A Personal Finance Blog with a Mission

My name is Sammy Azzouz, JD, CFP®. I run a wealth management firm in Boston and help successful individuals and business owners use a Beyond the Basics Roadmap to make the right financial decisions to build and protect their wealth.

Aspects of this roadmap are shared in this blog, my personal finance book, and on Heritage Financial’s bi-weekly podcast, Wealthy Behavior.

Take Your Finances Beyond the Basics

If you already know the financial planning basics, the fundamentals, and the mistakes to avoid, but are uncertain what comes next to build your wealth, this personal finance book is for you.

I’ve been published or featured in several news outlets, including Barron’s, Forbes, The Ringer, Yahoo Finance, and US News & World Report. In 2023, Investopedia put me on their Top 100 Financial Advisor list of the country’s most engaged, influential, and educational financial advisors.

Awarded 7/11/2023. No compensation was provided or received in exchange for the ranking.

My Boston based wealth management practice focuses on business owners, although our team serves a diverse client base who typically have one thing in common: they need help getting serious with all aspects of their finances.

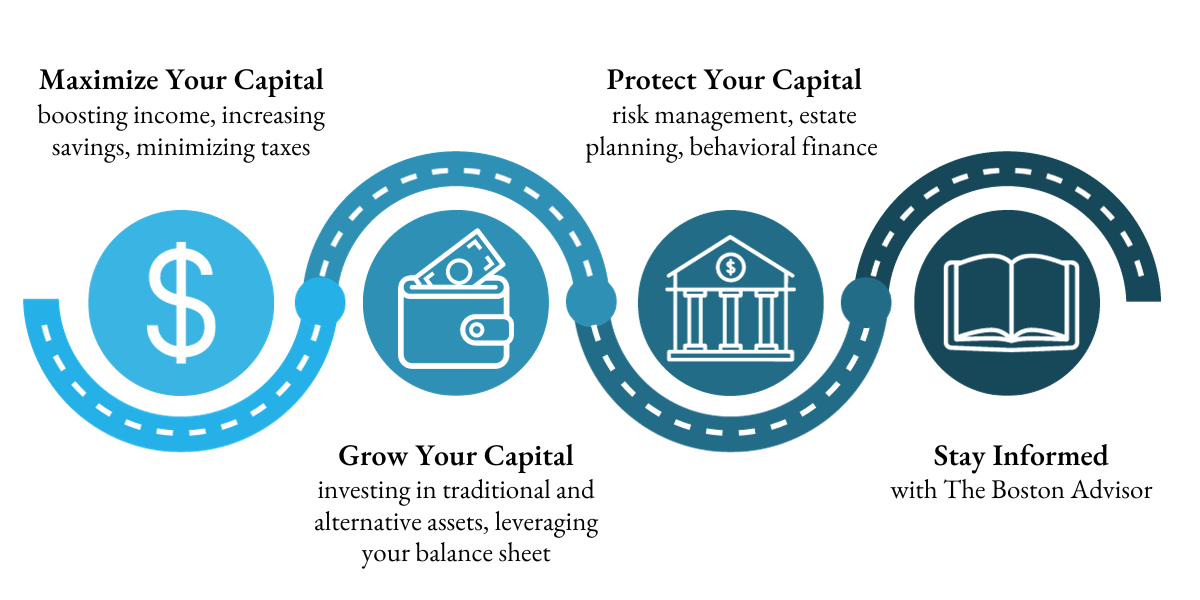

The Beyond the Basics Roadmap

It starts with three building blocks:

- Strategies to maximize your capital

- Techniques to grow that capital

- Tools to protect your capital

The roadmap’s fourth part?

Staying informed.

The successful individuals and business owners I work with recognize that knowledge is power. But they are busy people who don’t have time to read all day. Instead, they rely on trusted content curators to help them focus on the right things.

I’ve built my Wednesday Reading Lists to deliver that content to you.

A few minutes a week is all you need to review key takeaways from the best content I consume. And subscribing to the blog will deliver original roadmap content like:

Your Financial Planning Checklist

Interested? Give it a try.