Featured In

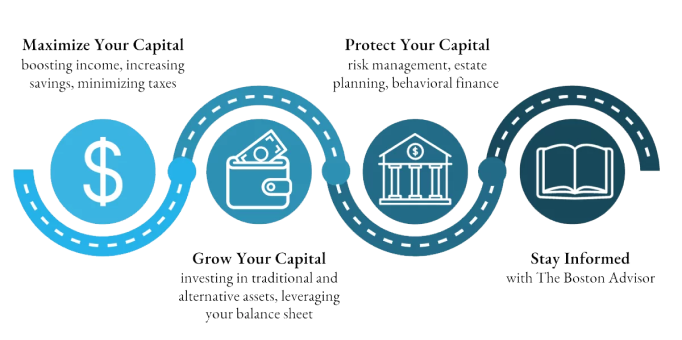

My Approach to Helping You

My name is Sammy Azzouz. I run a wealth management firm in Boston and would like to help you ignore the noise and build toward a successful retirement through my Beyond the Basics Roadmap, aspects of which are shared through this blog, my personal finance book, and on Heritage Financial’s bi-weekly podcast, Wealthy Behavior.

How to Recreate Your Paycheck in Retirement

The retirement planning strategies most people get wrong - and how to get them right

45-minute comprehensive training revealing the retirement income system I've refined over 24 years

Wealthy Behavior Podcast

Wealthy Behavior digs into the topics, strategies, and behaviors that are key to building and protecting personal wealth and living a rich life.

Beyond the Basics Book

If you already know the financial planning basics, the fundamentals, and the mistakes to avoid, but are uncertain what comes next to build your wealth, this personal finance book is for you.

Get Started

If you would like help with your finances, please complete my form or click the link below to schedule a call with me.

"*" indicates required fields