Learning from the Best This Week

I’ve had the privilege this week to attend Barron’s Advisor Independent Summit in Dallas. As described by Barron’s, it’s

“A gathering of self-made leaders who have earned a distinct place within the financial services industry. This invitation-only event offers the top independent practitioners a unique opportunity to interface and network with the peers who best understand their businesses. Offered by Barron’s Advisor since 2009, this curated experience has become the premier annual event for ranked independent advisors, with content designed to highlight the best practices and specific needs of independent advisors.”

Barron’s Advisor

Barron’s does a great job putting these events together, bringing in the top advisors, investors, and economists we can learn from for the benefit of our clients.

Some takeaways from the three days that might be helpful to you:

- No one knows where the economy or the markets will go short-term. Three straight speakers had three distinct views. This will probably go on my tombstone, but you shouldn’t make portfolio moves based on anyone’s short-term forecast.

- There is consensus that the Fed will hike rates next week still, it’ll be .25%, and the struggles in the banking industry may cause the Fed to be more dovish going forward. Everyone agreed the Fed needs to slow down soon.

- Side note: The great Jeremy Siegel (author of Stocks for the Long Run, featured as one of my Best Financial Literacy Books) gave Jerome Powell a D- grade. It was only that high because he said he learned as a professor that you can’t fail anyone easily anymore. If you do, you’ll have to give them the right to be retested, the administration gets involved, and you end up moving it to a D- anyway

- New Fed inflation target may be 2.5%, and it could end up running a bit higher which would be fine.

- What regulators did last weekend to save depositors at the two troubled banks was a very big deal and a creative, beneficial solution.

- Bond yields are attractive, and that’s not necessarily an indictment against stocks. But you can take less risk (owning fewer stocks and more high quality bonds) and get comparable returns to a portfolio with more stocks and lower quality bonds.

- There’s very little risk the dollar loses reserve currency status. “In the land of the blind, the one-eyed man is king.” The Euro and the Yuan are in no position to challenge the dollar.

- A year ago crypto was everywhere, something I touched on here. This year there was much less crypto talk and much more eye rolling about it.

- Housing inventory is still scarce so higher rates aren’t as damaging to pricing as they would be otherwise.

- On policy, one speaker shared that President Biden’s proposed tax hikes were dead on arrival, long-term the Republicans will prevail in cutting back Medicaid and Medicare, but the Democrats will prevail in leaving Social Security untouched and bolstered.

- On politics, Trump or DeSantis would be the GOP nominees, but Pompeo is someone to watch if either falter. Biden is the likely Democrat nominee if he runs. Other candidates to consider depend on if he decides not to run, or runs but drops out for whatever reason. In the first instance, Bernie could be formidable. In the second, it would likely be Harris.

- Book recommendation shared by presenter: The Hot Hand: The Mystery and Science of Streaks by Ben Cohen

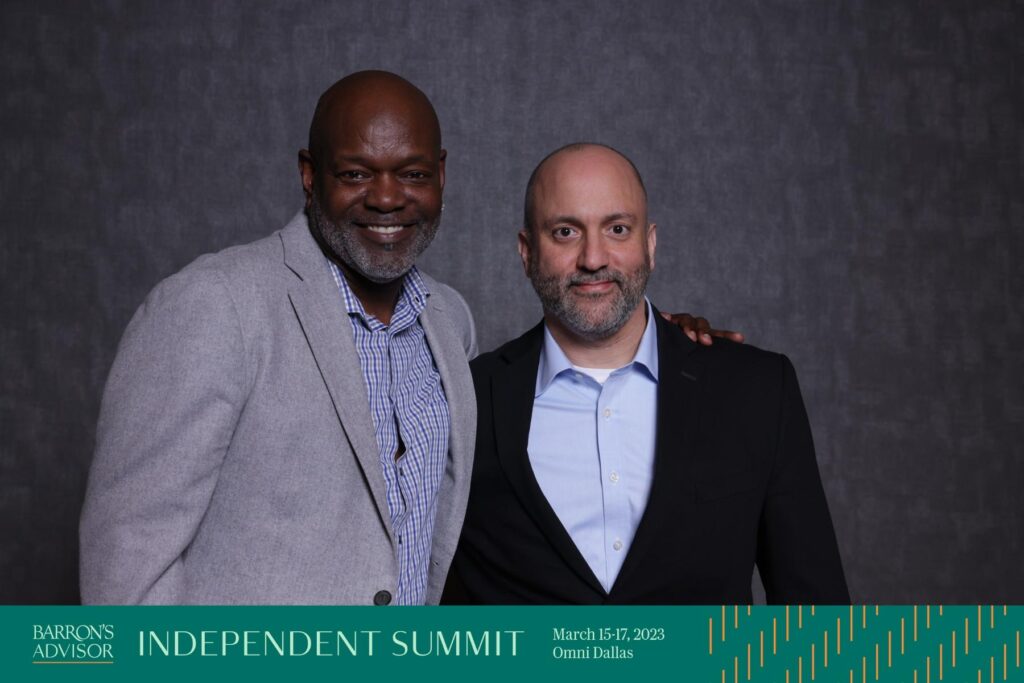

We also heard some great leadership and teamwork lessons from Hall of Famer Emmitt Smith.

I met some amazing people as part of this panel discussion on Roles in Transition: The Changing Responsibilities of C-Suite Execs.