Reviewing “The Deficit Myth” and MMT

Modern Monetary Theory. MMT for short. Nonsense, or an innovative theory liberating us from deficit fears so we can invest appropriately in our country’s future? Reading The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy by Stephanie Kelton helps give you an answer.

Kelton is an economics professor and leading MMT expert.

The Deficit Myth explains MMT by first shattering what she calls the deficit myth and then presenting a framework for fixing the country’s ails through more spending.

The myth-busting was somewhat informative and accurate.

The conclusions drawn from that myth busting were less so and called into question MMT’s purpose.

Myth Busting – 6 Deficit Myths to Ignore

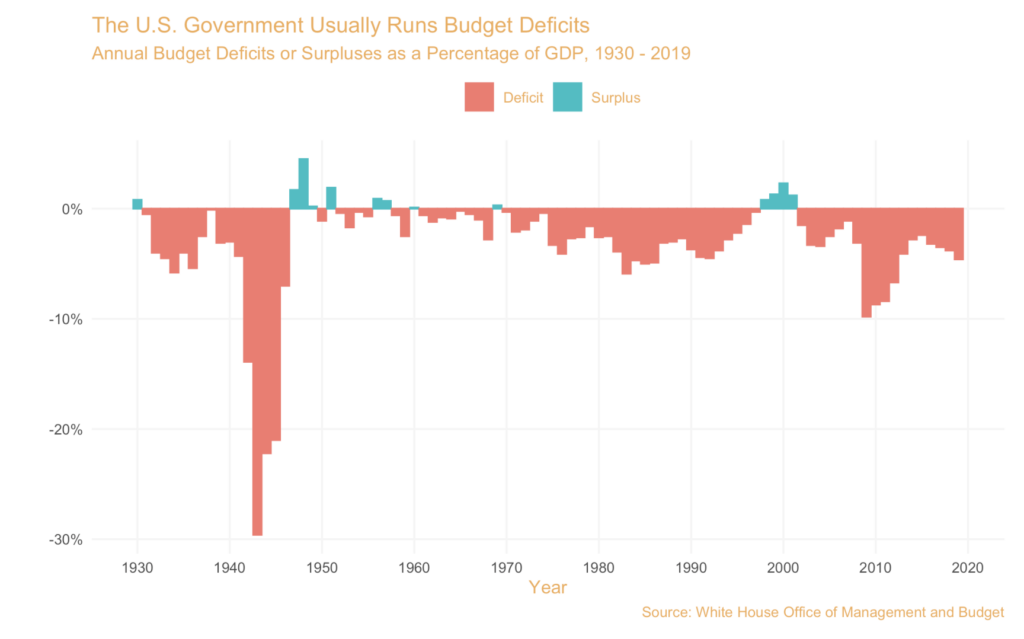

- Our Federal government should budget like a household. This is Kelton’s biggest point. And she’s right. To say that the Federal government can’t run deficits because households can’t run their finances that way is silly. Households can’t print their own money. A government that is the sole issuer of its own fiat currency (like the U.S.) can’t run out of money. Since 1970, we have run deficits in all but four years. We can’t face a debt crisis like Greece did after they traded in their Drachmas for Euros.

- Deficits are evidence of overspending. According to Kelton, deficits are half the story. A government deficit creates a surplus somewhere else in the economy. Eliminating that deficit pulls that surplus from someone’s pocket. Government spending has limits, but it’s based on inflation and not deficits. If we spend too much compared to our resources, inflation will take hold. If that’s not happening, you can create much larger deficits. This might sound like gobbledygook, but look back at the government’s response to the 2008 Great Financial Crisis. The stimulus Congress passed was too light, the eventual recovery was weak, and inflation was too low. Deficit concerns prevented the stimulus from being larger and more effective.

- Deficits will burden the next generation. If deficits aren’t a problem, they can’t be a burden.

- Deficits are harmful because they crowd out private investment and undermine long-term growth. The argument behind this myth is that to finance deficits, the government competes with other borrowers and soaks up all demand. I agree that this is a myth. Government bonds are safe low-yielding investments. The people buying them aren’t trying to fund projects targeting higher returns.

- Deficits make the U.S. dependent on foreigners. Calling this a myth felt like pretzel making to me.

- Entitlements are propelling the U.S. to a long-term fiscal crisis. If you aren’t worried about deficits until they get substantially higher than we can fund entitlement programs. Who knows? However, Social Security, Medicare, and Medicaid are fixable.

Modern Monetary Theory Myth Busting Thoughts

As I said, somewhat informative and accurate. The first myth bust alone puts deficit hawks on their heels.

We worry too much about deficits. Or, I should say we selectively worry too much about deficits. If your party is in the White House you get deficit worry amnesia. When your party is not in the White House, you turn into the equivalent of a personal finance scold telling people they can’t retire if they go to Starbucks. If deficits are financing things you believe in, you don’t worry. If the other side is deficit spending, it’s a big worry!

The Book’s Recommendations

But the conclusions and recommendations were less helpful. Here she moved from economics professor to political candidate. Packaging the economics and politics together creates the danger that people will ignore the deficit myth busting because they don’t like the policies she connected to it. Put another way, is the book providing an economics lesson or a way to pay for policies she supports?

That leads to my biggest critique.

Her rundown of our country’s problems is informative even if you don’t agree with it. But her program is too silver-bullety. Like the liberal version of trickle down economics. Both feel like they started with what they’d like to see (in trickle down’s case, lower taxes, and with MMT, significantly more spending) and their advocates created economic theories to support those programs.

What does this mean for you?

It’s helpful to understand that deficit concerns are overblown and that there are few permanent deficit hawks. When your party is not the one spending money, express your dissatisfaction with your vote and not through your wealth management approach. Too many people let their view of where the country is headed impact their portfolio and financial plans. Should You Sell Stocks Before the Election? and Protecting Your Portfolio From the News are two posts that go into this in greater detail.