3 Things Investors Want to Know Now

Investors are asking three main questions right now.

- Is the market rally we’ve seen since October real or another bear market head fake?

- Why not just get 4.5% or so in two-year Treasuries or a high yield money market?

- Is the debt ceiling debate going to hurt my portfolio?

We answered this and a lot more in the latest edition of our Wealthy Behavior podcast, where I sat down with our Chief Investment Officer Bob Weisse for our monthly market conversation.

February Market Update: Politics and Portfolios

Available through link in title

Is This Market Rally for Real?

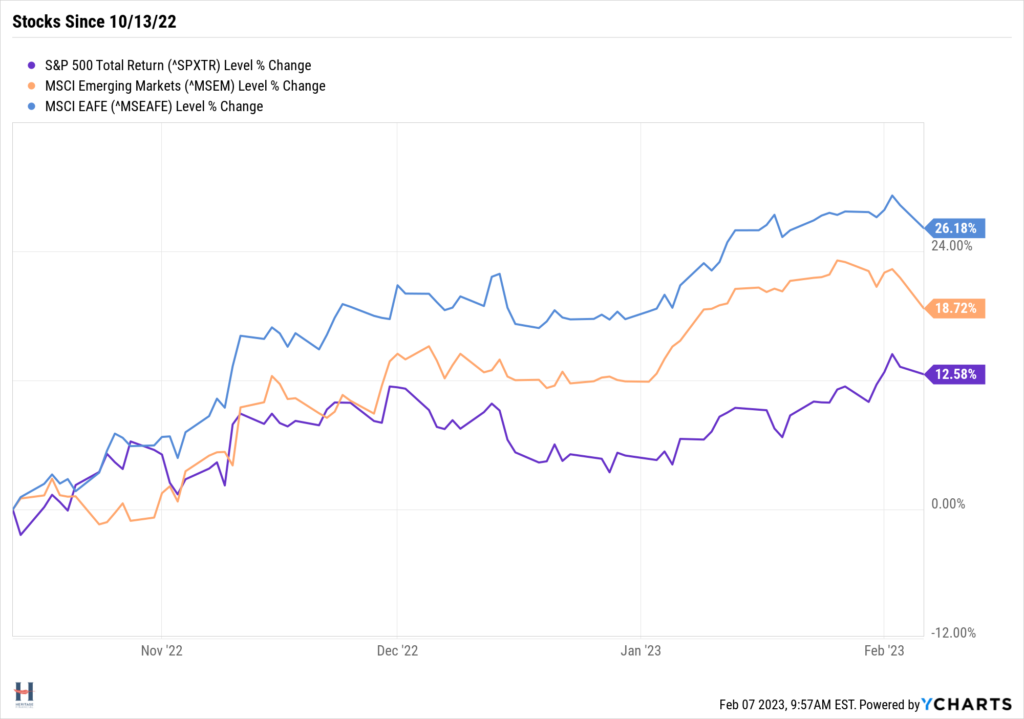

Stock markets are up a lot since the S&P 500 put in a bear market low on October 13, 2022.

U.S. stocks (S&P 500) are up 12.58%, Emerging Markets stocks (MSCI Emerging Markets) are up 18.72%, and Developed International stocks (MSCI EAFE) are up 26.18%.

Is this a head fake or should we be reassured by inflation easing?

Bob’s thoughts are that the international outperformance is supported by cheaper valuations. And here in the U.S. it’s clear from Powell’s comments that he understands inflation is slowing and the Fed can slow down its rate hikes.

The concern is that the jobs market is still very strong, and the market could be getting ahead of itself if the Fed has to eventually act more aggressively to slow it down. Bob thinks that’s the biggest risk to investors now (not the debt ceiling).

I am optimistic and shared why last week in Introducing My Bearish Friend.

Why Not Just Buy Short-term Bonds or a High-Yield Money Market?

The yield curve is inverted, so two-year Treasury bonds are yielding more than longer-term bonds. And for the first time in a while money market yields are attractive. So, why take more risk with longer-term bonds?

To improve your future returns and avoid reinvestment risk.

Reinvestment risk is less talked about as a concern, but it’s something to worry about in this environment. It’s the risk of having to reinvest in a lower yielding investment than the one you’re in.

Eventually the Fed will cut rates to help the economy it’s trying to slow down. When that happens the price gains in longer-term bonds will be more than in two-year Treasuries and your money market yield will decline.

Should I Be Worried About the Debt Ceiling Hurting My Portfolio?

In a word, no.

We may get short-term volatility as the June deadline approaches, but the U.S. cannot default on its debt like some deadbeat borrower. That would be catastrophic and even our chucklehead politicians will figure it out.

As Bob said,

“Don’t listen to politics and think about your portfolio at the same time.”

The Rest

Be sure to listen to the entire episode, as Bob and I also discuss:

- The risks today when investing in developed international and emerging markets

- An update on private investments and why real estate has us concerned

- A listener question on dividend-paying stocks and why we don’t target dividend payers specifically in our portfolios