Don’t Bail on Your Bonds

In December 2009, I was out grabbing drinks at an Irish pub with some colleagues after our company holiday dinner. Talking about the year that was, congratulating the new shareholders announced earlier in the day, and listening to the grumbles of those who fell short.

One of the senior investment guys leans into me conspiratorially at the bar.

“Hey, I’ve got a great investment tip for you. It’s a trade I’m all in on.”

That got my attention, and not because I wanted a great investment tip. We weren’t that kind of firm. Long-term investments and diversified portfolios. Hot trade ideas, not so much. And this guy in particular was a Kool-Aid drinking stickler.

“Short investment grade bonds. With all this money printing going on inflation has to be coming big time. Rates are going up. Bonds will get killed.”

Not the Greatest Trade Ever

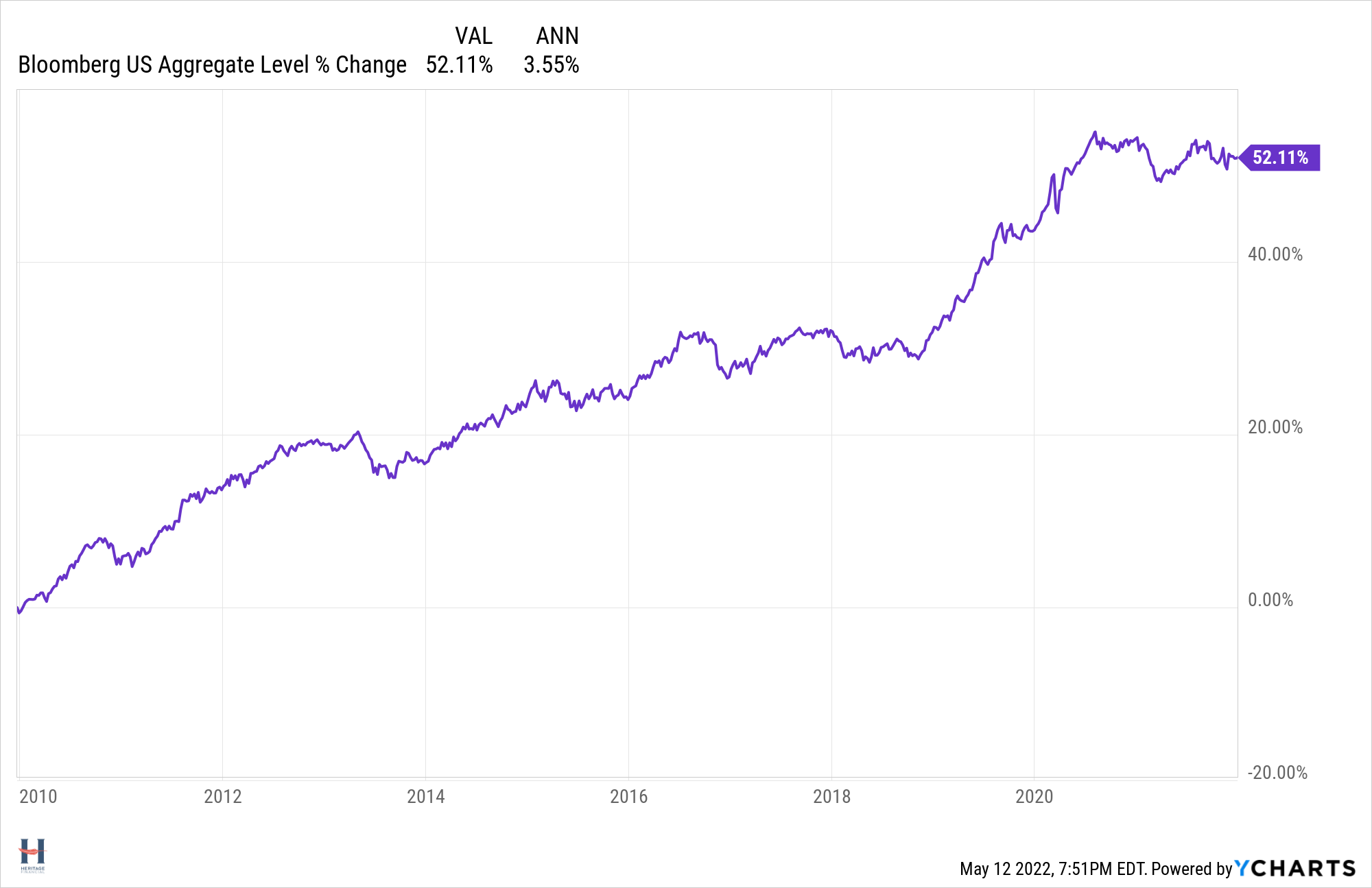

Almost thirteen years later he’s finally partly right. To be fair, he may have told me to wait twelve and half years to sell bonds short, but I don’t remember it that way.

In case you were worried about my portfolio, I didn’t listen.

- I don’t like betting against stuff. I’m not the guy who will ever bet the Don’t Pass Line at craps. Optimists Get Rich, Cynics Get Airtime.

- The budding cottage industry of inflation truthers and Fed critics annoyed me with their politics masked as economic analysis. Reviewing “The Deficit Myth” and MMT.

- Experts should stay in their lane. This guy was a stock picker. What did he know about macroeconomics that the Fed and the bond market didn’t know? It’s like listening to a journalist on sports radio who used to cover baseball start lambasting Bill Belichick’s drafts.

Investment grade bonds did just fine.

And for the first three years of the “great trade”, they returned over 7% per year.

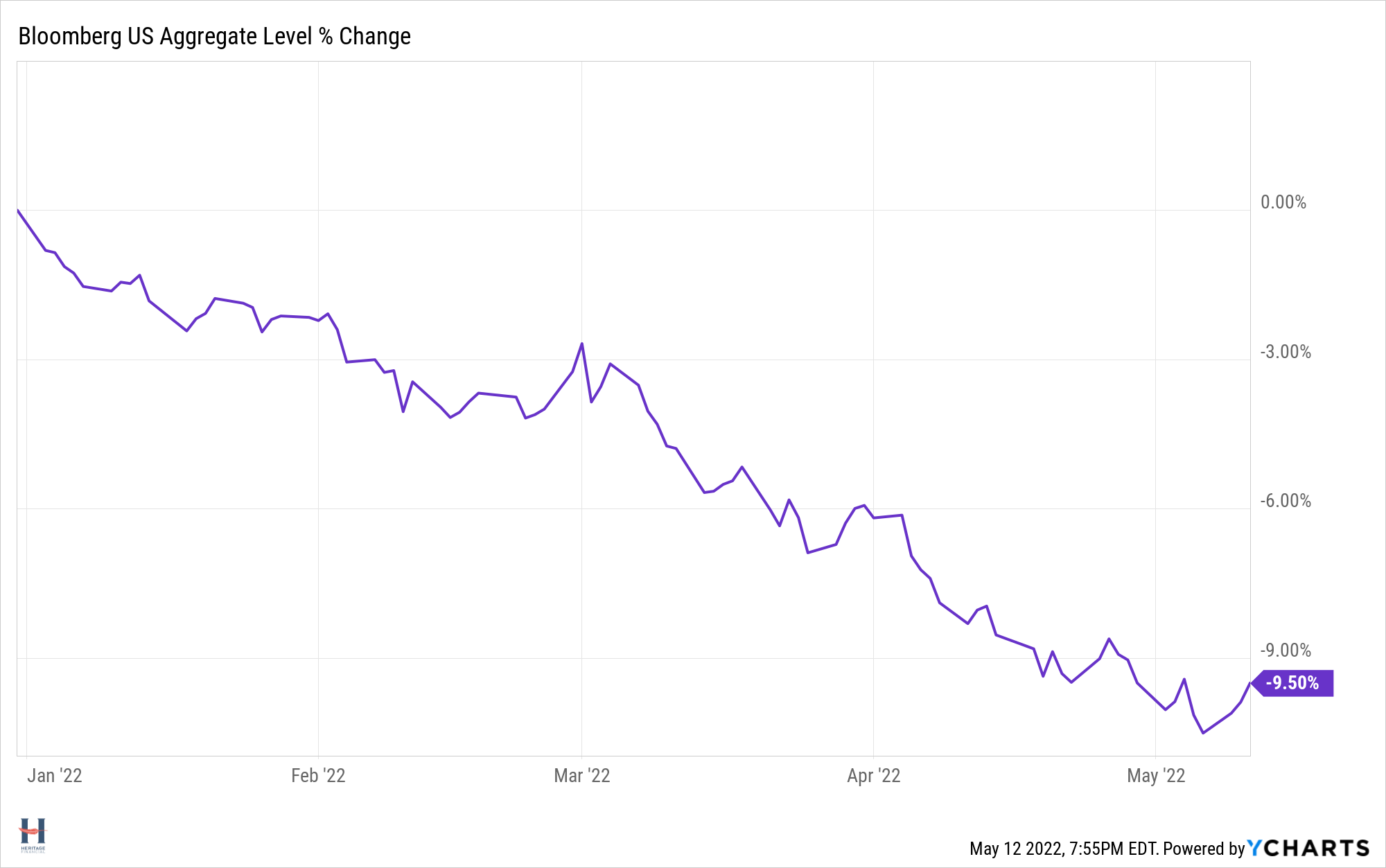

But this year it’s a different story.

Bonds Today

Investment grade bonds are down about 10%. Your portfolio’s “safe” piece doesn’t feel that way, and investors are irritated. Bonds are breaking the implied deal we have with them: don’t lose money and we’ll overlook the fact that you don’t make us more.

And now I’m writing a piece I didn’t expect to write.

Don’t sell your bonds, with one possible exception: if you think this stock market sell-off is a buying opportunity and you want to sell bonds and buy stocks. The sell-off would have to be deeper for me to do the same, but it makes sense to rebalance within reason.

Outside of that, stick to your plan. This isn’t one of those pieces where a financial writer tries to find the 800 millionth way to advise patience based on short-term concerns. (Well, not entirely anyway…)

Bonds are more attractive right now.

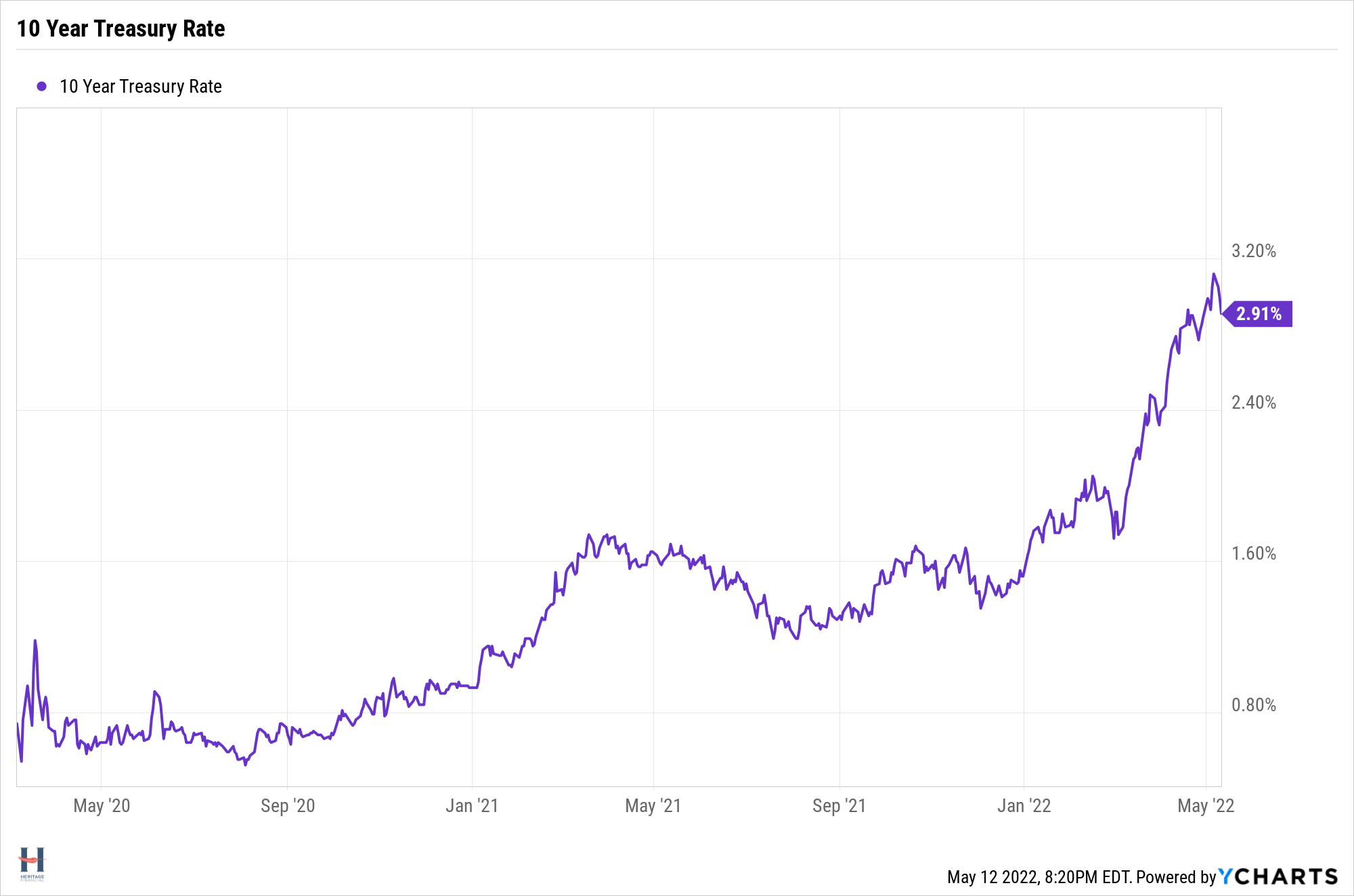

Yes, higher inflation has brought higher rates. And we have more Fed rate hikes coming. But the market knows about the upcoming rate hikes and may have priced them in already, and higher rates mean higher yields on your bonds.

As Jack Bogle explained in The Little Book of Common Sense Investing (one of the Best Personal Finance Books), predicting bond returns is easier than predicting stock returns.

The current yield on a bond (or portfolio of bonds) represents the expected return if the bond is held for the long term. Historically, the initial yield has proved to be a reliable indicator of future returns. In fact, fully 95 percent of the decade-long returns on bonds since 1990 have been explained by the initial yield.

The Little Book of Common Sense Investing by Jack Bogle

Yields are now higher (as measured by the 10 Year Treasury Rate).

So, expected returns are now higher. It took some short-term pain to get there.

Don’t sell your bonds now that they’re more attractive.