received softer support than President Biden from Democratic core constituencies.

Besides that my analysis was great.

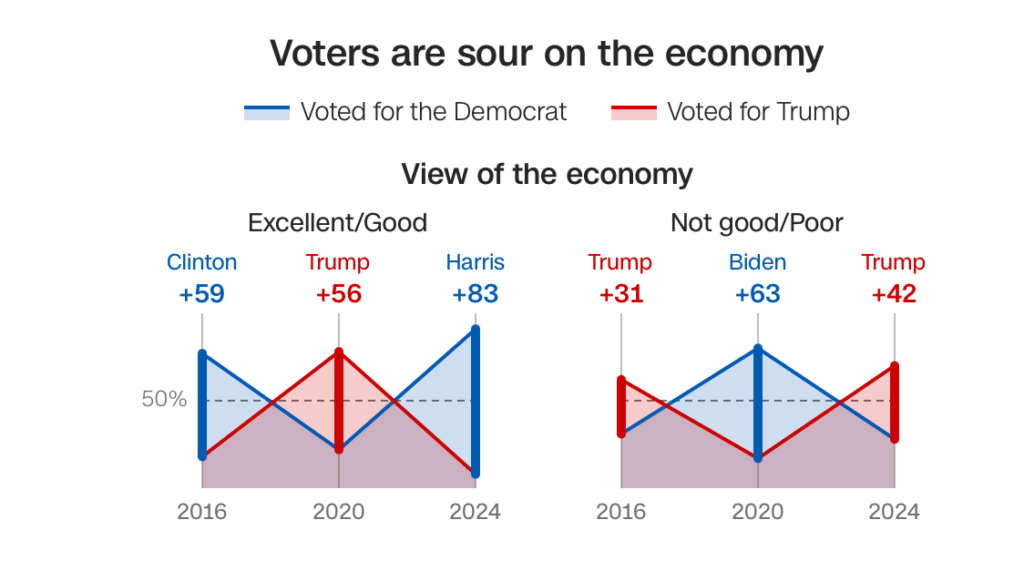

I also ignored the reminder I share with clients: the economy drives election outcomes more than the outcomes drive the economy. The winner of the last three presidential elections won massive support from voters upset with the economy. And people aren’t happy with the economy.

Next time I’ll just stay in my lane and remind myself that just because I have two brain cells that work in one topic doesn’t mean they do elsewhere.

Investments and the Economy

OK, self-reflection done and back to the regularly scheduled money talk programming. We discussed the investment implications on today’s Wealthy Behavior podcast. Bob and I focused on:

- The immediate market reaction: U.S. stocks were up over 2.5%, and small caps up close to 6%. International markets and bonds were down.

- The “Trump trade”: Higher growth expectations from tax cuts and deregulation helps U.S. stocks, tariff fears hurt international markets, and deficit concerns can cause yields to rise. Bond yields have backed down since we recorded, which makes for a more consistent reaction to the election in my view than when bonds sold off initially.

- 2016 vs. 2024: Yields were below 2% in 2016, inflation wasn’t an issue, and U.S. stock market valuations were lower. The setup now is more challenging for U.S. stocks, and we may be late in the economic cycle. That doesn’t mean short-term bad news as valuations tell you very little about the next twelve months, and late cycle can deliver the strongest equity returns. But if we have one concern, it’s that inflation could rise.

- International markets: While they could be hurt by the Trump trade continuing, valuations are more attractive, and it makes sense to remain diversified in this market.

Be sure to listen to the whole thing as we got into the Fed and what we’re seeing in the labor market, real estate, Goldman Sachs’s call for 3% stock returns for the next decade, and more.

Available via this link or wherever you get your podcasts

We’d love to hear from you! Email us questions, ideas, or feedback at wealthybehavior@heritagefinancial.net.