Are We In a New Bull Market?

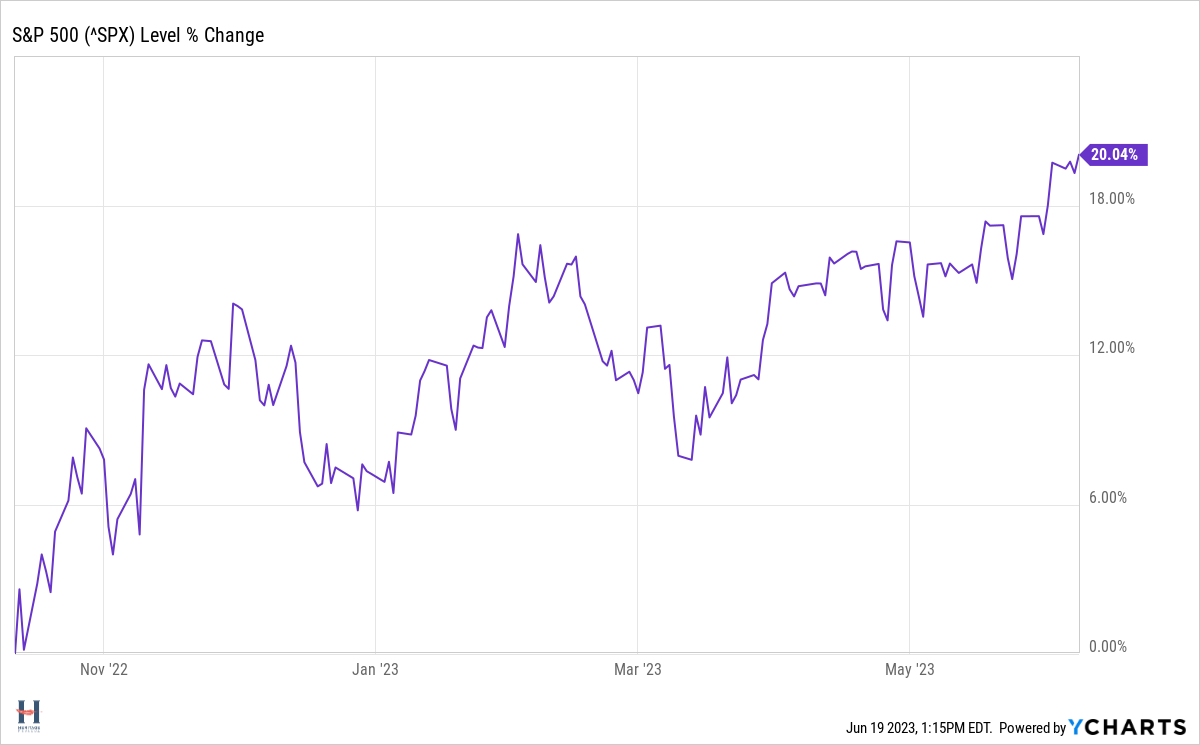

On June 8th, the S&P 500 closed at 4,293.93 – more than 20% from its October 12, 2022 low leading to a market commentary avalanche (to which I’m contributing) about whether we’re in a new bull market, effectively ending the January 3, 2022 to October 12, 2022 bear (25.4% loss).

This isn’t just semantics or market jargonairs geeking out at each other. The way I was taught about markets is through market cycles – peak to trough to peak again. A new bull market means:

That we cleared the bear market low and won’t retest it.

We’ll eventually reach a new market high, surpassing the January 3, 2022 levels.

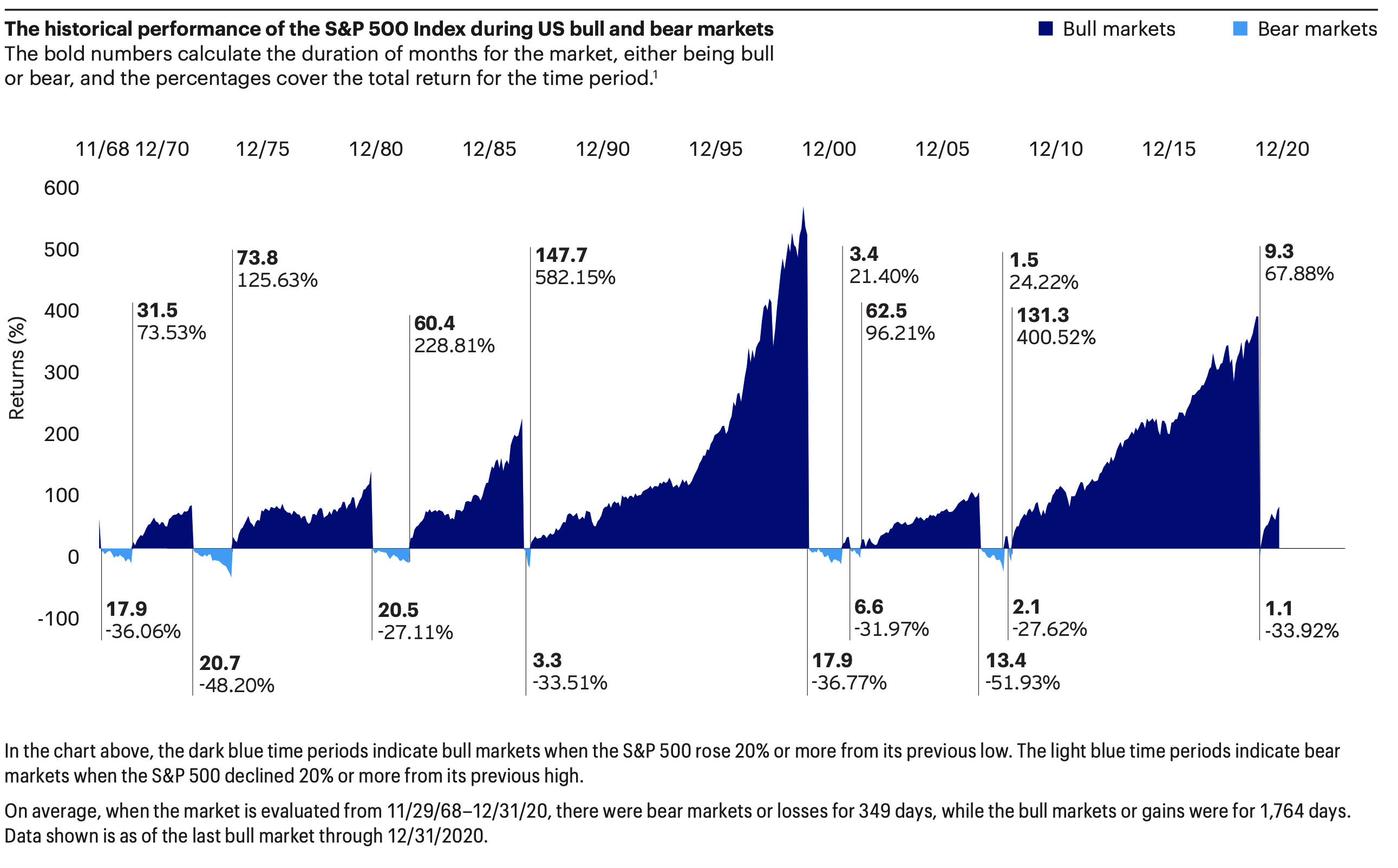

Bull markets typically last much longer than bears, giving portfolios opportunities for nice gains.

If we’re not in a new bull market, it means this is a bear market rally, another frustrating head fake in a prolonged market downturn.

So, where are we? No one knows, but I was curious to see if we’ve ever rallied 20% off the lows and then ultimately retested those lows. I learned two things:

First, there are multiple definitions of when you are in a new bull market. So much so that it was starting to feel like Justice Stewart’s definition of obscenity: “I know it when I see it.”

Second, the charts and tables out there are filled with mistakes.

New Bull Market Definitions

[W]hile investors tend to agree on how to mark the start of a bear market, there’s less consensus on how to define the start of a bull market.

Is the Bear Market Over? It Depends.

As we’ve discussed, some consider a 20% rise from the low a new bull.

Some don’t think it’s confirmed until we hit a new market high.

Then there’s people like me who think we need to clear the last bear market’s lows.

Those are the quantifiable measures. There was lots of squishier definitions too.

New Bull Market Research

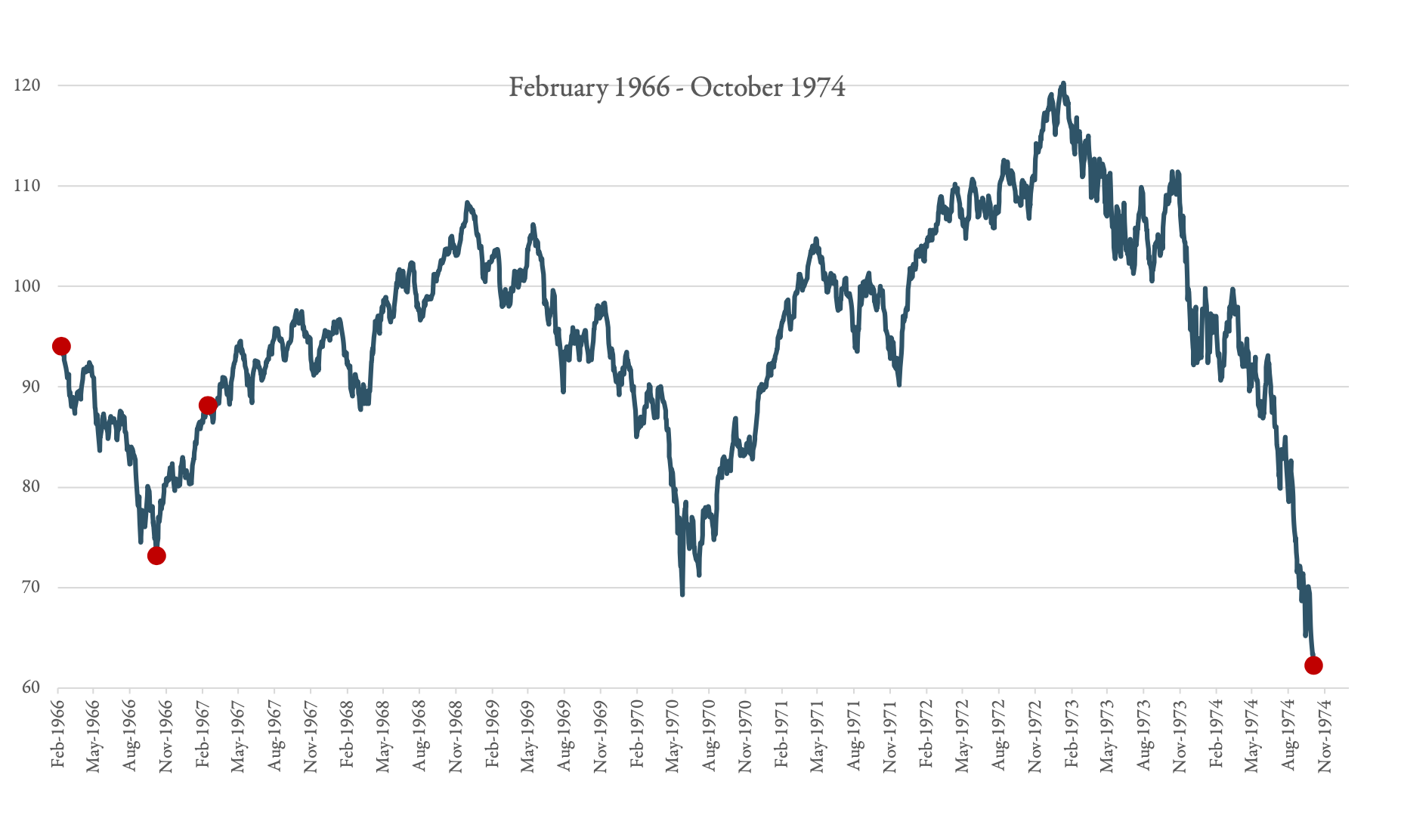

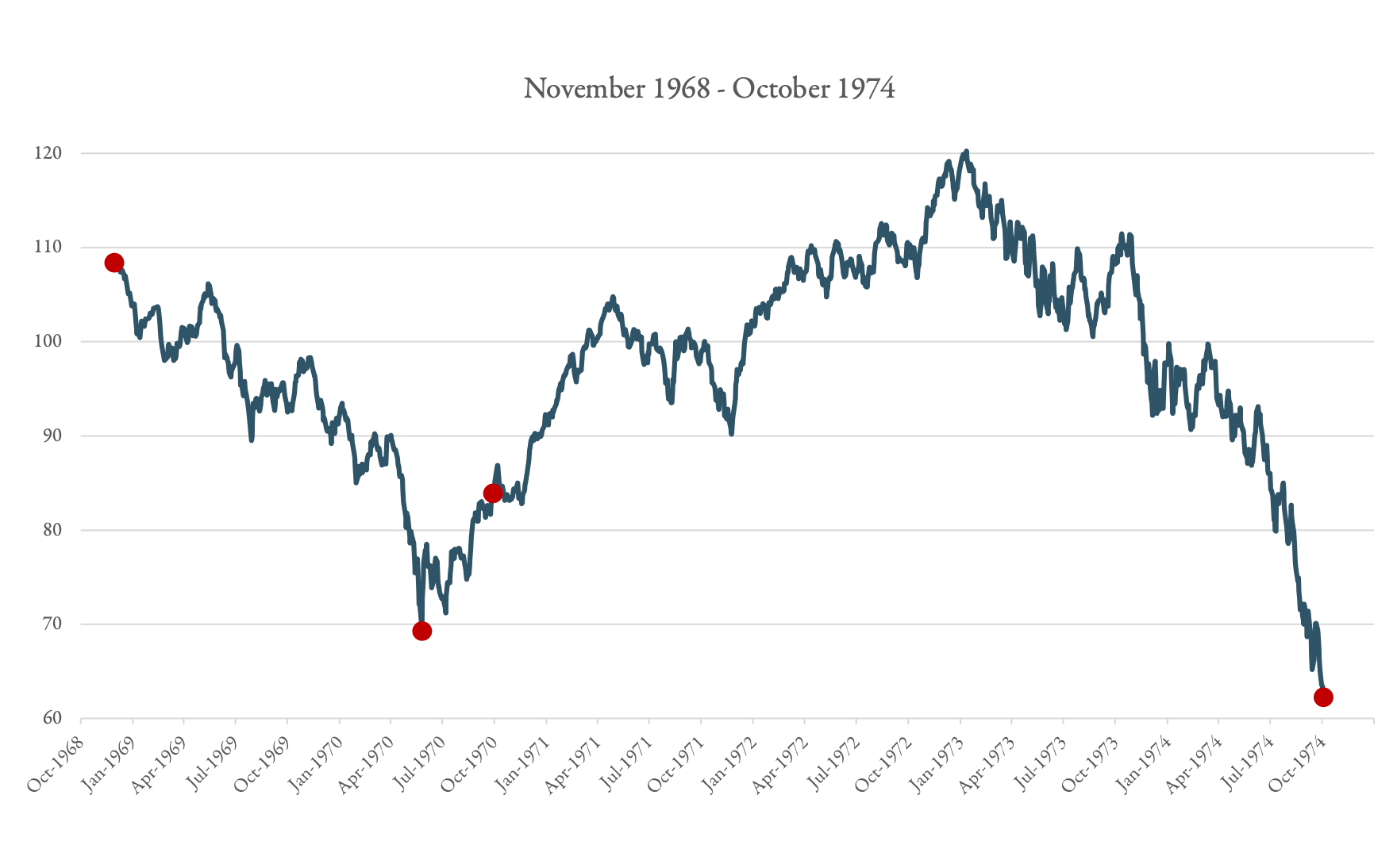

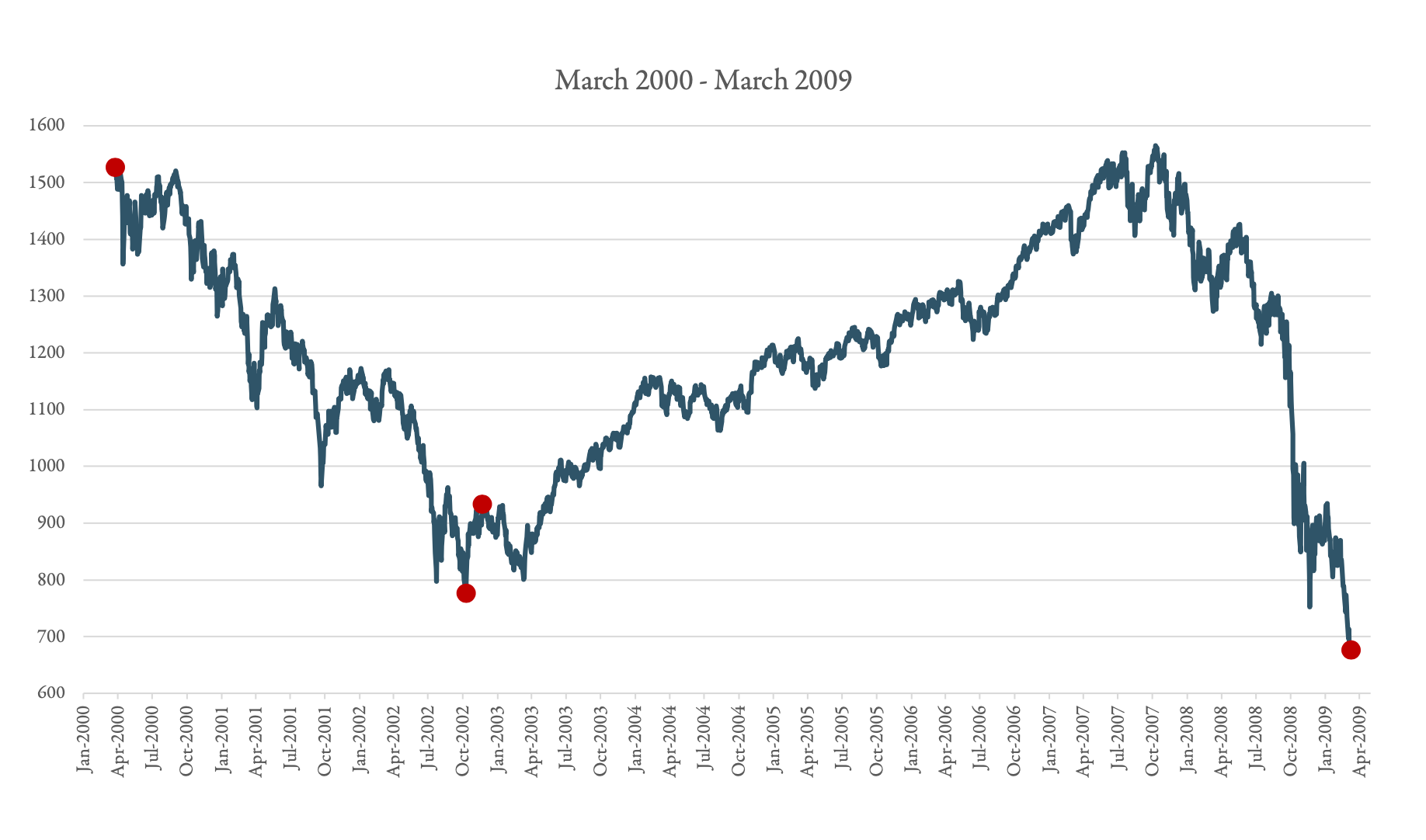

So, I asked our Director of Portfolio Management, Michael Waldron, to run his own numbers and see. According to Michael’s analysis, there have been three prior occasions (charted below) when the market rallied 20% off the low and then established a new low.

Going by the market cycle definition, we’re not definitively in a new bull market yet. Three times means it’s still rare, but it does happen. So, while there are good reasons for optimism about this rally, which we shared in our latest investment podcast, it wouldn’t be unprecedented for us to give back these gains.

What Could Go Wrong?

A good friend asked me this the other day. My answer: the main thing to me is that the market still doesn’t believe the Fed when it says it’s going to keep raising rates after this June pause. More hikes equals more risk to the economy, which can equal more risk to the market. The market ignored the Fed last year to its detriment, I fear the same thing could be happening again although this time around in an environment when the inflation numbers are improving.

Suggested Further Reads

June Market Update: Resiliency Remains