5 Reasons to Believe in Emerging Market Stocks

The GMO team just published a white paper worth reading (Emerging Markets) and not just because they started it with the lyrics to the greatest rock ballad ever – Sweet Child O’Mine.

GMO’s asset allocation team has long recommended that investors overweight Emerging Market stocks because of how cheap they have been compared to U.S. and Developed International stocks. That call makes sense since I believe that price matters when making investment decisions. However, it’s fair to point out as you read this post and the white paper that the call has not panned out recently (although the time period evaluated matters a lot).

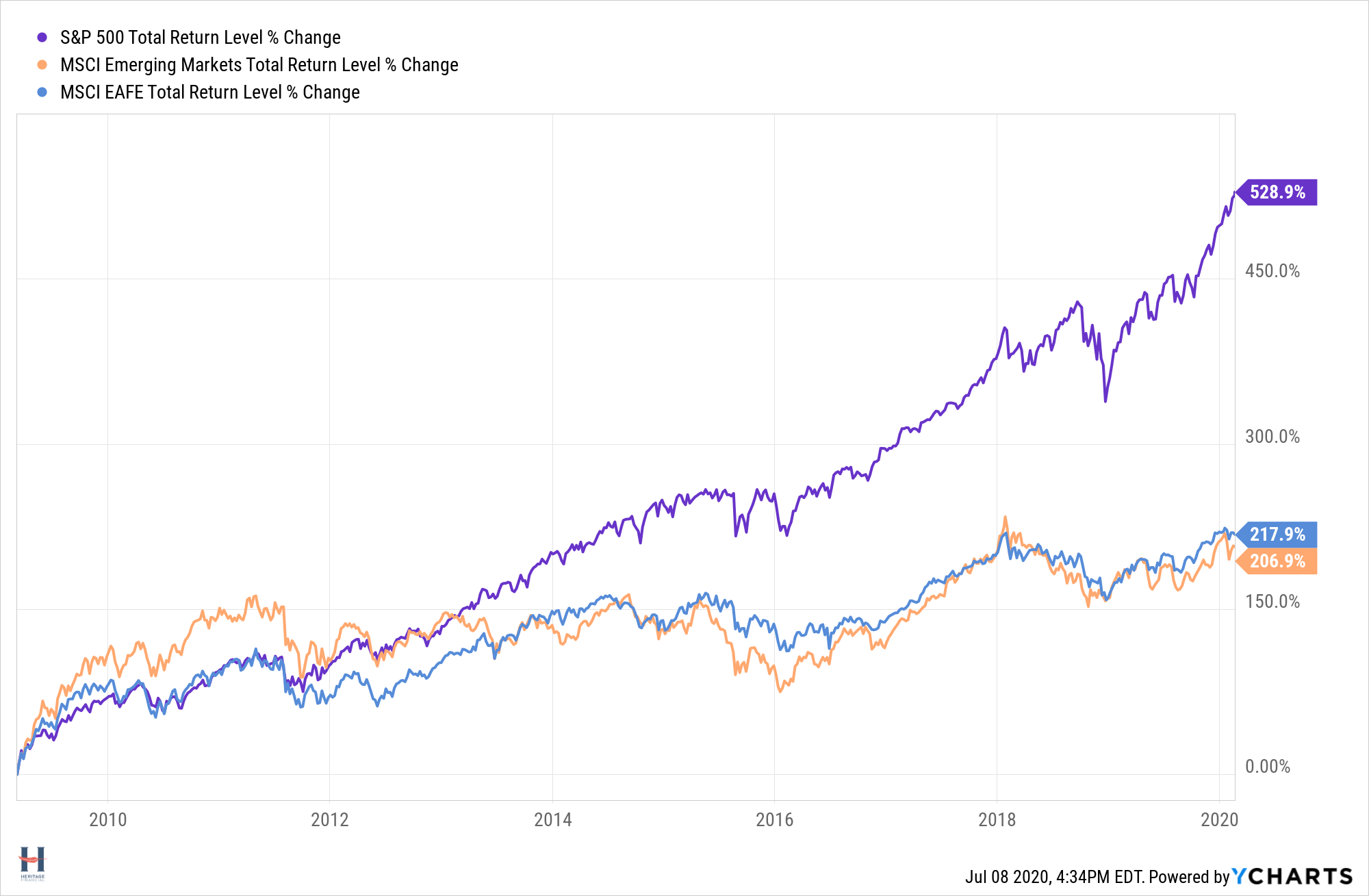

During the bull market that just ended, U.S. stocks (S&P 500) trounced Emerging Market stocks (MSCI Emerging Markets), which basically performed in line with Developed International stocks (MSCI EAFE).

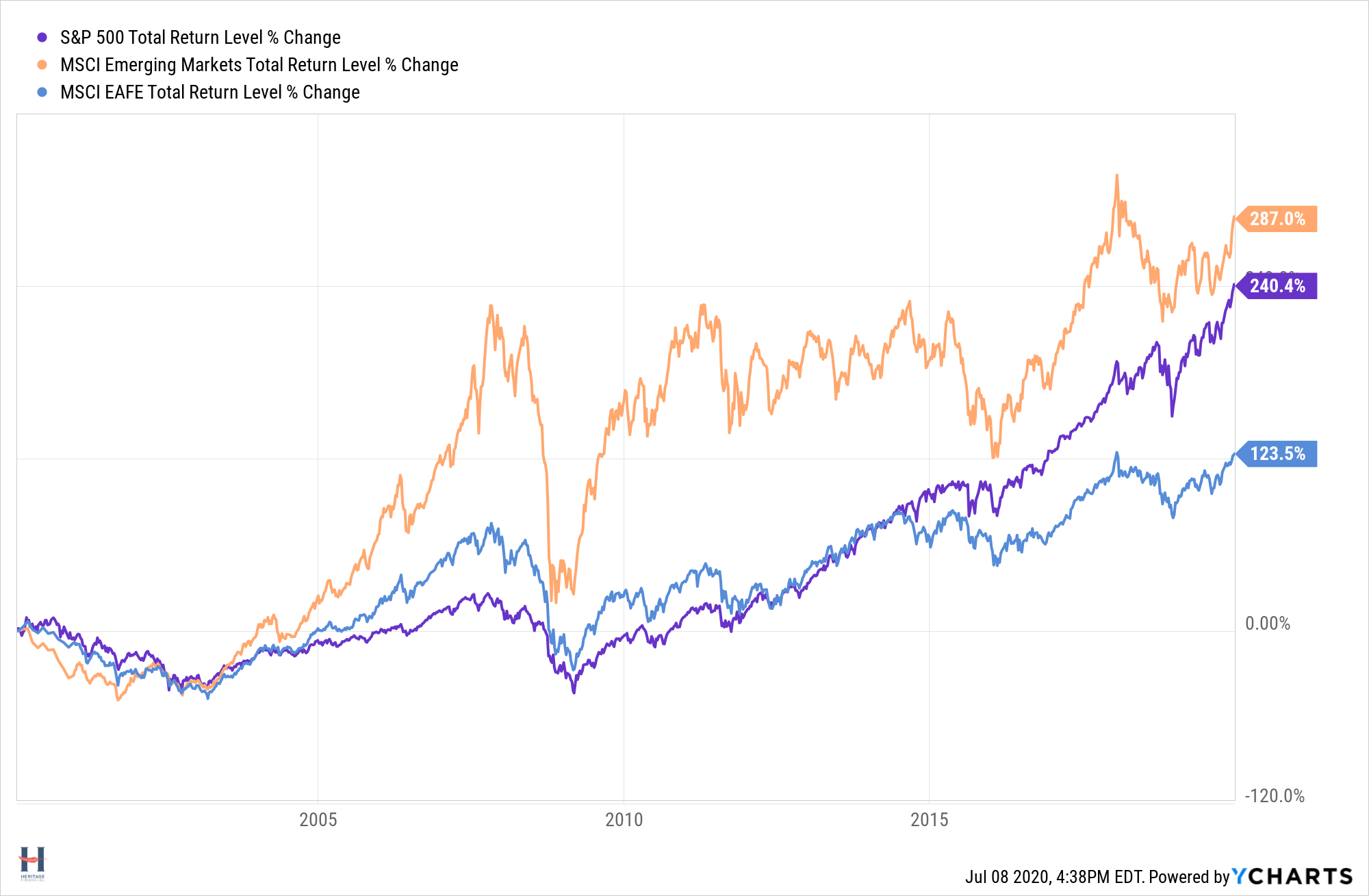

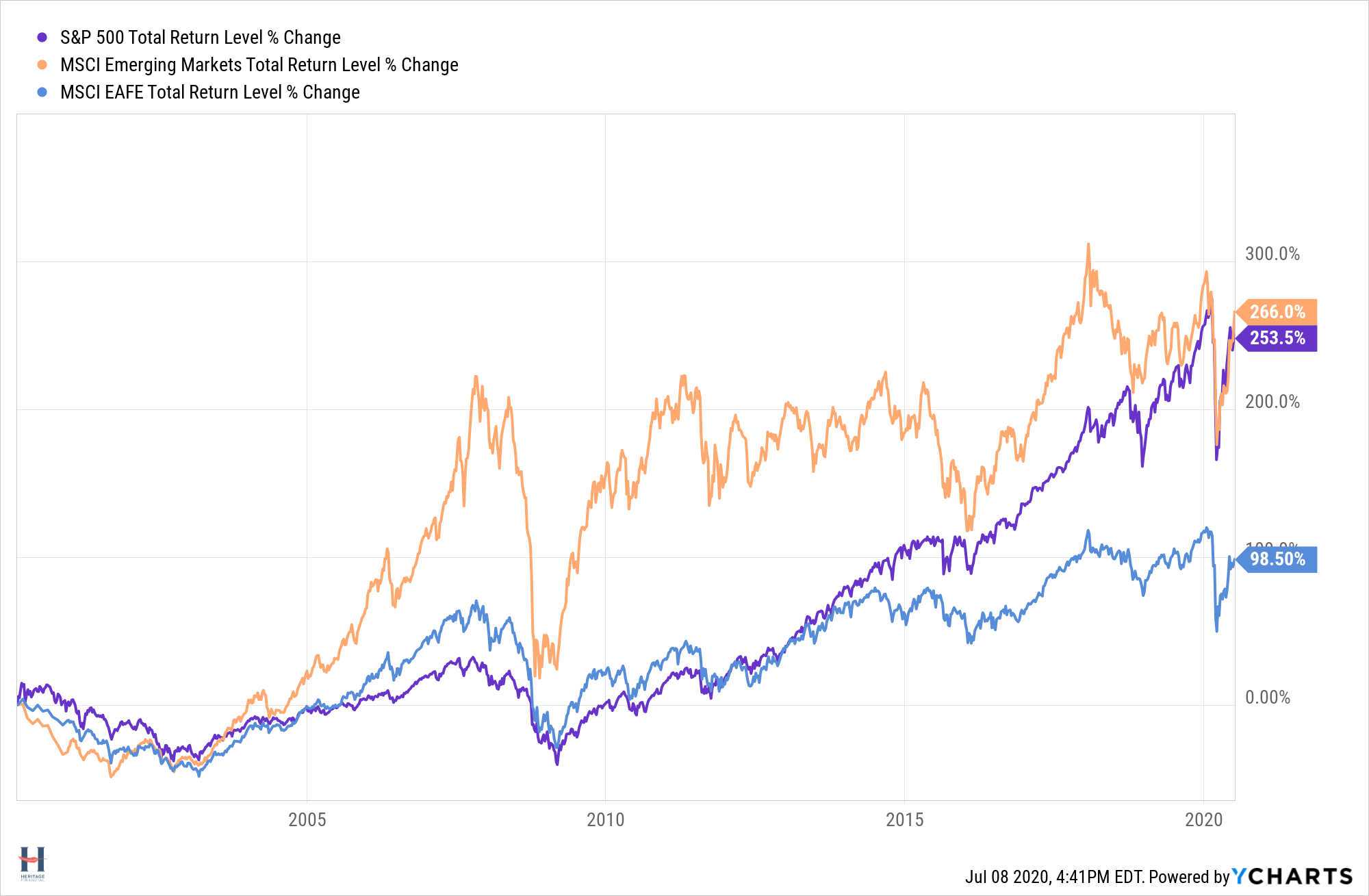

However, over the first two decades of this century, Emerging Market stocks solidly outperformed the S&P 500 and crushed Developed International stocks.

And since the market bottom on March 23, 2020 Emerging Market stocks are the top performers.

GMO presents a few reasons why they believe Emerging Market stocks “are more resilient today than in prior periods” and will experience less severe drawdowns going forward. This is important, as the volatility and short-term losses that come with Emerging Market stocks have caused some investors to sour on them.

They prefer the country makeup of the Emerging Markets index now. China is a bigger percentage of the index, and GMO says that its representation has grown at the expense of countries with more vulnerable economies. They consider the China exposure safer and believe in the resilience of its economy.

“For the last three decades, China has shown that it has the fiscal and monetary wherewithal to rebound from temporary economic setbacks.”

The sector makeup of the Emerging Markets index has improved with less in cyclical sectors like Energy and Materials and more in Internet and Technology. GMO also sees improved balance sheets in the cyclical sectors.

The financial sector is still a heavy part of the index, but the quality of those companies has improved.

They argue that there is less economic risk to the index and more ability to survive the COVID-19 economic crisis given how it’s positioned today.

”One key change has been that the weight of banks in the “vulnerable” country group as described previously has reduced from 46% to 10% of MSCI EM Financials.”

There are still risks to consider when making your asset allocation decision to Emerging Markets, and the paper concludes with a few of them. China being a larger part of the index could be a concern just as much as an advantage given the concentration risk in one country and potential for further trade wars. Currency risk, budgetary power, and health care infrastructure are also discussed. Investing always comes with risks (check out 3 Investment Risks You Can Conquer), and the paper does a nice job presenting and then addressing these topics.