Investing is as Easy as Losing Weight

I love stocks. They help my clients retire, just as I expect them to help me and my wife do one day. Good retirement planning comes down to earning money, saving it, and investing those savings into a portfolio to fund you for decades. That’s where stocks come in. They’re the portfolio Miracle-Gro and a key part of the investing formula pre-retirees should follow.

Stocks, as represented by the S&P 500, returned 11.8% per year since 1928. Doubling your money every six years. They made you money 73% of those years. You lost money about one out of every four years. Great odds. And in exchange for living through those negative years, your average stock market return in positive years was 21.2%. Source: Slickcharts.

So, my personal investment formula centers around stocks.

Besides my rainy day fund and the bonds I own in accounts where I will make withdrawals from in the next ten years, whenever I have excess cash to invest I put it in stocks. If I avoid speculative investments, resist the temptation to market time when I get nervous, don’t get greedy and chase stuff, and be patient, I should do well.

Easy, right? I know I’m making it sound that way, but there is a big difference between easy and simple.

A Simple, but Not Easy Investing Formula

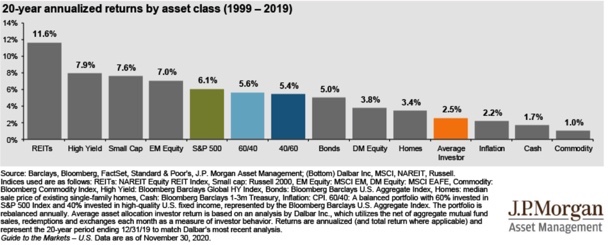

The investing formula above: put your long-term money in stocks, avoid speculation, and resist fear and greed is simple. But it’s not easy. If it were, we wouldn’t have data like this showing the average investor underperforming almost every asset class for the last twenty years.

Just like losing weight. The formula is simple. Move more, eat less. Yet, whenever we see a friend or co-worker whose lost a noticeable amount of weight, we always ask – how did you do it? And we wait with baited breath for some formula that’s easier than the one above.

And sometimes they tell us something seemingly new: a new program, new rules, cutting out a food group or booze. But it’s all just different versions of move more, eat less. Losing weight could not be more simple. And it also could not be harder for most people, me included. I don’t think I have a weight problem (no need to comment), but I love to lose the same 5-10 pounds over and over.

Why? Because it’s not easy to avoid all the tasty, high calorie, and unhealthy things out there. I can do it in spurts, but not my whole life. It’s not easy to get off the couch and move more every day after long days of work, and I am not one of those hardos who wakes up before the whole world to exercise.

It’s also not easy to just sit there and let your investments do their thing. The investing formula is simple. The numbers back that up. Buy a diversified stock portfolio. Ignore it. Wait a long time and see the results.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Benjamin Graham

But investing is not easy. Volatility is stressful and pushes us to act. The news makes us pessimistic, and we’re tempted to market time. The urge for instant gratification prevents patience and we chase performance.

But investing is simple.

Put your long-term money in stocks, avoid speculation, and resist fear and greed.

Move more, eat less.

Easy, right?