The Easiest Way to Increase Your Investment Returns

Put your cash to work.

To build enough wealth to accomplish your long-term goals, you not only have to make money and save it, you have to allocate that money correctly. Money should go where it belongs.

Cash you don’t need for a long time should be invested aggressively, money you need in the next few years should be in the bank, and then there’s a category in between.

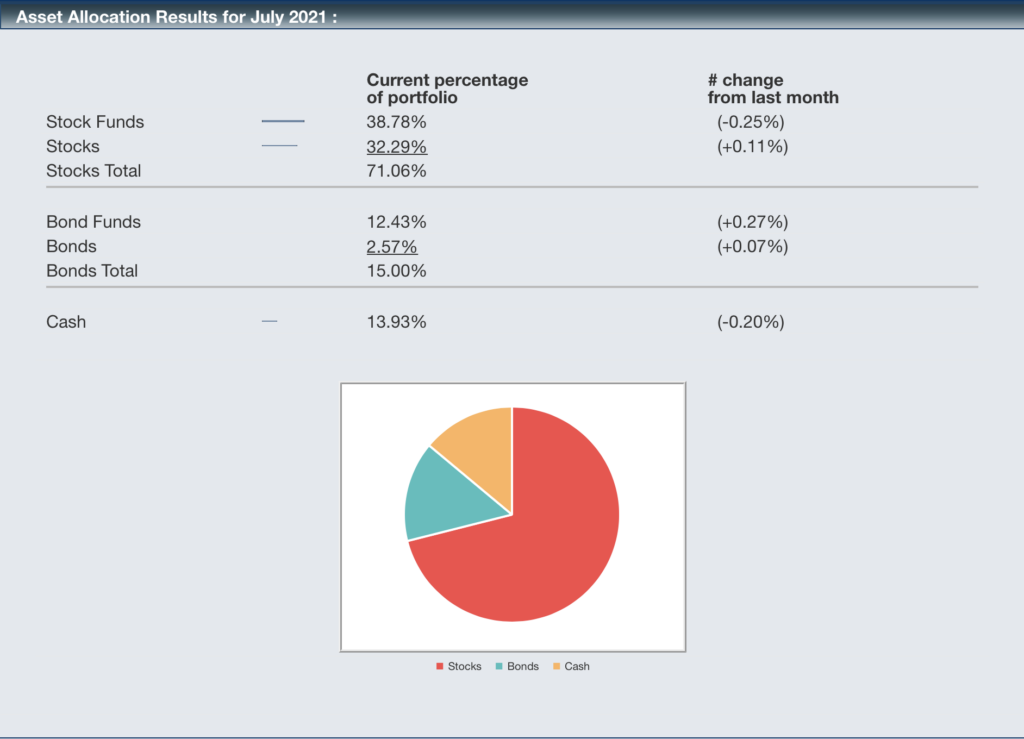

New clients we work with are usually sitting on too much cash. I’m not talking about folks who just sold their business or somehow acquired a lump sum and came to us to invest it. I’m talking about folks who consider themselves fully invested. Between excess cash in the bank and their investment portfolios, I’ve seen cash positions that average around 15%. This echoes other findings.

The American Association of Individual Investors Survey for July, 2021 shows an average cash position of 13.93%.

Vanguard’s How America Invests study from December, 2020 noted that affluent investors averaged 15% in cash.

Getting that cash to work is the easiest way to increase investment returns.

Cash to Work in Action

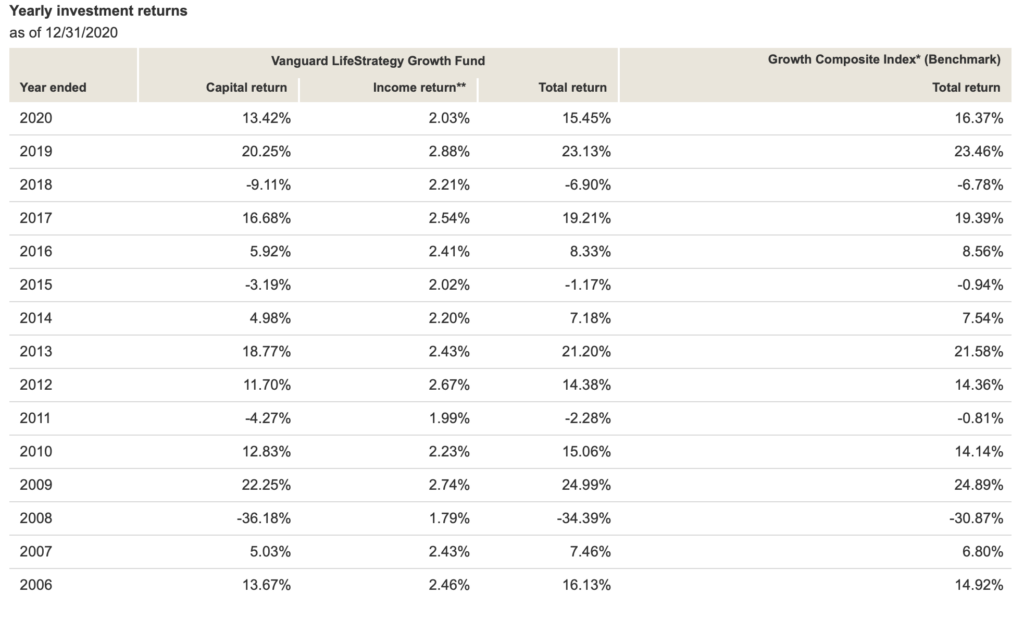

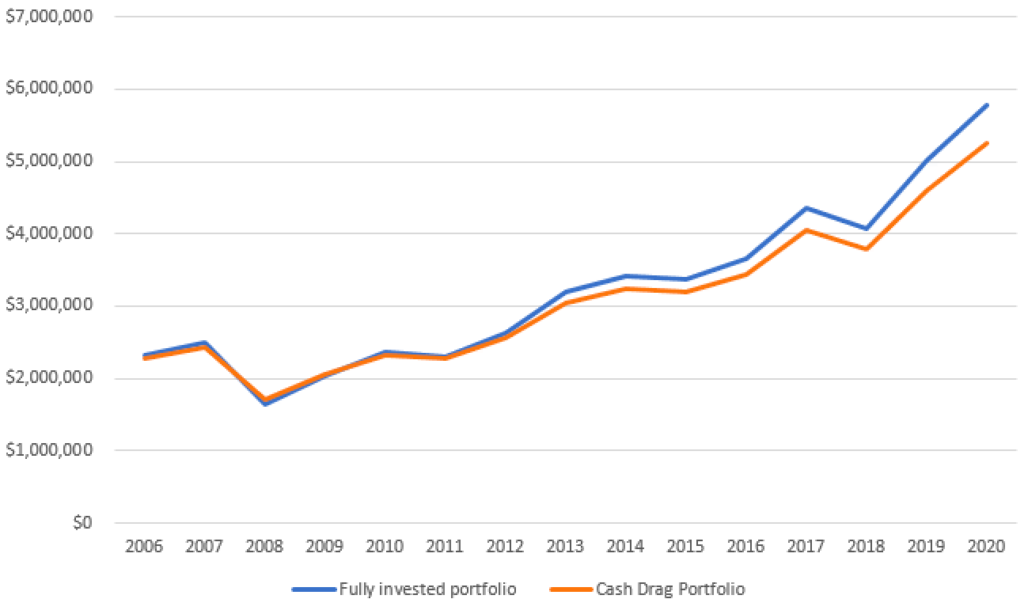

Check out this example using the Vanguard LifeStrategy Growth Fund (VASGX). It’s growth-oriented at 80% stock (20% bond), has a long track record, and invests globally through index funds. I’m not recommending it, just using it as a proxy for a diversified portfolio’s return.

If you had $2,000,000 invested in this fund between 2006 and 2020 your average annual growth rate would have been 7.33%.

If 15% of that portfolio was sitting in cash earning 1%, your average annual growth rate would have been 6.66% – .67% – or $518,052 – less.

Two-thirds of a percent more just by putting cash where it belongs.

Do some financial planning.

Figure out your ideal rainy day fund. Put it in the bank.

Invest the rest.

You work hard for money. Give it the best chance to grow. Cash isn’t the answer. Inflation will likely cause it to have a negative real return over time.

Common reasons for Excess Cash and How to Remedy

Excess cash happens for a variety of reasons. Here are a few.

- Over-estimating the necessary rainy day fund. The Certified Financial Planner Board of Standards recommends maintaining three to six months of living expenses in cash, depending on your situation and the economic climate. Target a larger cushion if your income is volatile, if you have less job security, or if you have larger financial obligations.

- Money was set aside to buy something, like real estate, but the market got away from you and you never made the purchase. Be realistic in determining if you’re going to buy. While I don’t want you to invest money you’ll need soon, don’t give up returns for a theoretical purchase.

- Cash hits your account, and you’re uncertain whether now is the right time to invest. Perhaps you think the market is too expensive, or you’re concerned that it’s about to go down for whatever reason. It doesn’t matter. Now is the right time to invest. Putting money where it belongs is always the right answer. To eliminate this need to constantly evaluate whether to invest available cash, set up auto-investing from your bank account like you do with your paycheck and 401(k). I hardly ever see excess cash in 401(k) accounts. Or hire an advisor to make sure it’s done. A good financial advisor will sharply reduce your portfolio’s cash drag by keeping you fully invested. The return improvement mentioned above would almost cover a full advisory fee, and a good advisor does so much more for you than this. Finding a Good Financial Advisor can help you find one.

- You were fully invested, but sold because of the election, the Covid crash, the Delta variant, worries the market had gotten ahead of itself, etc. Hold your nose and get back in.

Suggested Further Reading

Your Financial Planning Checklist