Stock Investing Mistakes

You can get wealthy through disciplined investing and avoiding common stock investing mistakes along the way that keep you from earning your fair share of market returns.

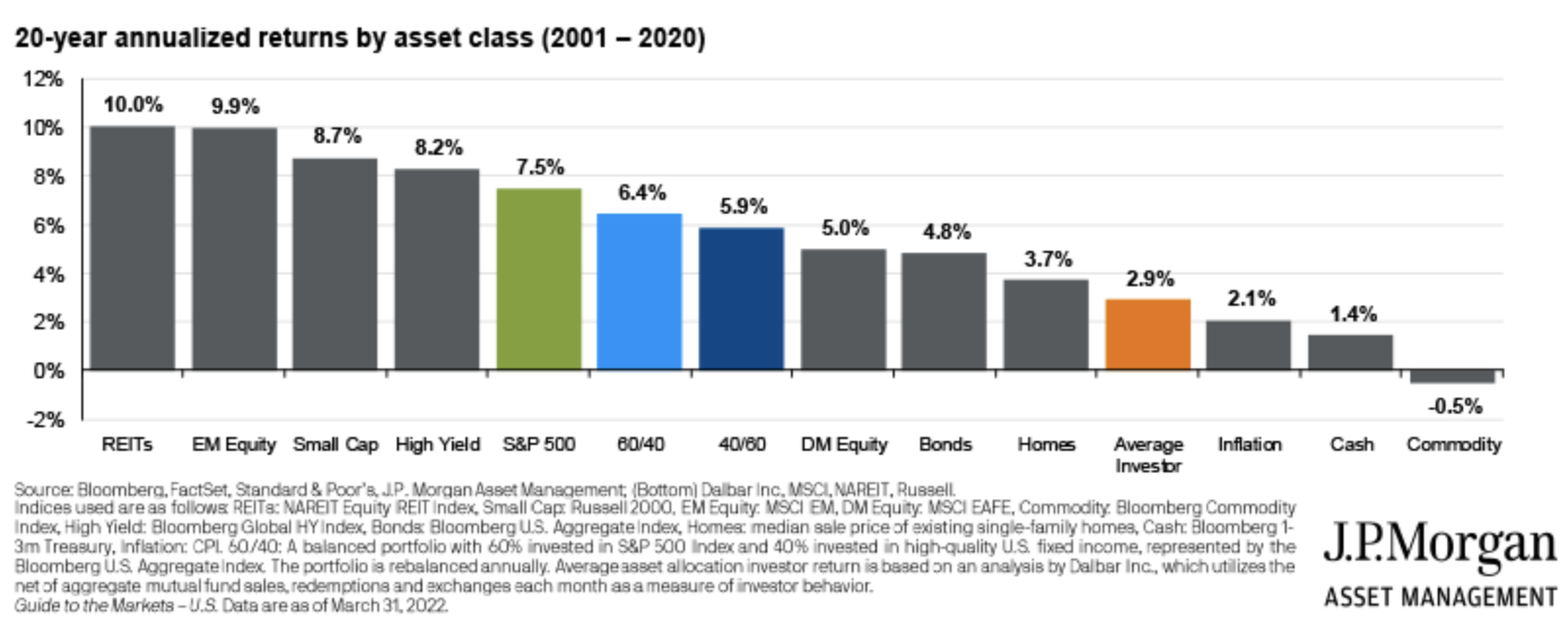

Stocks, as represented by the S&P 500, returned 11.8% per year since 1928. Doubling your money every six years. They made you money 73% of those years. You lost money about one out of every four years. And in exchange for living through those negative years, your average stock market return in positive years was 21.2%. Source: Slickcharts

Besides your rainy day fund and bonds and other asset classes you should own in accounts that you’ll take withdrawals from in the next ten to fifteen years, you should own stocks. If you avoid speculative investments, resist the temptation to bail out of a weak market, don’t get greedy, and remain patient, you should do well.

It’s a simple formula.

And easy, right? I know I’m making it sound that way, but simple and easy aren’t the same thing. Just look at this chart.

Investing is as Easy as Losing Weight

There’s a simple weight loss formula: move more, eat less. Yet, whenever we see a friend or co-worker whose lost lots of weight, we ask how they did it and wait with baited breath for something new.

But it’s always a version of move more, eat less. Losing weight is simple, and could not be harder for most people.

It’s hard to avoid tasty, unhealthy food and drink. Just like it’s hard to get up and move more.

It’s also hard to follow a simple investment formula. Volatility is stressful and pushes us to act. The news makes us pessimistic, and we’re tempted to market time. The urge for instant gratification prevents patience so we chase performance.

We make mistakes.

You can’t win until you keep from losing.

Bill Belichick

Here are the five biggest stock investing mistakes preventing you from winning the investment game.

Trying to Time the Market

You can’t time the market. Believing you can leads to three versions of this stock investing mistake.

- Predicting a market decline will get worse and selling out so you can jump back in when it’s “safer”. JP Morgan once said, “in a bear market, stocks return to their rightful owners.” You’ll lock in a loss and struggle to get back in – if you ever do. This happens in bad bear markets like in 2008 or 2020.

- Forecasting a decline during good times, selling your stocks, and then watching the market keep rising while you miss those returns. Worries about upcoming elections and global events tend to cause this type mistake.

- Thinking the good times won’t end, upping portfolio risk, and then getting burned when the market turns. This happens in speculative times like the late 1990’s or late 2021.

Listening to the News

Don’t let the news influence your investment decisions. Protecting Your Portfolio from the News isn’t about the oft-expressed concern whether now’s the right time to invest given bad headlines. The answer is always the same to that one. Disciplined investing in stocks means sticking to your plan and investing when you have money to do so.

Instead, this is a warning to protect yourself against a market timing temptation that arrives in the sheep’s clothing of fake investment advice.

You own an investment—let’s say it’s an emerging markets fund. It’s performing poorly, while your US stock investments are doing well. You want to dump it, but know you shouldn’t. Then you start reading. Articles in The Economist and The Wall Street Journal about how the emerging markets. They explain what’s going that could be making those markets perform poorly.

Aha! You knew it. You have ditch that investment now.

Or do you? It’s a news article, not investment analysis. A market is performing poorly, and a respected media outlet is telling you and providing context.

I hate most weather analogies—unless they’re my own—but when the weather report tells you it’s cold and wet outside, why it’s cold and wet, and the precautions you should take to stay safe, warm, and dry, it doesn’t mean they canceled spring.

Reporters aren’t investment analysts, and current events don’t create future returns.

Markets discount, which means market participants make investment decisions now about expected future returns. The news reports what’s going on today. Avoiding this stock investing mistakes requires understanding the difference.

Impatience

The stock market is designed to transfer money from the active to the patient.

Warren Buffett

Retail investors hold mutual funds for less than two years. This is a costly error. You miss returns when you impatiently jump from one strategy to another in two ways.

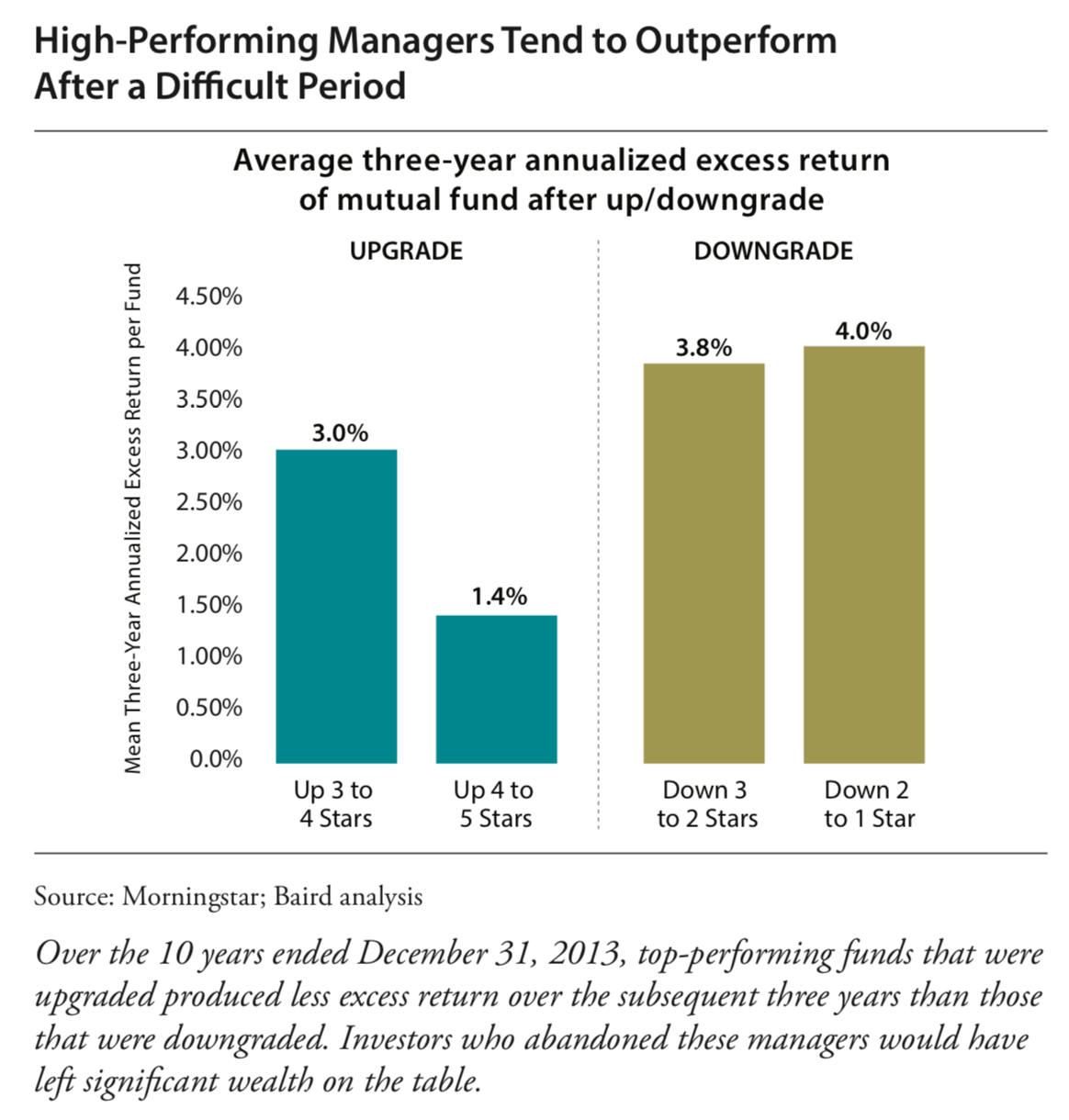

First, unless the money is in retirement accounts, moving generates long-term capital gains. Second, you’ll miss a possible performance rebound. In the study referenced below, Baird’s Asset Manager Research team found that top performing mutual funds that had underperformed their peers subsequently when on to outperform after they received a performance based ratings downgrade from Morningstar.

“Most high performing managers can and do make up lost ground and add excess return following periods of weakness, particularly over an intermediate time period.”

So, you invested in some mutual funds because they had strong long-term track records. They hit a rough patch. You sell. You buy new funds. Studies show the ones you left will do well after you lost patience with them. You experience the underperformance but not the outperformance.

How Long to Give an Investment Strategy provides more details on the right evaluation time period and how to assess your investments in the short-term.

Breaking Investment Rule #1

Warren Buffett’s top two investing rules are:

- Never lose money

- Don’t forget rule #1

He doesn’t mean avoiding investments that can decrease in value. His crankier sidekick, Charlie Munger, made that quite clear when he said, “if you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder and you deserve the mediocre returns you’re going to get.”

Understanding Investment Rule #1 means understanding that this stock investing mistake isn’t about permanent loss of capital.

The 2007-2009 bear market was the worse one of my lifetime. The S&P 500 went down by 57%. Investors who held on recovered those losses less than three years after the market bottomed.

Investors in Lehman Bros. during that same time who saw the stock go to zero never recovered those losses. Zero is permanent.

Investment rule #1 isn’t about avoiding market volatility. It’s about avoiding permanent loss.

Once money is gone, it can’t grow.

Capital that’s temporarily decreased in value, even by 30% – 50% can eventually grow.

Here’s how I’ve seen some investors get into trouble with investment rule #1:

- Investing in speculative things like penny stocks, hot tips, and other lottery ticket type investments.

- Having a concentrated portfolio. In a portfolio of 5-10 stocks if even only one of those stocks goes bust, you’ve permanently lost 10% – 20% of your portfolio (assuming equal weighting).

- Trading options

- Market timing

Holding Too Much Cash

Cash you don’t need for a long time should be invested aggressively, money you need in the next few years should be in the bank, and then there’s a category in between.

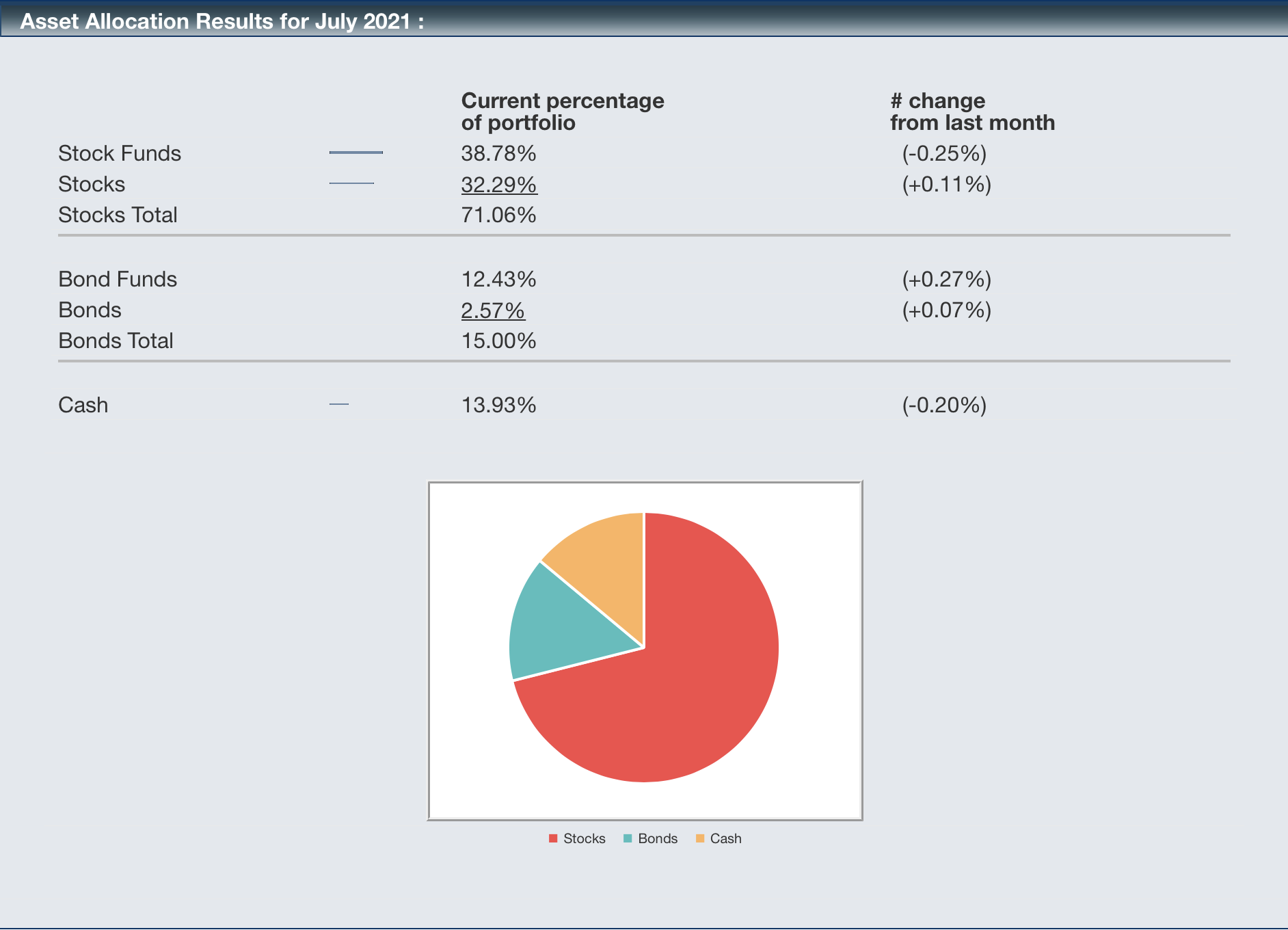

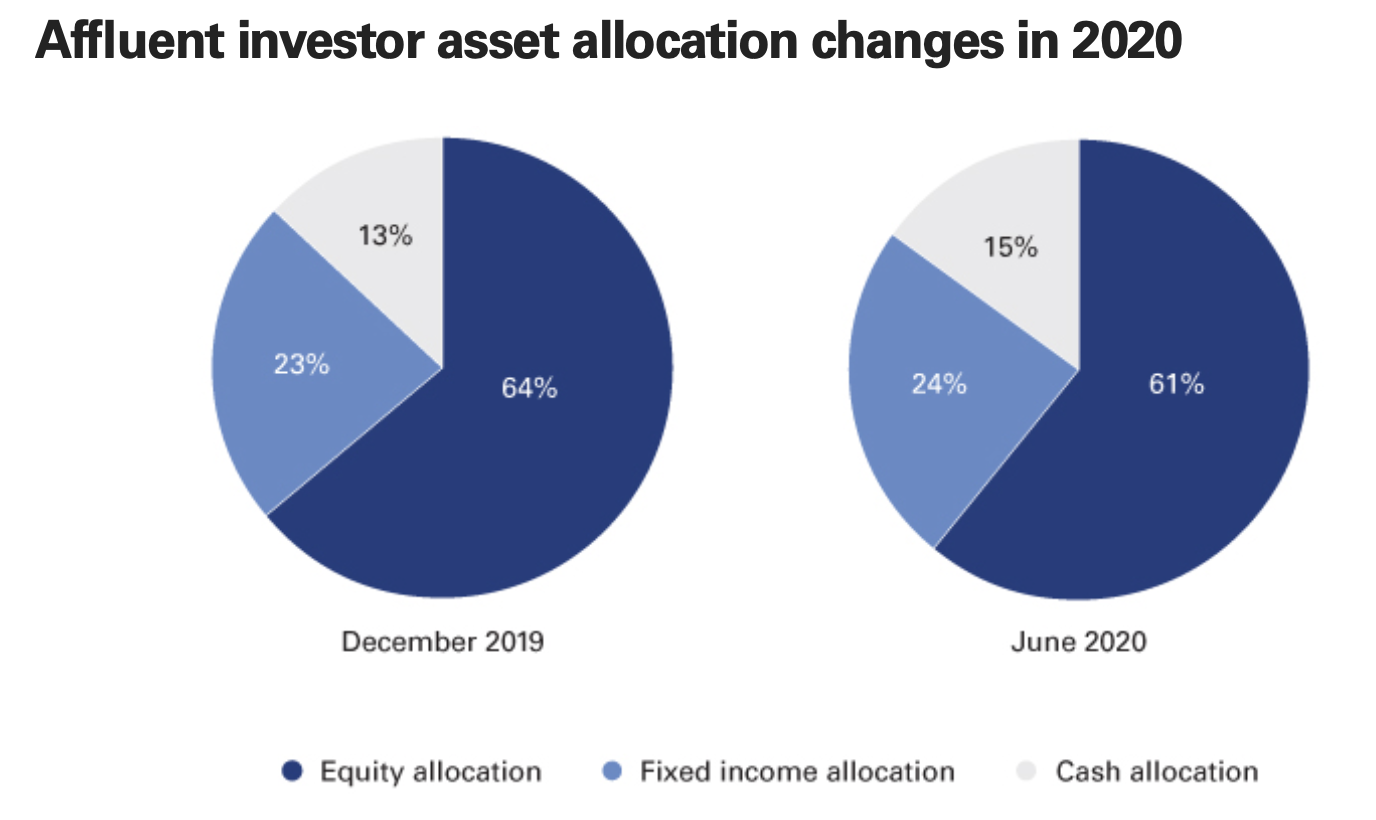

New clients we work with who consider themselves fully invested usually have too much cash. Between excess cash in the bank and their portfolios, I’ve seen cash positions averaging 15%. This echoes other findings.

The American Association of Individual Investors Survey for July, 2021 showed an average cash position of 13.93%.

Vanguard’s How America Invests study from December, 2020 noted that affluent investors averaged 15% in cash.

Getting that cash to work is The Easiest Way to Increase Your Investment Returns.

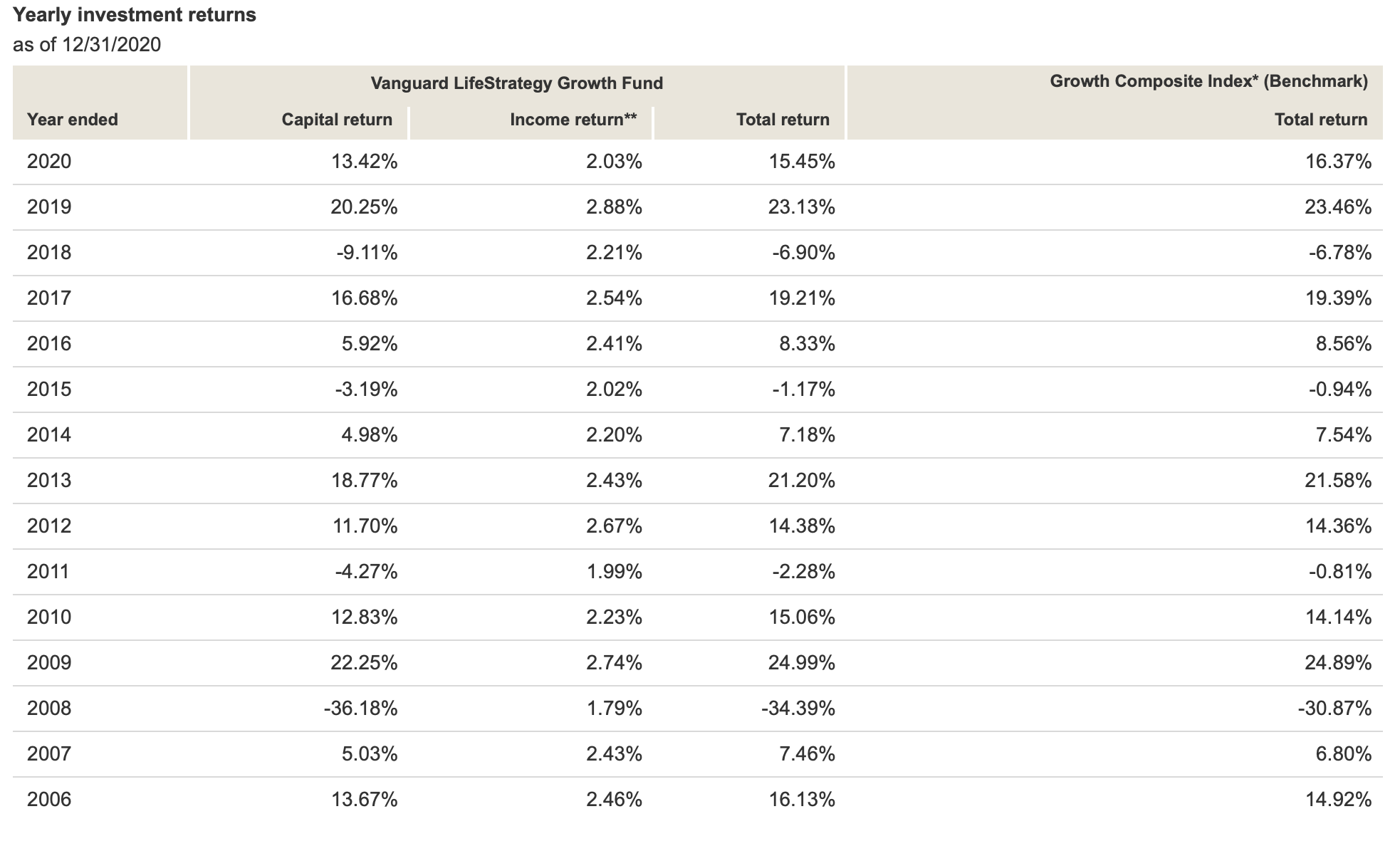

Check out this example using the Vanguard LifeStrategy Growth Fund (VASGX). It’s growth-oriented at 80% stock (20% bond), has a long track record, and invests globally through index funds. I’m not recommending it, just using it as a proxy for a diversified portfolio’s return.

If you had $2,000,000 invested in this fund between 2006 and 2020 your average annual growth rate would have been 7.33%.

If 15% of that portfolio was sitting in cash earning 1%, your average annual growth rate would have been 6.66% – .67% – or $518,052 – less.

Two-thirds of a percent more just by putting cash where it belongs.

Final Thoughts

Winning the investment game is about not losing through avoidable mistakes.

If you see yourself in this list, it’s hopefully a call to action for you to work with a professional advisor and negate the portfolio headwinds.

If you don’t see yourself in this list, I commend you for handling your portfolio well. Just be sure you’re right. As Charlie Munger said of his pal Buffett, “One of the reasons Warren is successful is he’s brutal in appraising his own past. He wants to identify mis-thinkings and avoid them in the future.”

Related Reading

Learning to Avoid the Sunk-Cost Effect with Bill Belichick