Table of Contents

Part Four in my Planning for Retirement Series based on my How to Recreate Your Paycheck in Retirement class.

Part one covers why you need to invest for retirement: it’s likely to be longer than expected due to increased life expectancies and people often retiring sooner than planned, inflation erodes purchasing power by half during retirement, and we need portfolio growth on top of our savings to fund a long retirement.

Part two focuses on figuring out how much you need to retire, which means determining a safe withdrawal rate from your retirement portfolio, why the 4% rule is a good starting point, and how you can deviate it from it based on your specific financial plan.

Part three looks at how to accurately build your retirement budget even if you’re years away from retiring by capturing your current spending accurately and making important retirement adjustments to it.

The Tax-Free Roth Bucket

When it comes to retirement planning, most people focus on accumulation—building the nest egg. But you also need to focus on tax-minimization, both during the accumulation and decumulation phases. A powerful and overlooked tax-planning strategy involves building out the tax-free Roth IRA bucket to provide greater flexibility and control over your taxable income.

Why the Roth Bucket Makes Sense

The Roth IRA’s primary benefit is that since it’s funded with after-tax dollars, the growth is tax-free, and is withdrawn tax-free in retirement. This creates a powerful hedge against future tax rate increases. A tax-free income stream in retirement also provides several key advantages:

- Flexibility and Control: Unlike traditional IRAs and 401(k)s, Roth IRAs have no required minimum distributions (RMDs) for the original owner.

- Tax-Efficient Income: In retirement, you can use your Roth IRA as a flexible, tax-free income source. This can be especially useful for managing taxable income to potentially reduce how much your Social Security bene3fits are taxed and keep your income below thresholds that trigger higher Medicare premiums.

- A Tax-Free Legacy: A Roth IRA can be an excellent way to pass wealth to your heirs, as beneficiaries can generally take tax-free distributions.

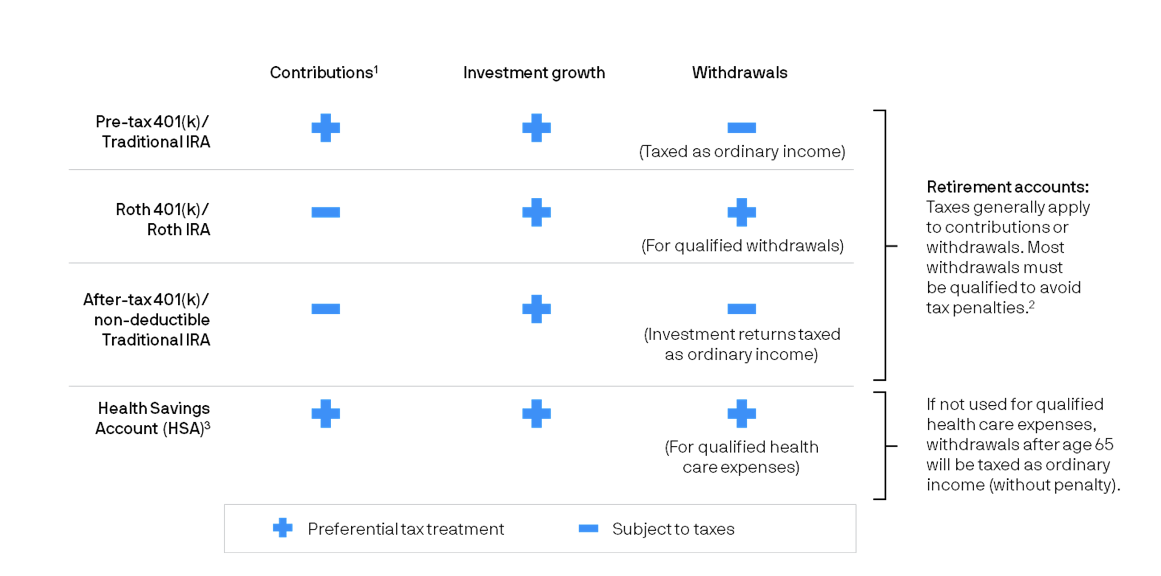

Tax implications for retirement savings by account type

1Income and other restrictions may apply to contributions. Tax penalties usually apply for early withdrawals. Qualified withdrawals are generally those taken over age 59½; qualification requirements for amounts converted to a Roth from a traditional account may differ; for some account types, such as Roth accounts, contributions that are withdrawn may be qualified. See IRS Publications 590 and 560 for more information.

2Withdrawals from after-tax 401(k) and non-deductible IRAs must be taken on a pro-rata basis including contributions and earnings growth. For non-deductible IRAs, all Traditional IRAs must be aggregated when calculating the amount of pro-rata contributions and earnings growth.

3There are eligibility requirements. Qualified medical expenses include items such as prescriptions, teeth cleaning and eyeglasses and contacts for a medical reason. A 20% tax penalty applies on non-qualified distributions prior to age 65. After age 65, taxes must be paid on non-qualified distributions. See IRS Publication 502 for details.

Source: J.P. Morgan Asset Management.

“A powerful and overlooked tax-planning strategy involves building out the tax-free Roth IRA bucket to provide greater flexibility and control over your taxable income.”

How to Fill Your Roth Bucket

There are two primary ways to fund the Roth IRA bucket for those who make to make to be eligible to contribute directly.

The Backdoor Roth Contribution:

If your income is too high to contribute directly to a Roth IRA, you can make a backdoor Roth contribution. This is a two-step strategy that allows high earners to bypass the IRS income limits:

- Step One: Make a non-deductible (after-tax) contribution to a Traditional IRA.

- Step Two: Immediately convert those funds to a Roth IRA

This strategy works because there are no income limits on converting a Traditional IRA to a Roth IRA. A critical point is the “pro-rata rule,” which states that if you have a mix of pre-tax and after-tax funds in any of your IRAs, the conversion will be taxed proportionally. To avoid this, it’s best to have no pre-tax funds in a Traditional IRA when you do the conversion.

There’s also something known as the Mega Backdoor Roth 401(k) conversion that’s not available to everyone as the eligibility depends on income limits and your retirement plan’s features. You can learn about it here.

The Roth Conversion in Retirement

This strategy is particularly useful for retirees who find themselves in a lower tax bracket than their working years. By strategically converting funds from a Traditional IRA or 401(k) to a Roth IRA, you can pay a lower tax rate now in exchange for a tax-free future. You’re getting the best of both worlds, the tax break from contributing to the retirement account when you’re in higher brackets and pulling it out and putting it into a Roth when you’re in lower brackets. Building a detailed financial plan with an advisor can help you project when you’ll have lower tax-bracket years that are ideal candidates for conversions.

Conclusion

Whether you are a high-income earner using a backdoor contribution or a retiree doing conversions at a lower tax bracket, building a Roth IRA bucket creates tax-free income and allows more control over your financial future.

Frequently Asked Questions

1) What’s the main difference between a Roth IRA and a Traditional IRA for retirement taxes?

Roth IRA contributions are made with after-tax dollars, so qualified withdrawals in retirement are tax-free. Traditional accounts often give an upfront deduction, but withdrawals are taxable later. That difference matters when you’re managing taxable income, Social Security taxation, and Medicare premium thresholds. Roth IRAs also have no required minimum distributions for the original owner, which can add flexibility. The best mix depends on today’s bracket, future bracket expectations, and your cash-flow needs. Tax rules change, so build options, not guesses.

2) How does a backdoor Roth contribution actually work, and what can go wrong?

A backdoor Roth is usually two steps: make a non-deductible contribution to a Traditional IRA, then convert that amount to a Roth IRA. The complication is the pro-rata rule. If you hold other pre-tax IRA money, part of your conversion becomes taxable. Many people “clear the deck” by rolling pre-tax IRA assets into an employer plan if allowed, then converting. Track your after-tax basis carefully and file the right tax forms each year. Timing matters, but paperwork matters even more.

3) What is a Roth conversion, and when does it usually make sense?

A Roth conversion moves money from a pre-tax account (Traditional IRA or 401(k)) into a Roth IRA and you pay income tax on the amount converted. Conversions can make sense in years when your taxable income is temporarily lower, so you lock in a lower rate now for tax-free growth later. Conversions may also reduce future RMDs, which can help manage Medicare surcharges. They are not reversible, so decide the amount and timing with care. Run projections before you convert.

4) What does “tax diversification” mean, and why is a Roth bucket part of it?

Tax diversification means having different “buckets” to pull from in retirement: taxable, tax-deferred, and tax-free. A Roth bucket gives you a tax-free lever you can use to control taxable income in any given year. That can help you smooth taxes over time and respond to surprises like big medical costs, market drops, or a one-time expense. It also supports legacy planning, because beneficiaries can often receive Roth distributions tax-free. Flexibility is the whole point. Retirement often demands that flexibility, too.

5) What are common mistakes people make with Roth strategies (backdoor or conversions)?

Common mistakes include ignoring the pro-rata rule, converting too much in one year and jumping tax brackets, and forgetting state taxes. People also overlook Medicare IRMAA thresholds and how conversions can increase the taxation of Social Security. Another issue is poor recordkeeping of non-deductible IRA basis, which can lead to paying tax twice. Finally, some investors convert without a plan for paying the conversion tax bill, which reduces the strategy’s benefit. The fix is planning, pacing, and tracking every detail.