R.I.P. 2009 – 2020 Bull Market & Lessons Learned

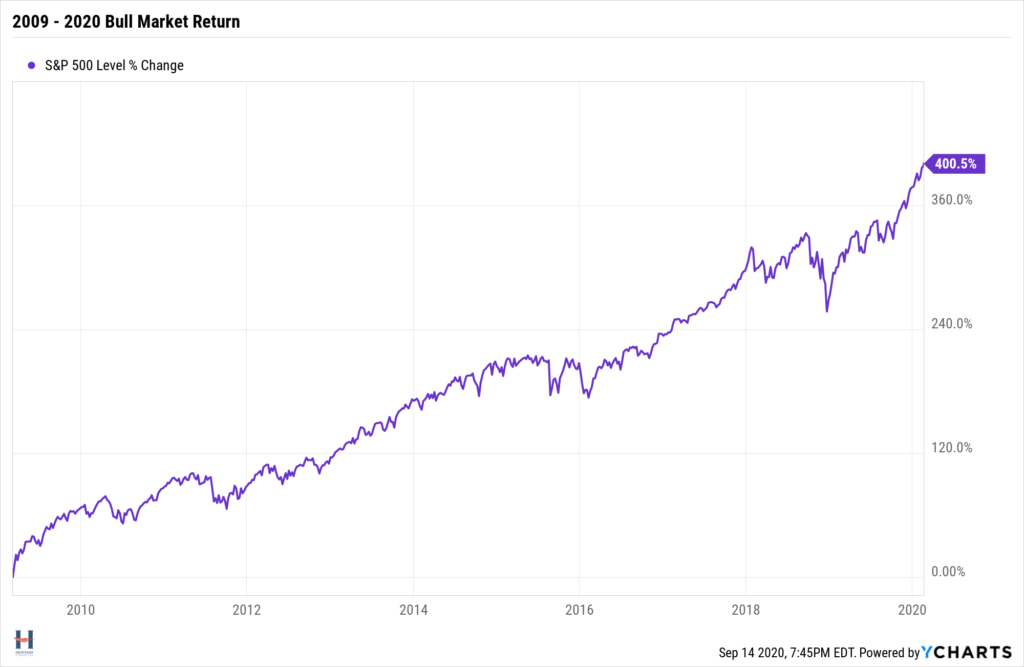

On March 11, 2020 the longest modern era bull market in U.S. stocks came to an end. It started on March 9, 2009, weighed in at 134 total months, and peaked on February 19, 2020.

It trailed only the bull market that began in October, 1990 in terms of total return – 417% to 401%.

Its average annual return was 18.27%, outpacing the S&P 500’s average annual return of 8% since its 1957 expansion according to Investopedia.

And it was a good friend. It made my clients money, accompanied me for 60% of my professional career, and taught me much along the way. I hope to share those lessons with this quote’s help.

“Bull markets are born on PESSIMISM, grow on SKEPTICISM, mature on OPTIMISM and die on EUPHORIA.”

— Sir John Templeton

The bull market was born on pessimism on March 9, 2009

Thinking back, it’s strange without Templeton’s perspective to imagine that the longest bull market ever could start amidst financial institution wreckage, market weakness, and hatred for U.S. stocks (pessimism).

Financial institutions battered

Two weeks before the bull started, the government effectively nationalized Citigroup, one of the few mega financial institutions that had survived The Great Recession thus far. It was the third attempt to fix Citi during the crisis and followed a string of other shocking events.

March 17, 2008 Bear Stearns, facing bankruptcy, was sold to JPMorgan in a shotgun wedding for 94% less than its share price one year earlier.

July 11, 2008 IndyMac failed.

September 7, 2008 the government took over Fannie Mac and Freddie Mac.

September 15, 2008 Lehman Bros. declared bankruptcy.

The next day the Federal government took over AIG. The original money market fund broke the buck, causing the short-term lending market to freeze.

September 26, 2008 Washington Mutual declared bankruptcy and was seized by the FDIC after a bank run.

October 3, 2008 Wachovia was sold to Wells Fargo.

During this stretch:

Merrill Lynch sold to Bank of America to survive

20% of Morgan Stanley was sold to the Mitsubishi Group

Goldman Sachs and Morgan Stanley converted to bank holding companies for more Federal Reserve protection.

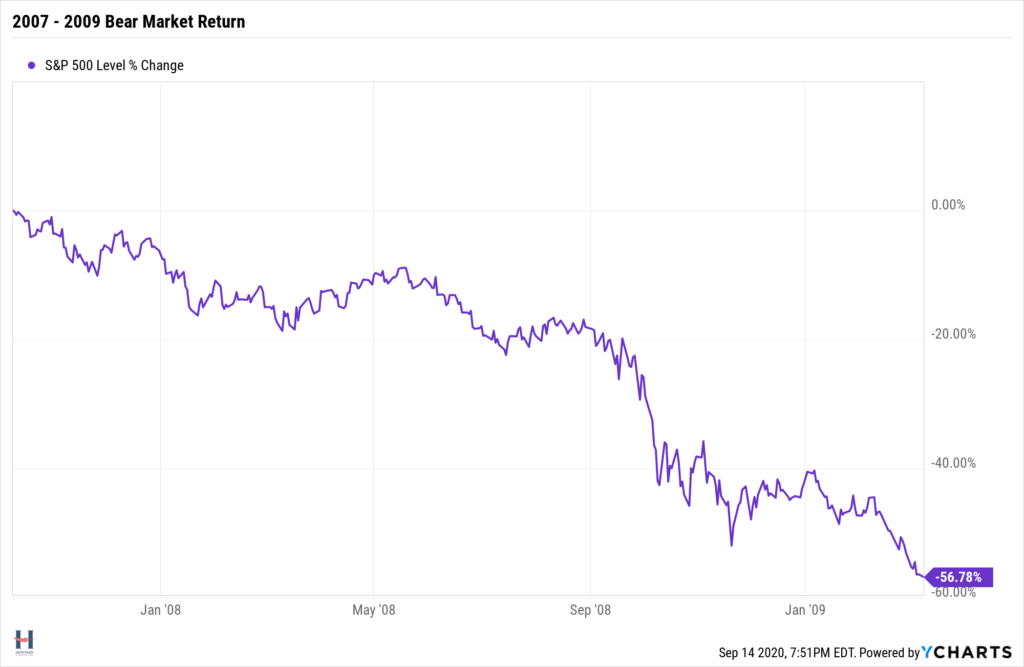

Markets obliterated

Between late 2007 and early 2009, investors lost nearly 60% in U.S. stocks in the worst bear market since 1937.

Investors hated U.S. stocks

It seems hard to imagine now, but U.S. large cap stocks were not popular in 2009. They had just emerged from the lost decade. Returns were negative 15% over ten years. Two bear markets hit within that span (49% during the tech wreck and 57% during the Great Financial Crisis).

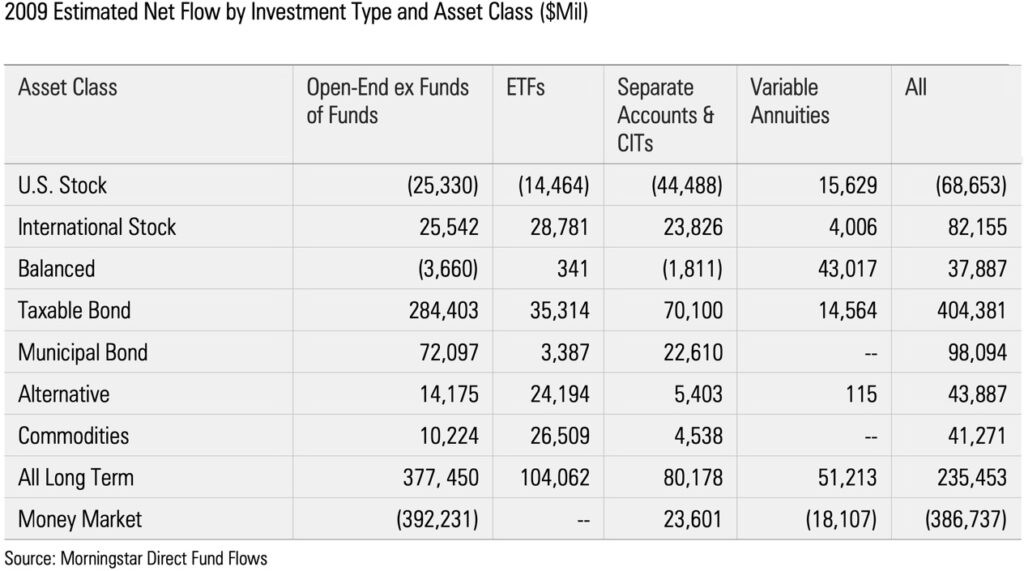

It took twelve years for an investor in the S&P 500 on January 1, 2000 to make money. So, by 2009 investors were quite pessimistic. They pulled a collective $68 billion out of U.S. Stock funds and poured them into anything else they could (except cash).

LESSON: Bull markets begin before you think they should based on the economy and news, something I’ve written about here and here, and the strongest reversals come at the worst times.

The bull market grew on skepticism

Investors hardly went bargain hunting for U.S. stocks early in the new bull. Despite a gigantic Wall St. sale, it wasn’t until late 2013 that flows into U.S. stock funds regained the peak levels of the 2003 – 2007 bull market. That’s growth on skepticism as the market had gained over 150% by then.

Fund flows are a good way to measure investor sentiment as other measures can be anecdotal. However, it was called the most hated bull market in history for so long it became a bad Wall St. cliche, and a jog down memory lane reminds us of some prominent skeptics and fear mongers who kept people out of the market.

- Nouriel Roubini, aka, Dr. Doom, one of the only economists to call the crash referred to the 2009 market as a sugar rush and predicted increasing pain for the investors.

- Bill Gross and Mohamed El-Erian coined the term new normal to warn us of a decade of subdued growth and weak investor returns.

- John Hussman, the fund manager and prolific writer, was warning of 30% – 40% stock market drops still to come in April, 2009.

- Cranks like Peter Schiff and James Rickards who were basically afraid of everything under the sun, maybe even the sun itself. I wasn’t listening.

The news didn’t help either.

2010 brought the Flash Crash, BP oil spill, and Greek debt crisis and a 16% market drop in the S&P 500.

2011 saw a U.S. debt downgrade and international stocks getting hit hard due to Eurozone economic stress and a 19% market drop in the S&P 500.

LESSON: Too many investors miss the powerful returns earned during a bull market’s rally phase because they question how the market could be going up so quickly while things still seem bad. Stay invested so you don’t miss out. More about this here and here.

The bull market matured on optimism

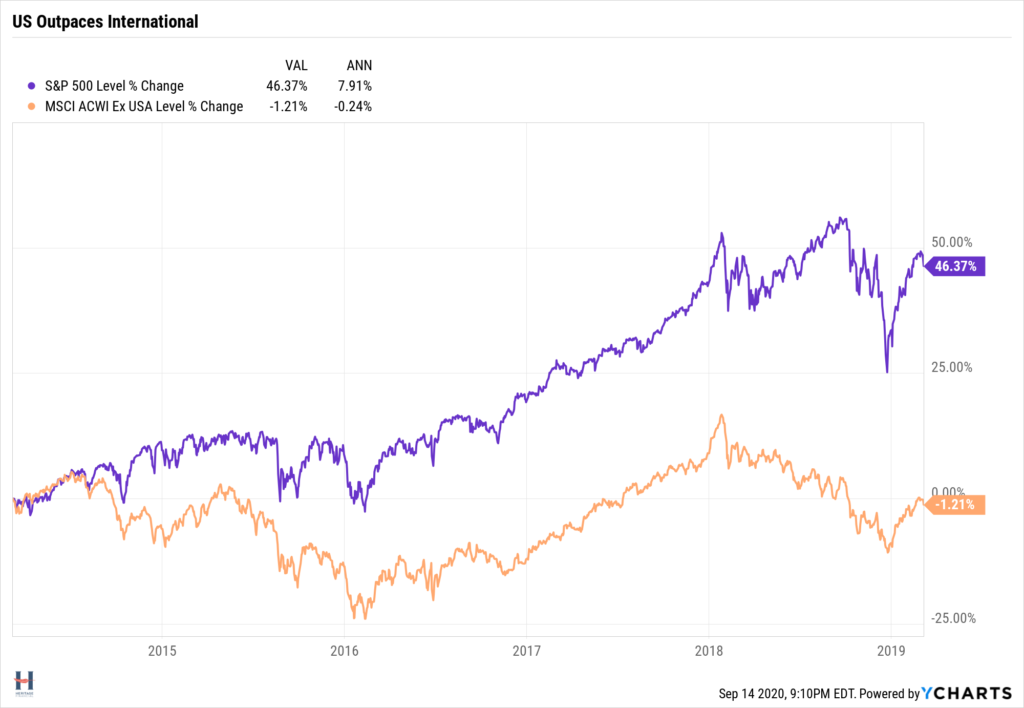

My friend’s popularity eventually picked up as people noticed its strength. Its long-term relative returns going back to 2000 was not a standout (as mentioned above). However, things change around major market events and investors put 2000 behind them and started looking at performance during the bull market that started in 2009. Early in that bull the S&P did very well, returning 22% per year, but international stocks were also strong at 16% per year average between March 9, 2009 and March 9, 2014. However, the story changed dramatically over the next five years. International stocks were slightly negative, while U.S. stocks returned almost 8% per year.

Conversations shifted from trying to convince people to own U.S. stocks to trying to keep them from only wanting to own U.S. stocks – large cap U.S. stocks in particular.

Fund flows into U.S. stocks surpassed the peaks of the 2003- 2007 bull market. Optimism reigned.

LESSON: This is the easiest part of the market cycle for investors. The economy is humming, and the market’s recent returns are strong, so it makes sense to invest. The biggest lesson learned was that investors who were too pessimistic and skeptical to invest in stocks made the mistake of never jumping back in because they thought they’d missed the boat and continued to be uninvested during the profitable optimism phase.

The bull market died on euphoria

This last part of the Templeton quote may be the hardest to reconcile given the obvious narrative that the bull didn’t die from euphoria but a medically induced economic coma to protect people from Covid-19. I’m not here to dispute this, but before we dive deeper here it’s important to explain what Templeton means by dying on euphoria.

Whenever people are getting Tiger King crazy about an asset class, it ends poorly. We saw this with tech stocks in the late 1990’s, real estate in the middle of the last decade, Tulips in the 1600’s (well, we had to read about that one…)

It’s hard to pinpoint what drives markets in the moment, but while we may not have had full-fledged euphoria in February, we already know we were in the longest bull market ever, investor enthusiasm shifted toward U.S. stocks significantly during those eleven years, stocks had gotten expensive, and it did not seem like a market that would react favorably to an exogenous shock like the novel coronavirus.

But this gets us somewhere more technical and not apparent through Templeton’s quote – the difference between a secular and cyclical bull market.

A secular bull market is a period of above average market returns that lasts beyond just a few years. A cyclical bull market is shorter and is only a few years long.

The bull market that began in 1982 and lasted until the dot-com bust in 2000 was a secular bull. The 2003-2007 bull was a cyclical one trapped in the secular bear market that began in 2000 and ended March, 2009.

Connecting this back to Templeton and this piece, it appears that the bull market ended but didn’t. (No, I’m not nuts). The cyclical bull did, but the recovery’s strength since March 23rd this year, indexes hitting new highs, and the lack of a euphoric melt-up leading up to February 19, 2020 are my main reasons for thinking so.

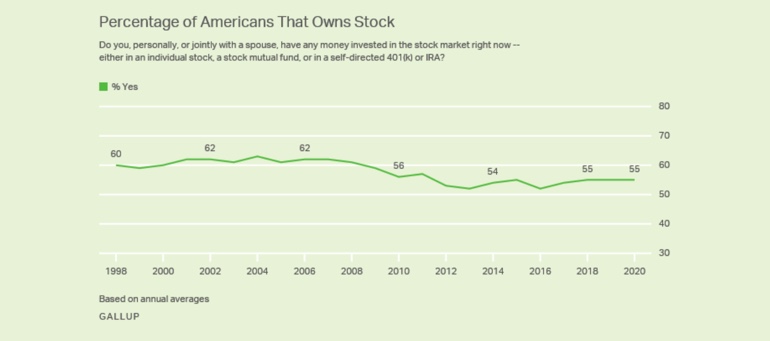

The chart below also shows that the level of stock ownership is still where it was before the bull.

The 1982-2000 secular bull ended with the biggest stock market bubble we’ve seen bursting. Seemingly everyone was talking about stocks and trading them.

The 2000-2009 secular bear ended with a complete stock wipeout. A 57% decline accompanied by fear and panic selling the likes of which we did not see in 2000 or this year.

The cyclical bull ended this year, but the secular one is still alive.

This does not mean the market will go up forever. It does not mean we won’t have another bear market at some point. As we’ve seen, you can have cyclical bulls and bears within a long-term secular move. It also doesn’t mean I’m right about all this. These are just my thoughts as I reflect on what has happened this year and comparing them to markets I’ve watched or studied in prior years.

But if Templeton is right, and I think that quote about stock markets is the best I’ve ever seen, then the lack of a full-blown euphoric melt-up where everyone was buying stocks and shifting their portfolio more aggressively to avoid FOMO means this secular bull still has room to run but the protections you take through diversification and asset allocation are still appropriate given the short-term volatility of markets and always present uncertainty about the future.