The stock market is a device for transferring money from the impatient to the patient.

Warren Buffett

Teaching Financial Literacy by Heritage Financial

At Heritage we believe it’s imperative to talk about money and enjoy educating our clients about all aspects of their financial lives. Here are four tips to begin teaching financial literacy to your kids today.

ChatGPT versus Bard: Which AI Chatbot is Better for Marketing? by Mark Schaefer

A comparison of ChatGPT versus Bard, Google’s answer, by a marketing strategy consultant who received early access to it.

See also: The Age of AI has begun by Bill Gates

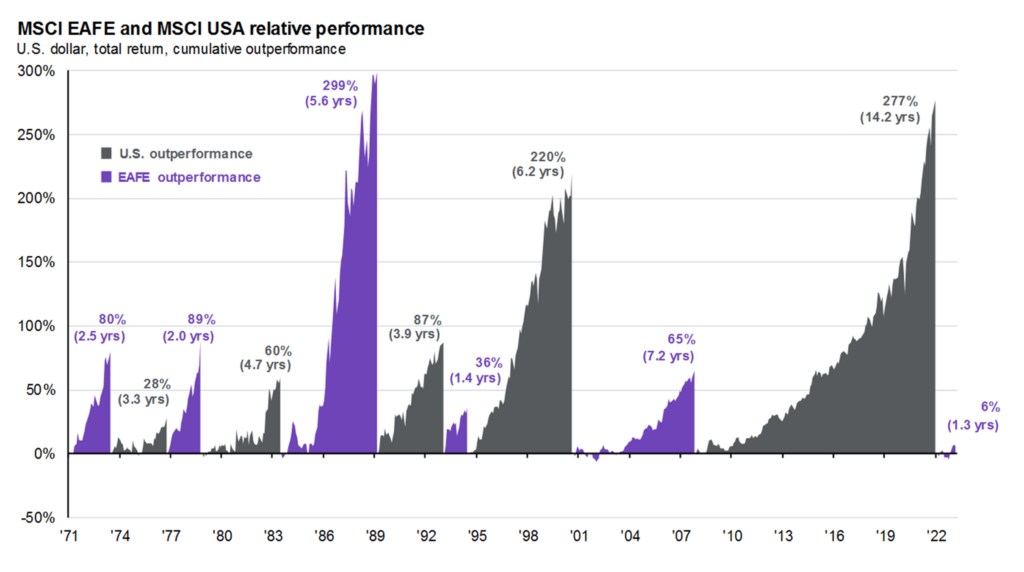

Chart of the Week

Cycles of U.S. Equity Outperformance – U.S. and International stocks take long turns outperforming each other. Is a long stretch of U.S. outperformance at an end?

The Seven Virtues of Great Investors by Jason Zweig of The Wall Street Journal

Based on decades of watching and interviewing the world’s leading investors, Jason Zweig wrote a series about the essential attributes that all great investors seem to share. It’s summarized in this posts with links to all parts of the series.

How You Can Grab a 0% Tax Rate by Laura Saunders of The Wall Street Journal

The zero rate on investment income is often overlooked. Make sure it’s in your tax tool kit.

Financial experts share their greatest money regrets — all have one thing in common by Jessica Dickler of CNBC

CNBC Financial Advisor Council members share their greatest money mistake, and what they learned from it. In every case, their younger selves made tradeoffs that sacrificed their long-term financial well-being.

Are Americans Too Pessimistic About Their Financial Futures? by John Rekenthaler of Morningstar

Only 21% of Americans feel confident that their children’s generation will be better off than theirs. The case for why they’re right and the majority is wrong.

Simple Actions Today Can Lead to Positive Results Tomorrow by Adam Newell of Fiducient Advisors

In the spirit of Financial Capability Month, this article provides some practical tips and strategies to help you begin to take control of your personal finances.

See also: Your Financial Planning Checklist a running checklist I periodically update with links to extra resources

Revisiting Short-Duration Stocks by Jeffrey Kleintop of Charles Schwab

Although central banks may be near the end of the rate hike cycle, short-duration stocks may still be an attractive investment theme should interest rates remain at higher levels.

April Market Update: Bonds Are Back

In this month’s market update:

- An overview of the Silicon Valley Bank and Credit Suisse failures, the impact on the banking sector and the broader markets.

- The silver lining of a banking crisis.

- Where investors should put their cash.

- What a slowdown in rate hikes means for investors’ asset allocation.

- Fears of Inflation vs. Fears of Recession. What is the market telling us?

- An update on the housing market.