Table of Contents

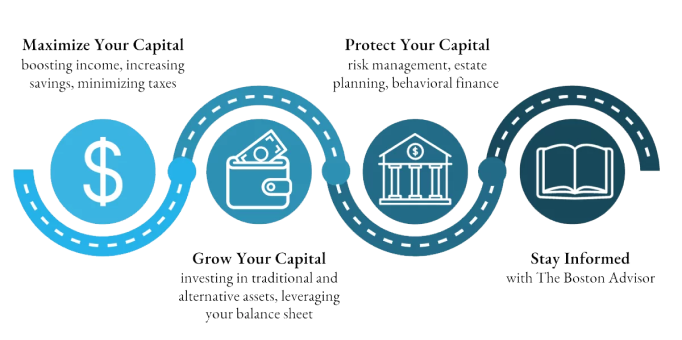

Looking for a resource to make sure your finances are in good shape? This wealth management checklist created as part of my Beyond the Basics road map to grow and protect your wealth is a good place to start.

Dive deeper into select financial planning checklist items marked with an asterisk.

The Basics

- Set goals

- Create a way to track progress toward your goals

- Pay off your credit cards monthly

- Pay off high interest rate debt, which I consider anything above 5%*

- Contribute to your work retirement account to at least receive the full company match

- Establish a rainy day fund covering at least 3-6 months of expenses

Next Level

- Establish a Home Equity Line of Credit for emergencies and short-term cash needs

- Track spending to fix any problem areas and verify you’re using all your monthly subscriptions*

- Increase retirement plan contributions over time to approach maxing out

- Contribute to IRA accounts and grow the tax-free Roth IRA bucket if eligible, including through back-door Roth IRA contributions

- Maximize work benefits*

- Invest your excess cash*

- Use a 529 plan to save for college

Advanced Capital Allocation and Investing

- Don’t take on too much debt compared to your assets (consider capping debt at 25-35% of your net worth)*

- Only borrow for investments that target strong returns competitive with what you can earn in stocks*

- Divest from investments that are not earning a competitive long-term return

- Maintain the right asset allocation for your different money buckets

- Short-term money (needed in next three years) invested in cash

- Long-term money (needed at least 10-15 years from now) invested in stocks

- Intermediate-term money (needed between 3-15 years) in a mix of stocks and bonds based on when you’re going to need the funds and how much per year

- Avoid speculative investments that could go to zero*

- Only invest in illiquid investments when there’s a pathway to higher returns

- Maintain a diversified portfolio

Minimizing Taxes*

- Avoid realizing short-term gains

- Have a low portfolio turnover rate in your taxable accounts (sub 35%)

- Contribute the maximum to a Health Savings Account if that is an option at work and the right fit for your health

- Gift to charity with something other than cash, such as with appreciated securities or an IRA Qualified Charitable Distribution

Protecting Your Family and Your Assets

- Have an up-to-date estate plan to protect you and your family from your death or disability*

- Make sure you have enough disability insurance to protect you and your family*

- Make sure you have enough life insurance to protect your family

- Make sure your beneficiary designations are up-to-date

- Title your assets correctly

- Maintain up-to-date and sufficient home, auto, and umbrella insurance coverage

Frequently Asked Questions

How often should I review my wealth management strategy?

Conduct a comprehensive review of your financial plan and overall finances annually, with quarterly check-ins on investment performance, asset allocation, and ongoing planning priorities.

What percentage of income should go toward wealth building?

The 50/30/20 budget rule is a good guideline. The 20% goes to savings, 50% to spending on needs, and 30% is for spending on wants.

Should I work with a financial advisor?

Consider professional guidance for complex situations, estate planning, or if you lack time for DIY management. Learn more about the value of financial advisors and how to find one.

How do I prioritize saving for competing financial goals?

Start with an emergency fund and contribute enough to your work retirement account to receive the employer match, then balance retirement savings, debt payoff, and other goals based on your timeline and risk tolerance.

Elevate Your DIY financial check-up

Buy the book that inspired the checklist