Portfolio Changes to Consider Now

2020 changed the investment landscape in a few ways. It’s time to reassess things and consider some portfolio changes.

Asset allocation drives your investment return. The amount of money invested in stocks, bonds, cash, etc., plus how you split those investments up within each category is your most important investment decision. Building your optimal allocation requires having a financial plan, understanding your risk tolerance, and building expectations for future asset class returns.

The first two factors are specific to you, but certain things have happened recently to adjust risk and return expectations for different asset classes. Therefore, it could be time to make portfolio changes.

We’ll first look at three things that have changed and what you may want to do about it.

What’s Changed

Fed’s lower for longer policy – The Fed announced that they would like to keep the Fed funds rate near zero until inflation rises above 2% for some time. Given that inflation has run below 2% for a while, it’s reasonable to assume that rates will be very low for years to come and that the Fed will let inflation top 2%.

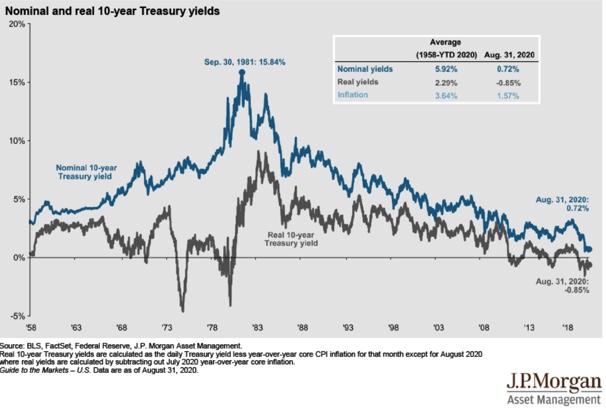

This chart illustrates how low rates and inflation are compared to long-term averages.

Falling dollar – Another potential implication of the Fed’s policy is that the dollar’s recent weakness could continue. This piece looks at this in greater detail.

New Bull Market – The bull market that began in 2009 ended earlier this year (R.I.P. 2009 – 2020 Bull Market & Lessons Learned) killed by the Covid-19 bear and second quarter’s sharp economic contraction. Markets have recovered since then, and third quarter GDP will be positive.

Your Portfolio Changes

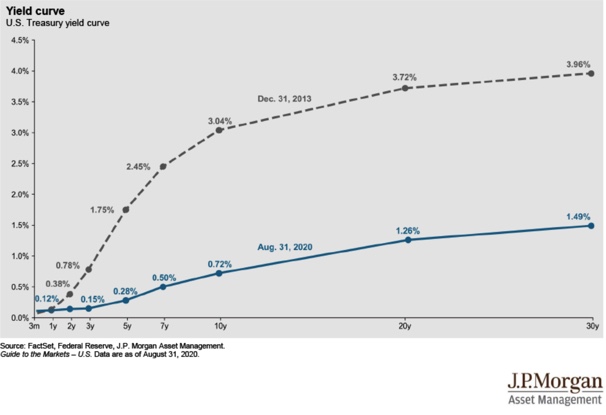

Bonds: The Fed’s various moves have flattened the yield curve. Long-term bonds don’t pay you much more than short-term ones. The chart below shows the yield curve at the end of August this year compared to 2013. The long-term yield dropped by 2.5%, and you are only getting paid 1.49% to own 30 year bonds now.

Long-term bonds are also more sensitive to interest rate increases. All else being equal, long-term bonds decrease in value more when interest rates rise than short-term bonds. With rates near zero, there is asymmetrical risk right now in owning long-term bonds. And if the Fed gets its stronger inflation, rates should rise as the yield curve steepens.

Positioning your portfolio in short-term fixed income provides almost as much return, stronger protection from rising rates, and the ability to more easily reposition your portfolio into longer-term bonds when the yield curve steepens.

Stocks: With rates near zero and bond yields low, stocks become more attractive by comparison. You may have heard of the TINA (There Is No Alternative) trade. It means that with yields low, there is no alternative to stocks if you want decent returns. I won’t go that far. Increased stock exposure comes with increased risk, and at some point stocks get too expensive regardless of the alternative.

However, if you have been underweight stocks in your portfolio it’s time to consider buying some. The exact amount again depends on your financial plan and risk tolerance. Work with your advisor to determine your optimal allocation and add to stocks if necessary. (Need help?)

Given the conversations I’ve had lately, buying stocks may be hard. People are skeptical about the market’s recovery, and there’s a pervasive sense that it’s divorced from economic reality. I wrote about this extensively here, but one quote from that piece is worth repeating:

“Bull markets are born on PESSIMISM, grow on SKEPTICISM, mature on OPTIMISM and die on EUPHORIA.”

— Sir John Templeton

It’s normal for a market’s early run to be accompanied by skepticism. This is the hardest part of the bull market cycle for people to understand. Too many investors miss the powerful returns earned during it because of fear the recovery isn’t real yet.

Beyond increasing stock exposure, investors should consider shifting the types of stocks they own. A falling dollar is a tailwind for international stocks, just as the strong dollar was an international stock headwind during the last bull market. Investors should adjust their U.S./International stock mix and bring it more in line with the global stock market index weights. U.S. stocks make up about 58% of a broadly diversified global stock index.

Take a look at your portfolio, and if you are meaningfully over that number consider selling U.S. stocks and buying international ones to take advantage of the falling dollar, cheaper relative valuations, and increased resiliency of the emerging markets.