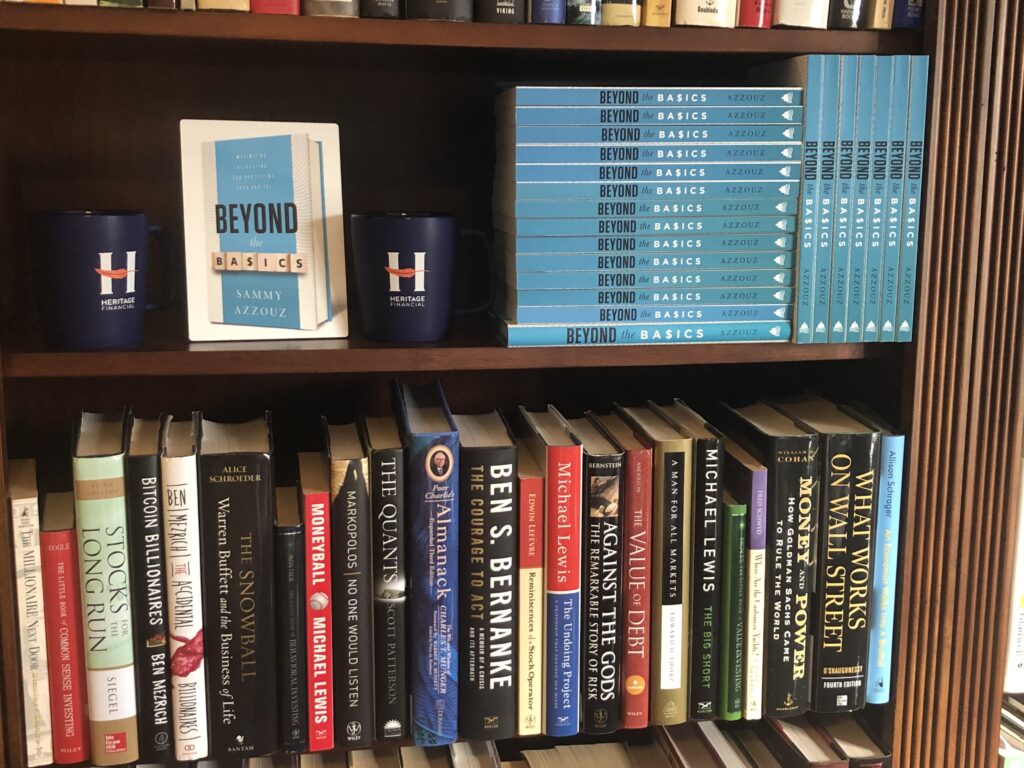

Best Financial Literacy Books

Here’s a running list of the best financial literacy books broken down by category and expected takeaways that you can work through based on interest level and time.

The Hall of Fame

The financial literacy books everyone should read. Important baseline information. Not too technical.

The Millionaire Next Door by Thomas Stanley and William Danko

My favorite financial literacy book. It breaks down who the wealthy are in America, how much they spend in important categories, and what they did to build and keep their wealth.

My review: The Millionaire Next Door

The Psychology of Money by Morgan Housel

Focuses on the harder to learn soft money skills you need.

My review: The Psychology of Money

The Little Book of Common Sense Investing by John C. Bogle

Teaches investment basics and what drives market returns. The advice to ignore international stocks and only index needs updating, but this book can teach you a LOT.

A Deeper Dive

More information about certain Hall of Fame topics.

Stocks for the Long Run by Jeremy Siegel

Stocks are an excellent way to build wealth, and this book is the authority on long-term stock investing and so much more.

All About Asset Allocation by Richard Ferri

Your investment return is primarily driven by your asset allocation, and this book covers the topic well.

The Little Book of Behavioral Investing by James Montier

All the investment knowledge in the world won’t help you if you cannot avoid behavioral investment mistakes.

Market History

“History doesn’t repeat itself, but it often rhymes” – Mark Twain

Bull! A History of the Boom and Bust, 1982 – 2004 by Maggie Mahar

A detailed look at the phenomenal market boom of the 80’s and 90’s.

Manias, Panics, and Crashes by Charles Kindelberger

A history of financial crises dating back to the South Sea Bubble.

Too Big to Fail by Andrew Ross Sorkin

The definitive account of the credit crisis that led to the Great Recession. Reads like a thriller.

Lessons in Unique Places

Moneyball by Michael Lewis

Perhaps the best financial literacy book out there is a baseball story about how a team without resources competed with rich teams by focusing only on the numbers.

The Snowball: Warren Buffett and the Business of Life by Alice Schroeder

The greatest investor of all-time, the big guy himself, profiled in this biography. Here’s his story. Here’s how he did it.

A Conspiracy of Paper by David Liss

The historical fiction thriller about wealthy stock trades, market manipulation, and the South Sea Bubble is a fun way to learn about money.

Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger Lowenstein

Before the Civil War, the government had no authority to raise taxes, no central bank, and no currency. To win the war, all these things were remedied (and more) and the greenback dollar was created.

Great Stories that Teach

The Quants by Michael Patterson

Mathematical brilliance, hubris, and debt fuel the fortunes of the investors profiled here and cause them to go bust.

Bitcoin Billionaires by Ben Mezrich

A sequel of sorts to Accidental Billionaires, it chronicles the Winkelvoss comeback and explains bitcoin well.

No One Would Listen by Harry Markopolos

One guy tried to warn us about Bernie Madoff. One guy had it figured out and “no one would listen.”