Protecting Your Portfolio From The News

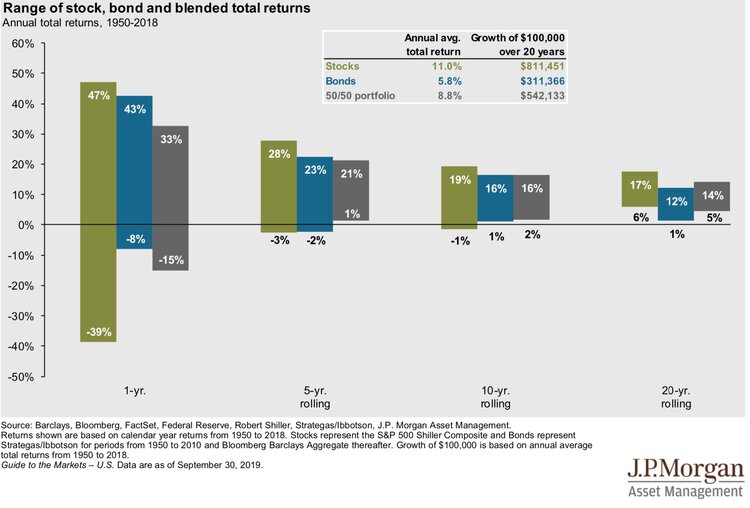

In the short-term, the stock market hits rough patches that can lead to serious portfolio declines. In the long-run, the stock market has historically provided very strong returns. The chart below highlights this well by looking at the one year range of outcomes for an all-stock portfolio in green, all bonds in blue, and a 50/50 stock-bond mix in grey over 1 year, 5 year, 10 year, and 20 year rolling time periods. As you can see, the longer your holding period, the better your investment outcomes have been. Stay invested. But sometimes it’s hard to do when the news isn’t great, which is why learning about protecting your portfolio from the news is crucial.

You need to stay invested through the rough patches in order to make money.

Historically, investors have struggled with this. We’ve sold out of stocks when owning them got too tough. Market-timing never works, but we’re always tempted to try it for a variety of reasons. Sometimes it’s letting the news influence your investment decision-making. It’s the market timing temptation that arrives in the sheep’s clothing of fake investment advice. To protect your portfolio from the news, please remember one thing:

Markets discount, and the news reports. Getting that backwards can crush your portfolio.

You own an investment—let’s say it’s an emerging markets stock fund. The fund is performing poorly, while your US stock investments are doing well. You want to dump the loser, but know you shouldn’t. So, you stick to your plan. Then you start reading. Articles in The Economist, The Wall Street Journal, and the like are talking about how bad the emerging markets are performing. They explain what’s going on in those economies that may be making their markets perform poorly. It’s all bleak and ugly stuff leading to bleak and ugly returns, including pithy quotes about how bad things are.

Aha! You knew it. You have to get out of that investment now.

Or do you? This is a news article, not investment analysis, despite the august publication it’s in. A market is performing poorly, and a respected media outlet is telling you about it and providing context since it would otherwise be a short and boring article.

I hate most weather analogies—unless they’re my own and I really need to make a point—but when the weather report tells you it’s cold and wet outside, why it’s cold and wet, and the precautions you should take to stay safe, warm, and dry, it doesn’t mean they canceled spring. It’s just what this raw winter day looks like.

Reporters aren’t investment analysts, and current events are not a way to figure out future returns.

Protecting your portfolio from the news requires you to understand this distinction.

Major jargon alert: The markets are a discounting mechanism. Markets discount, which means market participants make investment decisions now about expected future returns. The news reports what’s going on today.

That emerging market investment that’s been tanking—yes, it’s had an ugly ride, but what will it do from here? Is this an attractive price to buy it, since the future earnings you are purchasing cost less? The US stock fund that’s been on a tear—that’s been a great investment until now, what’ll happen to it next? Maybe it’s still reasonably priced and will continue to do well, or maybe that dollar of earnings you are buying is now too expensive to expect a decent return. That’s the analysis investors should be doing, but we too often conflate the report on current events with a future investment outlook.

Related Reading:

Understand Your Messenger’s Agenda

CNBC – Investor Friend or Foe?