Your Money This Week

The big news this week was the Fed meeting Wednesday. They didn’t cut rates, but forecast a milder inflation picture going forward and members penciled in three rate cuts for 2024.

The yield on the ten-year fell sharply. It’s now just under 4% after being just under 5% two months ago.

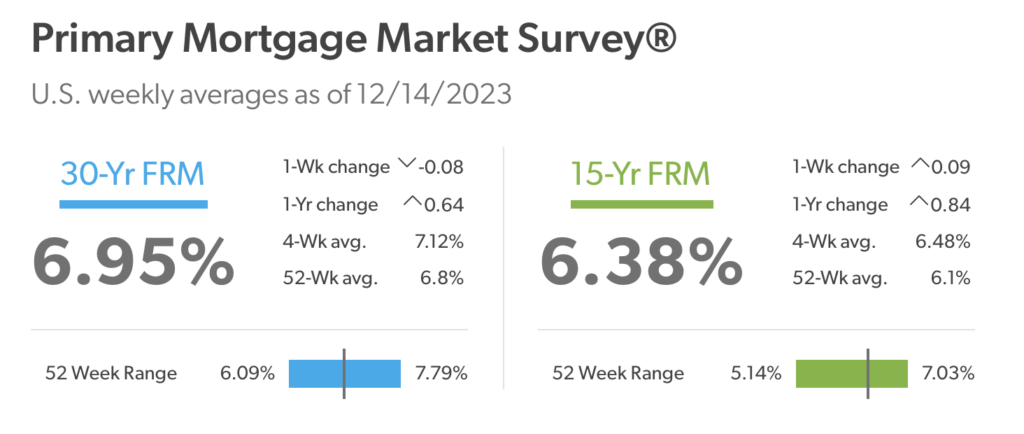

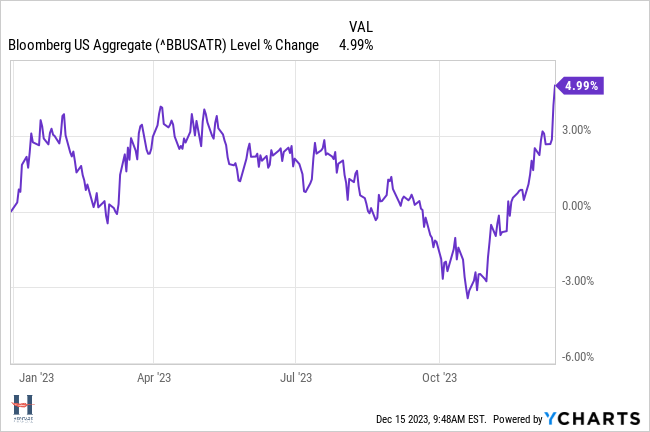

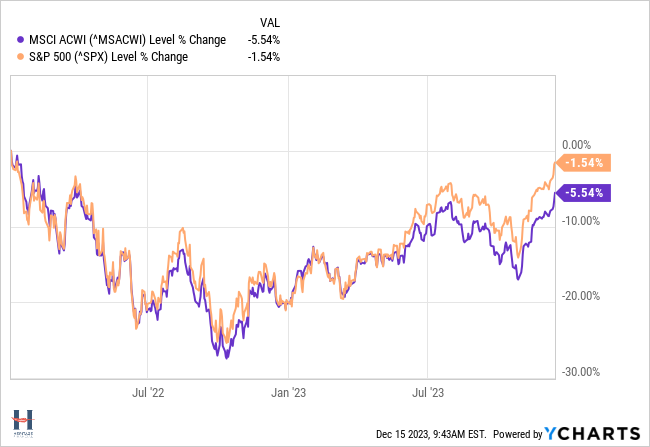

Mortgage rates, bonds, and stocks reacted positively.

Mortgage rates dropped below 7%.

U.S. bonds jumped, continuing a volatile year in the bond market. They’re now up nearly 5% year-to-date.

The market rally that started late October in U.S. and international stocks continued. Both are now within a few percentage points of their all-time highs reached in January, 2022.

The rally broadened with small-cap stocks doing particularly well.

What Next?

Well, obviously no one knows, but as I talked about with Bob Pisani, that doesn’t mean that’s the end of the conversation.

Hopefully, the mortgage market easing will drive real estate activity for people looking for new homes and provide recent purchasers refinancing opportunities.

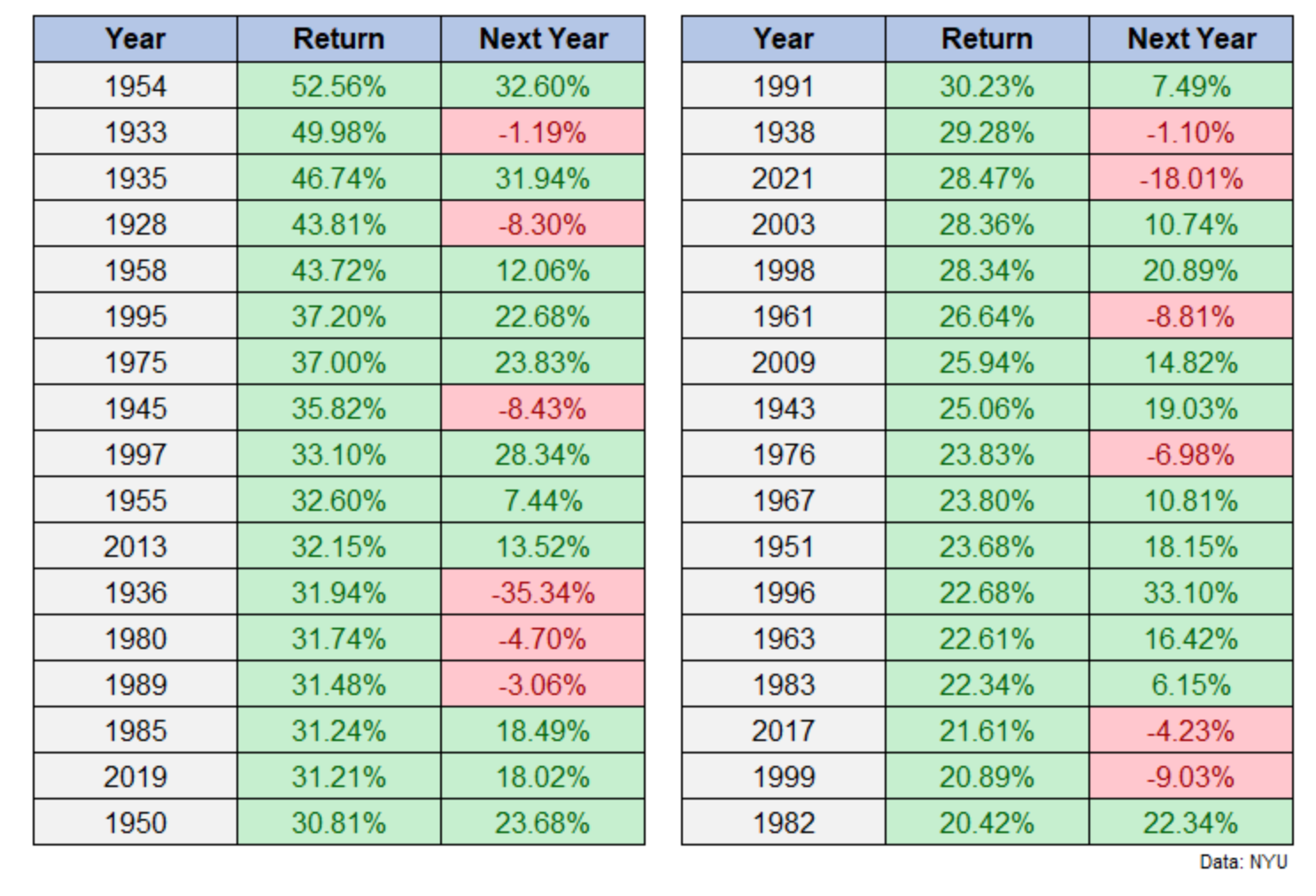

If you’ve been nervous to invest and now suddenly worry it’s too late because the market jumped, Ben Carlson shared some great stats on what happens in markets after 20% years you should see.

“Not too bad. More green than red for sure. Here are the summary statistics:

What Happens After a 20% Up Year in the Stock Market? by Ben Carlson

- The stock market was up 22 out of the 34 years following a 20% gain (65% of the time).

- The stock market was down 12 out of the 34 years following a 20% gain (35% of the time).

- The average return following a 20% up year was 8.9%.

- The average gain was +18.8% in up years.

- The average loss was -9.1% in down years.

- There were 19 double-digit up years.

- There were just two double-digit down years (1936 and 2022).”

Important Year-End Dates to Remember

December 31 is the deadline for (amongst other things):

- Satisfying Required Minimum Distributions for the current year

- Completing taxable gifts for the tax year

- Generating tax losses or gains in your taxable portfolio

- Making 2023 charitable contributions

- Making employee deferral contributions in your retirement plan

Got questions?

I’m always happy to hear from readers and help in anyway I can.