Disinflation Helping the Market

I don’t anticipate monthly economic reports like they’re the next season of Narcos, or The Mandalorian. Sorry, Billions, you used to be on this list, but I gave up on the endless feuds and plots. Your characters deserve each other (come for the finance talk, stay for the bad TV reviews).

Anyway…I was anxious for the July inflation report this week.

Inflation is the market story this year, and so far it’s been an ugly one.

It’s out of control.

The Fed is aggressively raising rates to combat it.

Stocks are in a bear market.

Bonds are down.

And things likely won’t turn around until we see signs that disinflation is helping the market.

Disinflation is commonly used by the Federal Reserve (Fed) to describe a period of slowing inflation and should not be confused with deflation, which can be harmful to the economy. Unlike inflation and deflation, which refer to the direction of prices, disinflation refers to the rate of change in the rate of inflation.

Investopedia

We’ve been talking about inflation’s impact on the markets for months on our Wealthy Behavior podcast. It’s kind of been the star of the show.

We’ve been preparing for it in client portfolios for longer (2022 Investment Outlook).

The June inflation report came in higher than expected, but we were seeing some signs that we had reached peak inflation. We needed the July numbers to confirm.

The market was expecting 8.7%.

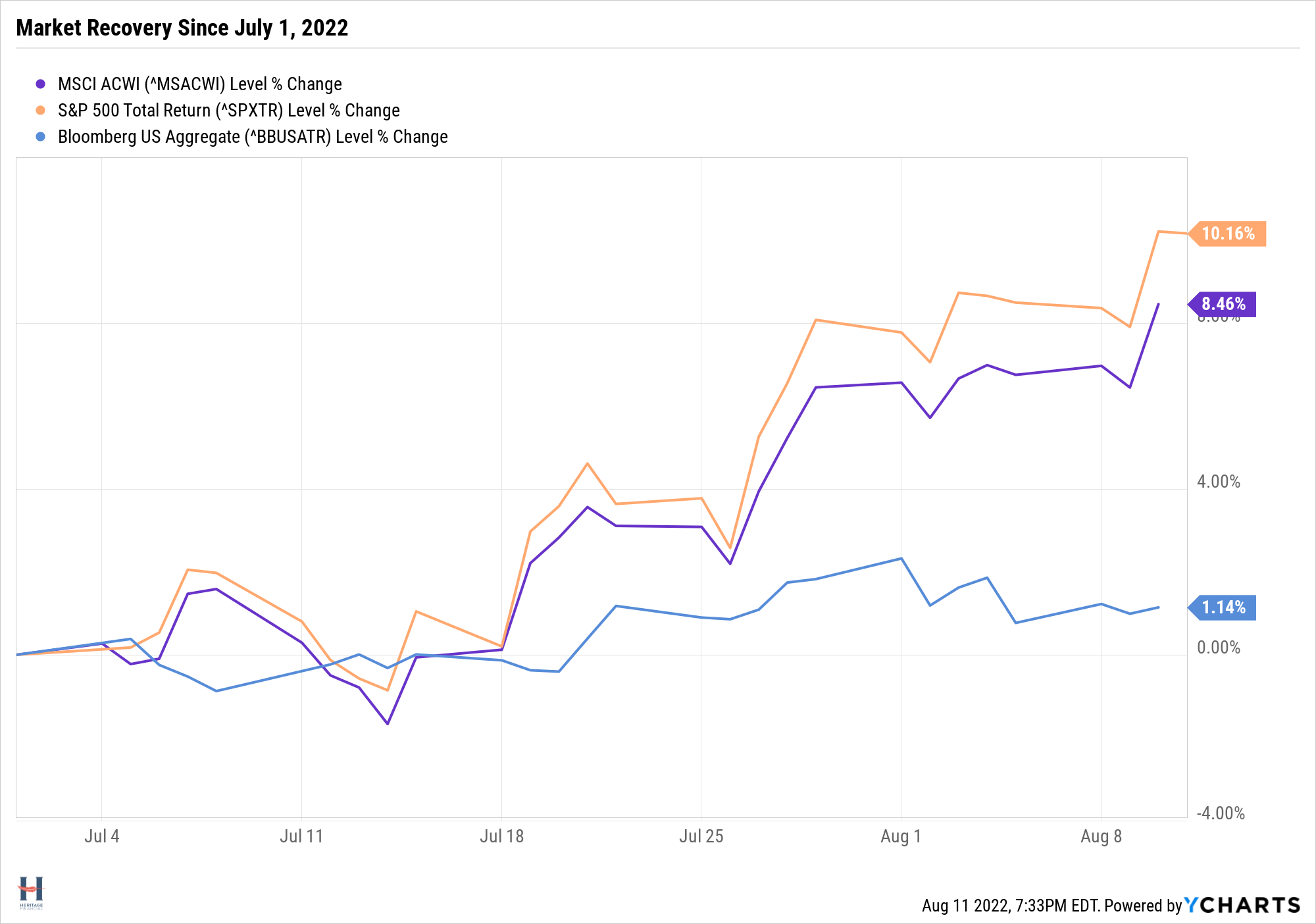

We got 8.5%, and the market ripped higher (Stocks soar, S&P 500 hits highest level in three months after key report shows slowdown in inflation), building upon a strong July. Since July 1st, global stocks, U.S. stocks, and bonds are doing well.

The markets want to see disinflation, and August gave us the first concrete glimpse. Two glimpses actually, since the day after the July CPI report the July PPI report came out with good news.

Where do we go from here?

You’ve figured out already that in the short-term I don’t know (or care) and believe the biggest mistakes are made by people who try to figure out short-term moves.

Two possibilities I am following.

#1: Markets are all-clear. Given the impressive rally supported by positive news about inflation, some technical indicators improving, and the fact that momentum exists in markets, the sell-off we saw to start the year signaled a slowdown that was priced in and the market is now pricing in a recovery and we will not retest the lows.

#2: More pain to come. Bear market rallies happen all the time. The disinflation news helped the market for now, but we may still be in for a longer slog of economic weakness, and it’s too soon for stocks to be rallying into a new bull market.

The fortune-tellers are lined up on both sides of the debate. Some of them will be right. None of them really know.

So, in my true cautiously optimistic nature, I’m going to expect the best, prepare for the worst.

Stick to my long-term strategy and avoid major changes based on fear and greed.

Oh, and work through the rest of my Netflix watchlist before the NBA season resumes.