Improving Retirement Planning, or Why Congress Doesn’t Get It

There are two bipartisan bills working their way through Congress to change our retirement rules. They’re similar and share the same goal stated in the House bill: To increase retirement savings, simplify and clarify retirement plan rules, and for other purposes. Some proposals are good improvements, some are overrated, but reading the bills makes it clear that Congress isn’t willing to go far enough to improve retirement planning.

The Good

Requiring 401(k) automatic enrollment with increasing default contribution rates gets more money into 401(k) accounts earlier.

Letting employers make matching contributions against an employee’s student loan payments is interesting and can get more dollars into plans. But it could also backfire if employees have less incentive to contribute enough themselves to get matching contributions.

Improving 403(b) plans and investment options is long overdue.

Indexing IRA catch-up contributions makes sense.

Allowing Roth contributions in a SEP and SIMPLE IRA allows participants in those plans to build a tax-free retirement bucket, which is good. So is allowing employer match contributions to be Roth contributions. I can’t see reason any why an employee would decline this.

The Overrated: Retirement Catch-up Contributions

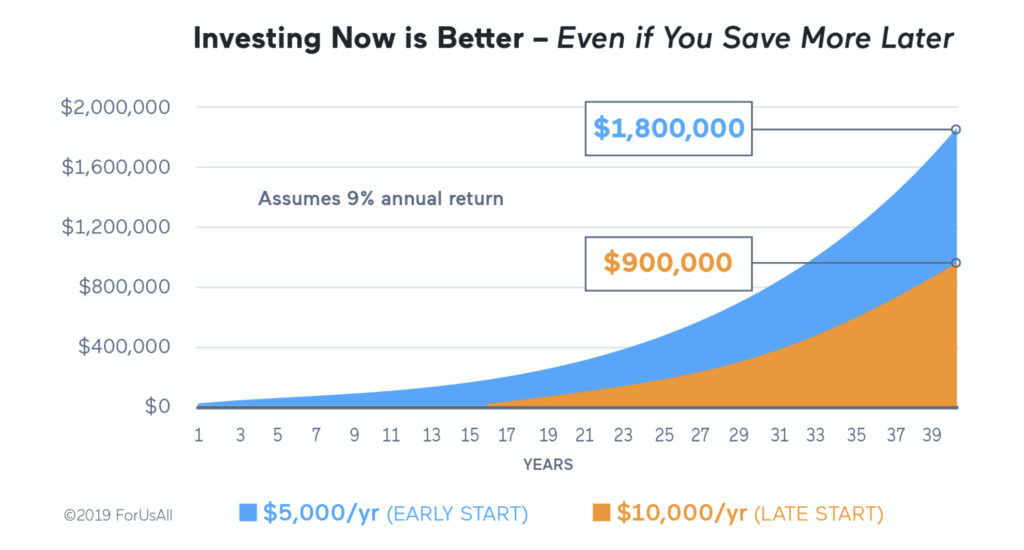

Catch-up contributions already exist. They allow those 50 or over to contribute more to certain retirement accounts every year. The new bills’ details differ, but both allow larger retirement catch-up contributions. It’s helpful, but the big challenge with retirement planning is getting more money in earlier since it’s so hard to catch up later.

You’ve probably seen a chart like this before, but it’s worth reiterating.

Here’s another way to look at it. To build a $4 million 401(k) nest egg, you can can start at 25 and contribute $15,441 per year. Or you can start at 45 and contribute $87,409 per year! This assumes an 8% return in the 401(k).

So, yes, catch-up contributions can help. But, they don’t go far enough.

A Better Solution to Improve Retirement Planning: Educate and Simplify

Since it’s key to get more dollars in earlier, Congress should focus on the two main obstacles to increased retirement contributions: our financial literacy gap and complicated and inconsistent retirement plan rules.

- Mandate financial literacy. Teach it in high school. Make it a requirement before you get your first credit card or student loan. Something else. I don’t know how to best fit it in, but I believe that if you educate Americans about having to plan for retirement earlier, you won’t need all the proposals contained in these two bills. And we currently do not do this. According to one measure, U.S. adult financial literacy is at only 57%. The Council for Economic Education’s 2020 Survey of the States shared that “less than 17% of high schoolers were required to take at least one semester of personal finance”.

- Simplify retirement plan rules and don’t make them employer dependent. What you are allowed to contribute to retirement depends on what plan your employer set up.

Employee contribution limits

| No Retirement Plan (IRA Contribution Limit) | $6,000 (plus $1,000 catch-up contribution) |

| 401(k) Plan | $19,500 (plus $6,500 catch-up contribution) |

| Simple 401(k) Plan/Simple IRA | $13,500 (plus $3,00 catch-up contribution) |

| SEP-IRA | Only employer contributions (no catch-up employer contributions) |

| 403(b) Plan | $19,500 (plus special catch-up rules) |

| 457 Plan | $19,500 (plus special catch-up rules) |

Added on to this inconsistency is different amounts that employers can contribute for their employees.

Who makes this stuff up? Oh wait, Congress… Figure out a dollar amount that people should be able to contribute to retirement regardless of where they work and what their employer wants to contribute. Then set some caps on what employers can contribute, and make it easier and cheaper for employers to create these plans.

Suggested Further Reading

Your Safe Retirement Withdrawal Rate – How much money do I need to retire is a popular question? What’s my safe retirement withdrawal rate is a better one. This post looks at the famous 4% rule and whether it still applies.

Personal Finance Curriculum – resources to help improve your financial literacy