What We’re Telling Clients

Our wealth management firm has been proactive with client communication during this latest downturn. We sent out a piece on February 29th addressing the market volatility and then again yesterday as global stock markets approached a 20% decline. The decline has been quick, and when paired with the spread of COVID-19 and plummeting oil prices, it has justifiably raised questions and anxiety levels. I’ve also written about it here.

We focused on three key points:

- Context is important

Communication decisions during these times can be challenging philosophically for wealth managers. We know our clients have questions and concerns and we want to help them navigate these stressful markets, while not deviating from fundamental tenets of successful investing. High market volatility and unexpected negative events have historically been normal aspects of a functioning market, and true financial reward is ultimately delivered to those who maintain a disciplined long-term investment strategy.

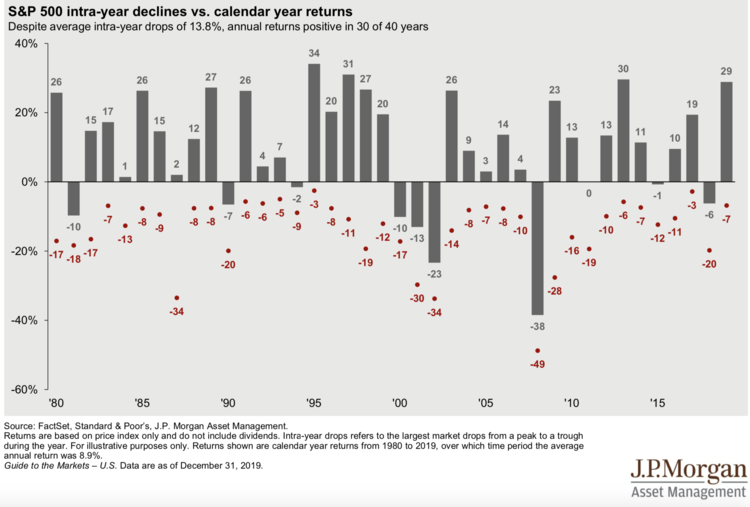

Therefore, we started by emphasizing that while the speed of this recent stock market decline has been noteworthy, the overall percentage loss has not. Over the past 40 years the average intra-year U.S. stock market pullback has been -13.8%.

And so far, we are down about 18% from the peak in the U.S.

While things could definitely get worse before they get better, we believe that markets will eventually rebound and long-term investors will continue to reap the attractive annualized returns of the stock market.

2. The economy won’t provide a trading signal

It’s reasonable to assume that global economic activity will retract in the near term as the world tries to slow the rapid spread of COVID-19. Slowdowns in manufacturing, interruptions to supply chains, and travel restrictions will have a negative economic impact, as will the damage to more sensitive specific industries and sectors.

We cannot predict the extent of the potential economic decline, nor the exact timing of the slowdown and eventual recovery, nor do we think anyone else can.

We do know that stock markets are a leading indicator of future economic activity, which simply means that stock markets move in anticipation of economic events down the road and not after they have been confirmed. Therefore, just as this stock market sell-off is signaling slower economic activity, the market typically begins rebounding before the economic slowdown bottoms out. This is a long way of saying that we can’t wait for signals in the form of actual economic data to tell us when to get in or out of the stock market.

3. Have an investment plan

Trying to time the markets in an attempt to avoid short-term declines is a game you can’t win. It’s time in the market, not timing the market, that delivers the best long-term results. Your investment strategy should have been built with a clear understanding of your financial situation, and most importantly, when you will need to withdraw assets from your portfolio and in what amounts. If done correctly, the asset allocation and design of your portfolio was structured to avoid having to sell a meaningful amount of stocks at a loss when markets decline to meet your spending needs. As an example for investors who need money from their portfolio, interest rates have also been plummeting at an unprecedented level during this stock market decline, which has pushed bond prices to all-time highs. Investors can take profits in bonds for spending money to avoid having to sell stocks that have declined in value.

What should you do instead of market-timing?

At some point, if the decline is severe enough it can and should be viewed as a buying opportunity.

You don’t need to jump into a modest decline, such as an average calendar year -14% correction. However, when you get to a more substantial pullback or bear market, such as a 20% to 30% drop, these have historically presented excellent buying opportunities. At these levels, you will rarely regret adding to stocks in a long-term portfolio. This could happen through a combination of rebalancing the portfolio back to its initial target weights and increasing the target allocation to stocks. The extent of the buying opportunity will depend on the severity of the decline, but the disciplined investor with a proactive strategy is in great position to take advantage of stock market weakness and buy stocks at a discount.

For more information, or to get help with your portfolio you can schedule a time to chat here.