2022 Investment Outlook

Our investment team just published its 2022 investment outlook (available here).

It’s a great overview of current market conditions and thoughtful guidance on positioning your investments for this year and beyond.

Heritage has a four person investment team and a seven person investment committee that works in consultation with a large independent investment consultant (Fiducient Advisors) to prepare annual capital market assumptions, asset allocation recommendations, select investments, and monitor the market and portfolios throughout the year for any necessary adjustments.

Markets changed in 2020. We had the first bear in 12 years and a pandemic driven recession followed by an immediate market recovery. Smart investors reassessed their portfolios and made changes (Portfolio Changes to Consider Now).

2022 is more of a continuation of 2021’s themes.

Important takeaways:

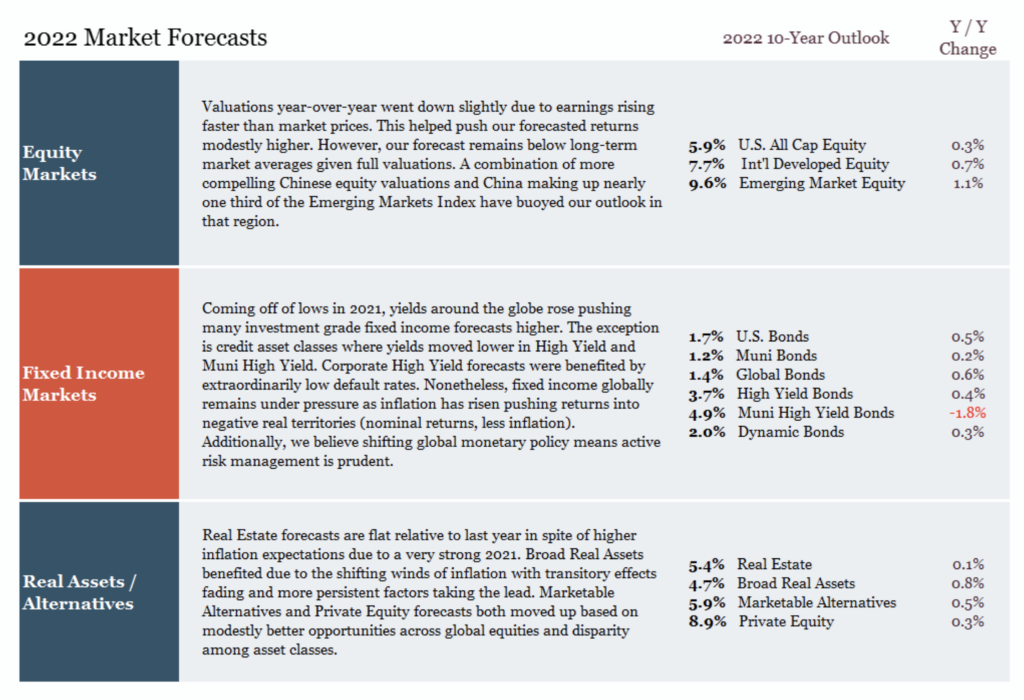

Our team provided the specific return expectations for U.S. stocks, international stocks, bonds, real assets (including real estate), and alternative investments we use to build portfolios.

While always optimistic about markets and skeptical of pessimists (Optimists Get Rich, Cynics Get Airtime), it’s good to plan prudently, and given where valuations are, to use lower returns today to build your plan.

We’re still forecasting healthy long-term returns, and investing is a long-term exercise so it’s important not to try and time the market with short-term forecasts. Instead, be nimble and make thoughtful adjustments as needed. We’ve been active with bonds, alternatives, and real assets in particular lately.

There are still continued concerns about inflation and rising rates. A strong economic recovery and higher inflation make it reasonable to assume a tighter monetary policy going forward, at least from the Fed and ECB. This has investment implications. An easy monetary policy is better for investors, which I focused on in Why to Watch (and not fight) the Fed.

Responding to Tighter Monetary Policy

Diversify globally. As we share in the 2022 investment outlook, the “era of global coordination among banks is beginning to fade.” China, for example, has taken recent steps to ease their monetary policy.

Manage the interest rate and credit risk of your bond portfolio actively.

Finally, shifting a portion of your portfolio from bonds to real assets continues to be important. Real assets diversify a portfolio. They have higher return expectations than bonds, which helps your portfolio without adding stock market risk.

Looking for More Portfolio Guidance?

Watch our 2022 Market Outlook Webinar

We shared our expectations for stock and bond markets in 2022 and thoughts on less traditional investment strategies that will be important for meeting your goals.