Minimizing Taxes Under Biden’s Proposed Tax Plan: Webinar Replay

The Democrats control the White House, House, and tiniest of majorities in the Senate. It’s time to take a look at President Biden’s proposed tax plan and review ways to minimize taxes under it. My recent Heritage Financial webinar covered this. Learn about Biden’s proposals, how likely they are to pass, and a tax savings framework to help minimize taxes regardless of if they do.

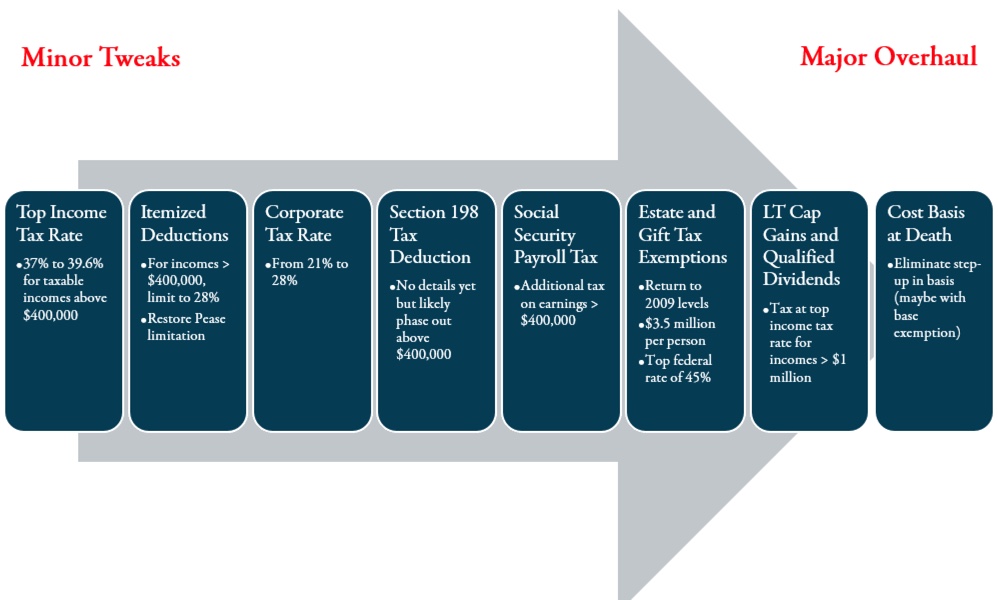

The webinar started with a look at what President Biden proposed during his campaign.

The webinar then shared a three-part tax savings approach:

- Minimizing taxes by what I call “Doing No Harm”: Reduce portfolio turnover and unnecessary capital gains. Pick the right investment strategies. Place specific investments in certain accounts to save on taxes.

- Specific tax savings ideas: Three ways to donate to charity more effectively. Pick the right retirement plan for your business. Use Health Savings Accounts.

- Estate planning: Understand the three levels of estate planning and how to use them to reduce your tax bill if the estate tax rules are changed.

Q&A covered a potential SALT cap adjustment, variable annuities, and the estate tax.

Stay tuned for future webinars and check out the further reading suggestions below.

_______________________________________________________________________________________________________________________

Further Reading to help you with your 2021 financial and investment planning beyond just minimizing taxes under Biden’s proposed tax plan:

2021 Investment Strategy Webinar – 5 Portfolio Changes to Make Now – 2020 changed the investment landscape. Learn what changed and how to adjust your portfolio accordingly.

Your Wealth Management Checklist – 6 part checklist to make sure your finances are in good shape and you’re not leaving any wealth creation opportunities on the table