Dangers of Investing for Income Today

Rates are low. If you bought a house recently, or refinanced your mortgage, you know this and hopefully took advantage. It’s helpful to borrowers. It’s not always helpful to investors. Sure, low rates caused the TINA trade, driving stocks higher. However, for those who can’t just own stocks and want retirement income, low rates are a problem. There are dangers of investing for income today to understand before moving your investment-grade bonds into higher yielding alternatives.

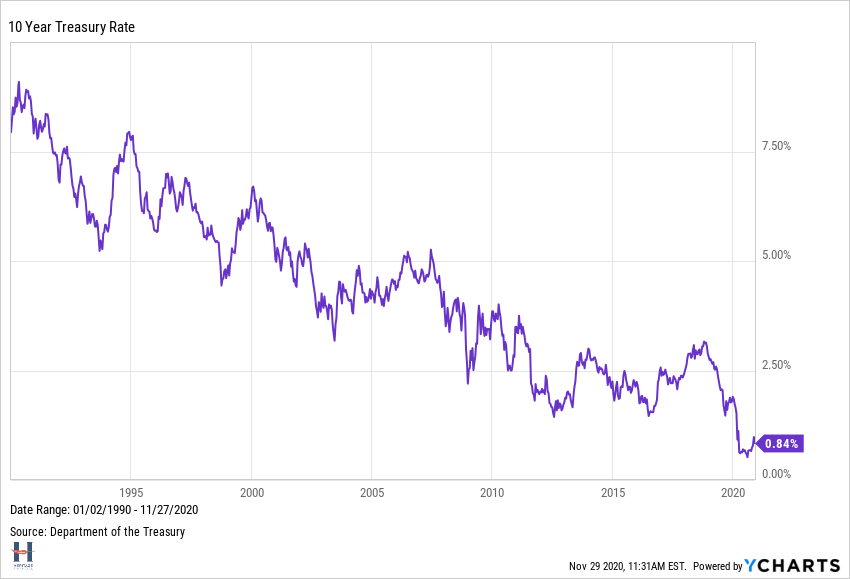

The 10-year Treasury now yields .84%, basically providing its lowest yield in the last thirty years. The real yield (adjusted for inflation) is negative even with inflation running below average. That means for investors buying 10-year Treasuries, a safe source of portfolio income, you will lose money to inflation. So much for investing for income today.

As a result, investors are searching for income elsewhere and ignoring the risks. Higher income is not a free lunch. It should come with higher risk, something Warren Buffet recently warned about here.

Let’s look at two popular income candidates as examples why.

REIT’s

According to Investopedia, “A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.”

Real estate income without the work. And it’s attractive income. Looking at a popular diversified ETF, the iShares Core U.S. REIT ETF, we see its 12 month trailing yield as of October 30th was 3.86%. This is nearly three percentage points higher, or more than four times the 10-Year Treasury’s yield.

But look out below.

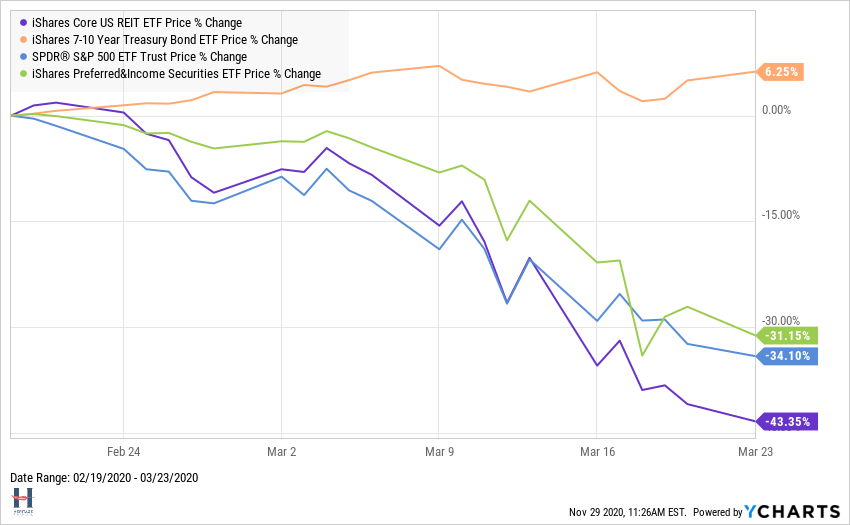

If you want income in your portfolio, you got it. However, it came with a side of risk you didn’t bargain for when you decided to sell your safe bonds. During this year’s bear market, the REIT ETF lost 43.35%. The stock market was down less, and a Treasury ETF was up 6.25%.

This doesn’t mean REIT’s don’t belong in your portfolio. But when investing for income today, you cannot simply target higher sources of yield and ignore the additional risk.

Preferred Stocks

Preferred stocks provide another lesson.

There are two types of company stock owners, common and preferred shareholders. Not every company has both, but when they do, preferred shareholders receive a higher claim on dividends and a higher yield.

Again using a popular ETF as a proxy of what a diversified portfolio of preferreds provides, we see that the iShares Preferred and Income Securities ETF had a 12 month trailing yield as of October 30th of 5.42%. That’s more than 4 percentage points higher than the 10-year Treasury and more than six times the yield. And it held up better in the bear market than the REIT ETF, but probably not what you were looking for when you sold your bonds to buy it.

This is the same chart as above with the Preferred ETF added. Down 31.15% during the bear.

Targeting higher income comes with higher risk you probably don’t want to add to your portfolio, especially if you’re selling your sleepy bonds to do so.

What to do Instead?

In Portfolio Changes to Consider Now, I suggested repositioning your bond portfolio into short-term bonds, which based on where the yield curve is today, provides almost as much return, stronger protection from rising rates, and the ability to more easily reposition your portfolio into longer-term bonds that pay more income when the yield curve steepens.

You also don’t want to be underweight stocks. I don’t want you to go crazy and chase stock returns simply because yields are low. That would be the same mistake this piece is warning you against. But if you have been underweight stocks in your portfolio, it’s time to consider buying some. The exact amount depends on your financial plan and risk tolerance.

But neither suggestion solves the income challenge. That’s mainly because I think you should ignore it. Your portfolio does not need to generate a specific amount of income for you to live off of it comfortably.

For example, you don’t need a portfolio to generate 4% of income if you want to spend 4% of your portfolio each year. Instead, invest for total return. Some of that return will come from income (dividends and bond interest), and some will come from investment growth. With total return investing, as long as your withdrawal rate is reasonable, your portfolio should grow over time and fund your retirement through a combination of income it spins off and withdrawals from investments that have grown. It also avoids the risks when investing for income today.

____________________________________________________________________________________

Related reading: Investment Mistakes to Avoid