Open Enrollment Tips to Maximize Benefits

October is open enrollment time at work. Too many of us rush through our selections and default to last year’s choices. That’s a mistake. Your work benefits can be your strongest option for many financial services important to you and your family. So, take some time to understand what you have access to and make the right selections.

Start with a review of anything that’s changed in your benefits from the prior year.

A normal menu provides:

Health insurance

Most companies offer some combination of PPOs (Preferred Provider Organizations), HMOs (Health Maintenance Organizations), and high-deductible plans.

PPOs tend to be more expensive than HMOs, but provider greater flexibility in which doctors you can see.

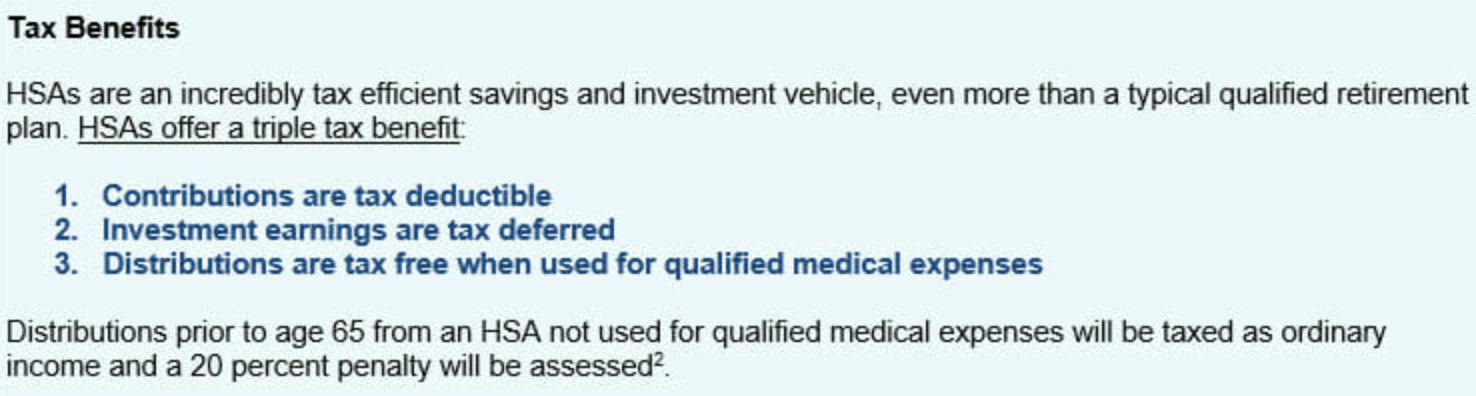

High deductible plans carry cheaper premiums, but you have to pay a bunch of money (the deductible) before your coverage kicks in. A high deductible plan can also be paired with a Health Savings Account, allowing you to save tax-free for future health care costs.

Understand what you and your family spend a year in health care and what you prioritize. If out of coverage doctors are important, PPOs may be the way to go. Consider an HMO if you don’t spend much on health care, or are fine with less flexibility. If you don’t spend much on health care, or don’t mind spending your own money to hit the high deductible and are looking for an extra savings vehicle, consider a high deductible plan paired with a Health Savings Account.

For 2024, the contribution limits for single people is $4,150 and $8,300 for families (there’s a $1,000 catch-up contribution allowed for those over 55).

Also, make sure you don’t miss out on any health or wellness incentives like reduced gym membership fees, or financial incentive for participating in wellness programs.

Vision and dental insurance

Here it’s important to understand what’s covered compared to the policy cost. Sometimes these plans have coverage caps that don’t make enough financial sense for you to enroll.

Life insurance

You don’t want to miss out on signing up for life insurance during open enrollment. Just understand that these policies have coverage limits which may be less than what your family needs, and if you leave your employer you usually can’t take these policies with you. So, you could be out of a job and the cost to get your own policy would be a lot higher than if you did it when you were younger or healthier.

Disability insurance

In my experience, most people don’t have enough disability insurance coverage. Your employer benefits plan is a great way to get some. Understand what the policy covers. Also, if there’s an option to pay the premiums yourself then you get the money tax-free. Disability Insurance Overview and Tips has more some practical advice.

Flexible Spending Accounts

Medical FSAs are a way to contribute pre-tax dollars into an account that you can use during the year for health care costs. Contributing pre-tax means that you’re not taxed on the income that goes in there. You usually have to use all the money within the calendar year. But it’s a nice savings.

A related benefit is a child care FSA. Same concept, but it covers child care costs.

Further Reads

Is Your Target Date Fund Missing the Mark? – Are you counting on target date funds to get you to and through retirement? While popular and seemingly easy, many target date funds have inherent flaws that could actually work against your retirement goals.

Interested in Doing More?

Here’s an easy to follow guide: