Our investments are simply not aware that it takes 365-1/4 days for the earth to make it around the sun.

Warren Buffett – 1966 Buffett Partnership Letter

With a new year, the world and the people in it reset in many ways. I started with the Buffett quote above because your investments don’t. They’re not programmed to move in calendar year chunks like other parts of your life. Markets move in cycles, directional momentum exists, and economic trends continue despite the new word of the day dictionary on your desk.

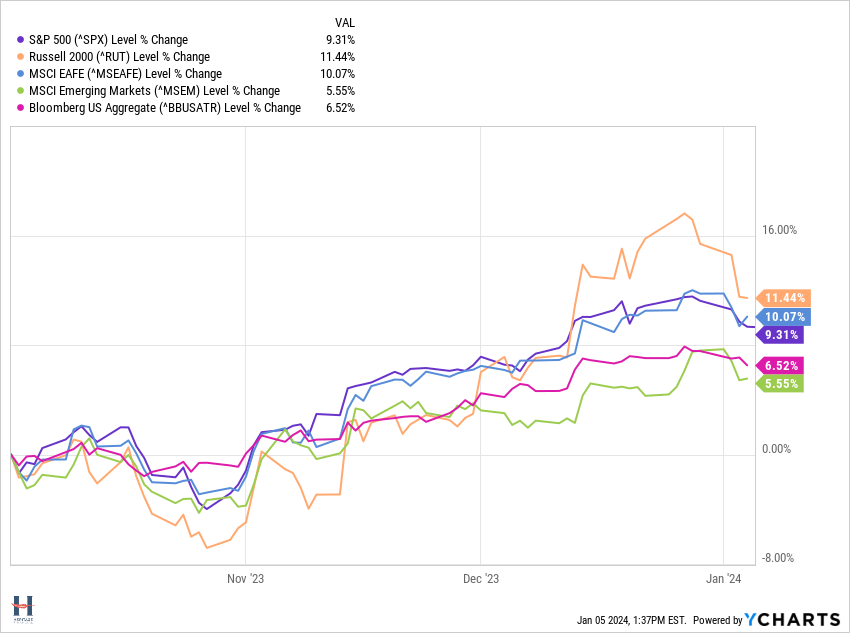

Stocks and bonds are down slightly this shortened trading week, but they’re coming off an amazing 4th quarter driven by good inflation news and reasonable expectations that the Fed will cut rates this year.

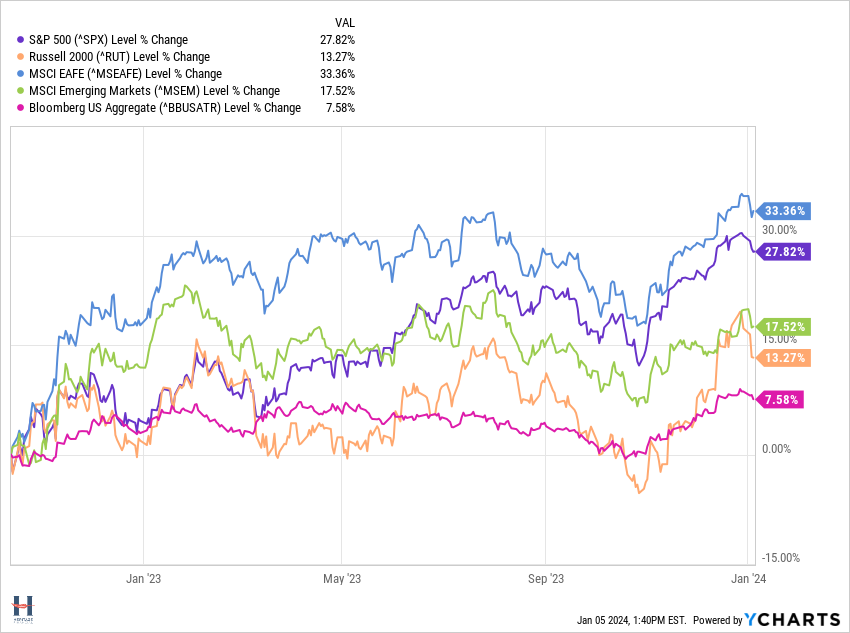

Stocks and bonds are also continuing a nice run that began in October, 2022 off the bear market lows.

Investment Conversation

This week Bob Weisse and I discussed this and more in our monthly podcast session about the markets and investing landscape.

Monthly Market Update: A Merry December

Favorable inflation reports, which the Fed recognized and a more balanced labor market, led to strong fourth quarter returns.

We discuss takeaways from the markets in 2023, our 2024 market expectations, REITS, interest rates, and changes coming in residential real estate.

Available through the link below and wherever you get your podcasts.

Budgeting

Creating and tracking a budget has financial planning benefits, although it can be an arduous task. As I recommended in Beyond the Basics: Maximizing, Allocating, and Protecting Your Capital:

“Track your expenses, at least temporarily, to know where your money is going…Do it long enough to get solid information about your spending habits in order to make improvements. And if you don’t continue tracking every week, month, or year, revisit it often enough to jeep your numbers accurate…Tracking allows you to find any smaller things worth attacking like recurring monthly expenses for items you don’t use or need. It can also reassure you about the small indulgences you take that don’t add up to much.”

A new year is a good time to start if you haven’t done it in a while.

There are lots of budgeting tools. This article highlights some popular apps. I used to use Mint, but it became difficult to keep the connections live to all different accounts and it’s no longer an option. If you don’t want to use an app or tool, what I’ve done instead is build my own spreadsheet and downloaded bank and credit card transactions into it and then categorized those once a month.

If you’ve done a good job budgeting and need some help organizing the rest of your finances, here’s a good checklist for you to utilize – Your Financial Planning Checklist.

Looking to learn more about investing and finances this year, but don’t know where to start? Best Financial Literacy Books has you covered.

Got questions?

I’m always happy to hear from readers and help in anyway I can.