The House Tax Bill

In January, I hosted a webinar looking at President Biden’s proposed tax plan from the campaign trail. The webinar reviewed his proposals, assessed likelihood of passage, and shared ideas on minimizing taxes. This week we have a draft House tax bill attempting to act on his ideas. This follows action by the Senate over the summer.

Directionally, the draft legislation feels similar to Biden’s proposals, but there are major differences.

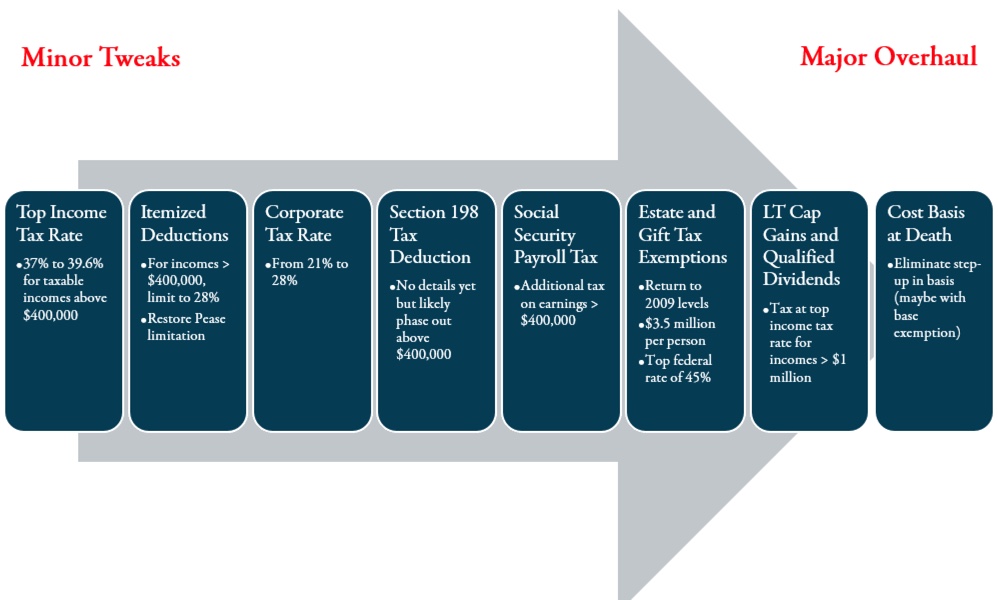

In January, I shared that items on the left had a higher chance of passing than items on the right.

Minor Tweaks vs. Major Overhauls

That prediction looks safe.

Going from left to right, the House tax bill proposes:

- Increasing the top marginal tax rate to 39.6% starting in 2022 for single individuals making more than $400,000, married couples making more than $450,000, and head of household filers making more than $425,000.

- I haven’t seen anything related to limiting itemized deductions, but the bill creates a new tax of 3% on individuals making more than $5 million.

- Increasing corporate tax rates to 26.5% and expanding the net investment income tax to cover net investment income earned from a trade or business for taxpayers making more than $400,000 (single filer) or $500,000 (joint filer).

- Nothing on the 198 Tax Deduction, but the bill limits the maximum 20% qualified income deduction (199A) for taxpayers making more than $400,000 (single filer), 0r $500,000 (joint filer).

- No changes to the Social Security Payroll Tax.

- Instead of returning to the 2009 levels for the estate and gift tax exemptions lowering the exemption amount to half the current exemption. This effectively changes the sunset year in the increase in the exemption amount from 2025 to the end of 2021. It’ll be $5 million per individual indexed from inflation from 2010.

- Increasing long-term capital gains and qualified dividends, but not to the level proposed by Biden. Instead of taxing them at ordinary income for those making more than $1 million, increasing the highest capital gains tax rate to 25% for high income earners.

- Nothing clear related to eliminating the step-up in cost basis. It may not be included in the bill or it may trigger for estates larger than $5 million per person.

The House Tax Bill Additions

- Prohibiting IRA contributions for a tax year if an individual’s total retirement account values exceeded $10 million at the end of the previous year. If an individual’s total retirement account values exceeded that $10 million threshold, a large required minimum distribution would be required the next year.

- Eliminating Roth IRA conversions (which includes backdoor Roth IRA’s) for individuals making more than $400,000 and married taxpayers making more than $450,000.

(Current) Final Thoughts

There’s still a ways to go on this one. The House has to pass its bill, and Democrats can only afford to lose three votes. A bill then needs to pass the Senate where Democrats cannot afford to lose a single vote. Two Senators have already expressed concerns about the size of the spending and tax plans.

But keeping more of what you earn is always good financial sense, and we are likely to see some tax increases.

January’s webinar shared a three-part tax savings approach that’s still applicable given these new proposals:

- Minimizing taxes by what I call “Doing No Harm”: Reduce portfolio turnover and unnecessary capital gains. Pick the right investment strategies. Place specific investments in certain accounts to save on taxes.

- Specific tax savings ideas: Three ways to donate to charity more effectively. Pick the right retirement plan for your business. Use Health Savings Accounts.

- Estate planning: Understand how to use the three levels of estate planning to reduce estate taxes.

The ten minutes between minutes 5 and 15 in this video reviews them in greater detail.

Suggested Further Reading

You Need an Estate Plan – Maintaining an up-to-date estate plan is an essential part of your financial planning. This article highlights some of the more common documents you should consider.

Your Wealth Management Checklist – An individual capital allocation checklist for people to use to make sure they’re taking the right financial planning and investment steps. Includes a section on taxes.