You have to know your goals to invest your money well. That’s why the best financial advisors build financial plans for their clients before recommending investments. Once they know when your money will be needed and how much, they create the right portfolio for you. But investing comes with risks that can prevent you from accomplishing your goals. Here are three investment risks you can conquer and how.

No Plan

If you don’t know where you are going, you might wind up someplace else.

Yogi Berra

Build a financial plan outlining future spending goals, like retirement, paying for college and taking care of your family. Establish savings targets to hit those goals. Assume reasonable rates of return. Check-in on the plan at least annually. Make sure your portfolio is managed well accordingly and make necessary adjustments.

Inflation risk

As costs increase, your money’s purchasing power decreases. If a dollar in the bank earns .5% interest and inflation is 2.5%, every year your money loses 2% of its purchasing power. It might not seem like much, but over years it adds up. Between 1999-2019 a dollar lost 35% of its purchasing power to inflation, and that was a period with below average inflation. Between 1970 and 1990 a dollar lost 70% of its purchasing power!

Inflation is a risk to protect against. The good news is it’s an easy fix. Money that you won’t need for a few years should not be sitting in cash exposed to inflation’s gradual erosion. Instead, it should be invested in things that grow faster than the inflation rate, the exact mix of investments again depending on your financial plan. This also helps you achieve your long-term goals since it’s likely you will need help from the stock market to turn your savings into enough money to fund future spending goals. Read How Does Inflation Impact Investors? and The Easiest Way to Increase Your Investment Returns for more.

Capital Risk

This is the big one.

Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

Warren Buffett

Capital risk is a permanent loss of some, or all, of your capital. Investments come with volatility, and volatility is one definition of risk. However, a volatile investment that fluctuates in value is not the same as an investment goes to zero. You cannot recover from zero.

Conquer Investment Capital Risk

- Avoid speculative investments: Do-it-yourself options trading, penny stocks, start-up companies, and other lottery ticket type investments should be avoided.

- Investment Diversification: A stock that goes to zero in a portfolio of five stocks is a 20% loss of capital (we’re assuming the stocks are equally weighted here). In a twenty stock portfolio, it’s a 5% loss of capital. In a one hundred stock portfolio, it’s a 1% loss of capital.

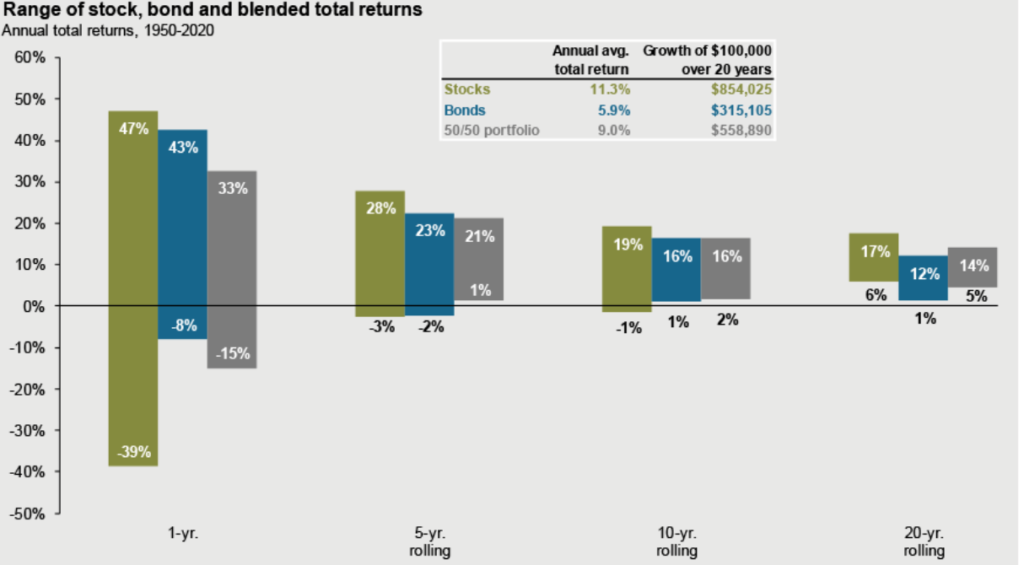

- Asset class diversification: If you own just stocks and need money during a downturn, you will have to sell stocks at a loss and lock in the decline. This may not be a major issue if the withdrawal amount is minor and part of your long-term plan. However, other asset classes like bonds give you the opportunity to free up cash from your portfolio when you need money.

- Panic selling: Stocks are volatile investments. In the long run, that volatility evens itself out and the performance earned from your stocks should line up with the performance of the businesses you own. Short-term that is not the case, and there is massive temptation to sell stocks during scary times. Resisting this temptation protects against permanent loss of capital. Don’t let what can happen in shorter periods knock you out of the long-term returns you can achieve by standing pat during bad markets.

Suggested Further Reading

Common Investment Mistakes to Avoid – Learn about the behavioral traps that keep us from earning our fair share of market returns.