Kicking off my Planning for Retirement Series based on my How to Recreate Your Paycheck in Retirement class I created to share the lessons I've learned in my career helping people build toward a successful retirement and avoid the most common mistakes.

There are three reasons why investing for retirement is essential (and best when started as early as possible).

Retirement is Likely to be Longer Than You Expect

Studies show that most Americans retire sooner than planned for reasons outside their control (lay-offs, burnout, health issues, and family health issues).

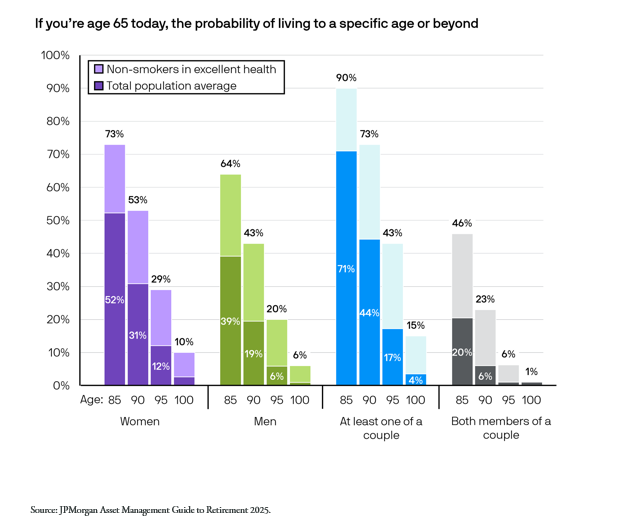

At the same time, life expectancies are have increased for healthy retirees. The chart below shows that a couple aged 65 who are non-smokers in good health has a 43% chance of a survivor living to age 95.

People underestimate their life expectancy and believe it’s more strongly linked to genetics and their parents’ experience than it is. Longevityillustrator.org is a good tool you can use to dig into this further.

Inflation

With a 3% inflation rate, your purchasing power will erode by more than half during a thirty-year retirement. This has become easier to understand over the past few years. You need a retirement portfolio large enough that you can withdraw less than what it earns annually to meet your standard of living during retirement and provide a cushion for purchasing power erosion.

You Need Growth

A long retirement where inflation erodes your purchasing power means you must get good at converting your human capital into enough financial capital to live off during retirement. It’s hard to save enough money to retire without getting strong growth on those savings.

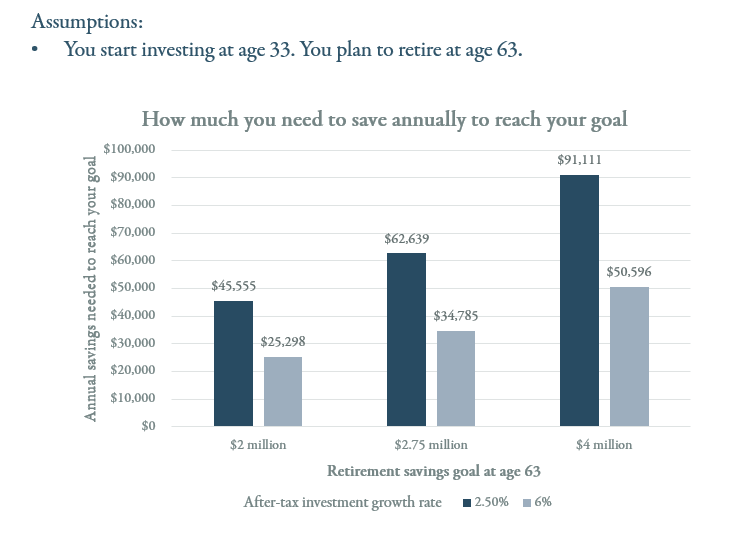

Some examples in the chart below use a thirty-year accumulation phase and two scenarios: Money in the bank earning 2.5%, or a stock and bond portfolio earning 6% (well below historically what a blend of those have done).

Investing for retirement cuts your savings burden by close to half.

Related Reads

Your Safe Retirement Withdrawal Rate (Part Two in the series)

Building Your Retirement Budget (Part Three in the Series)