Just Don’t Watch

Bear markets suck.

This is the fourth one of my wealth management career.

Bear Market Stats

- The Tech Wreck (3/24/00 – 10/9/02) down 49.1%, 929 days long

- Great Financial Crisis (10/9/07 – 3/9/09) down 56.8%, 517 days long

- COVID-19 Crash (2/29/20 – 3/23/20) down 33.9%, 33 days long

- Whatever This is Eventually Called (1/3/22 – present) down 24%

They start for different reasons, but always feel the same.

Awful.

Particularly because they come after great market runs that take your portfolio and wealth to levels you feel awesome about. Look, hon, our portfolio just hit ____. Then in the blink of an eye too much of that wealth feels taken away. Like you lost it all. You haven’t.

At the risk of being simplistic, the best advice I have is Just Don’t Watch.

This is a normal part of investing. The market looks awful, but it’s not misbehaving.

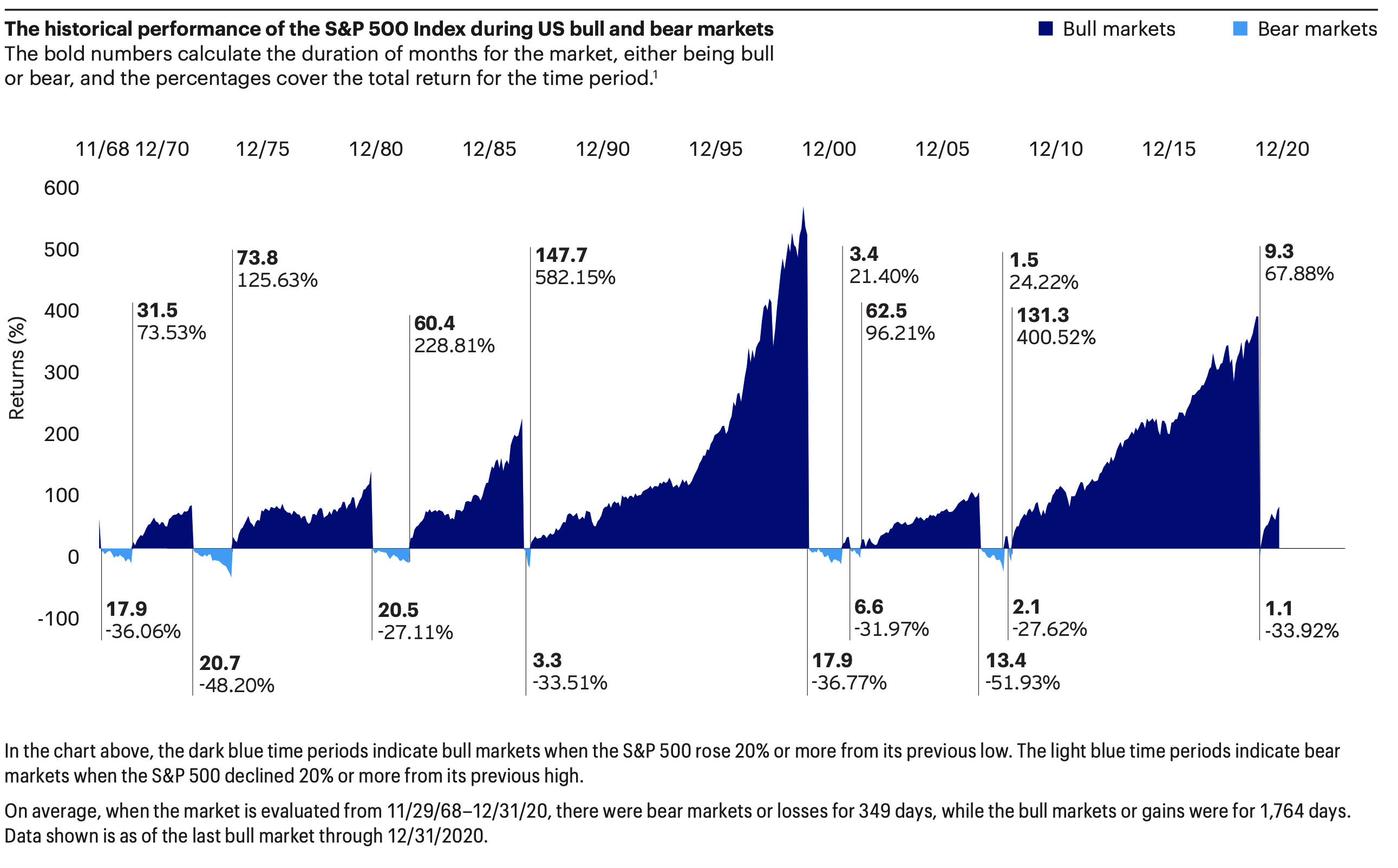

The bulls last a lot longer than the bears. Markets trend up over time. We have to experience these gut-wrenching moments to get our long-term returns.

I got caught watching yesterday morning. The market rallied the day before, and yesterday we were giving it all back. I grumbled, got distracted by it, then eventually realized I couldn’t let it derail my day or week. There’s important stuff to do. Client meetings. Talking to new investors. Strategic planning for next year and beyond. Coaching meetings with my team. Talking to our investment team.

I could stare at red arrows or be productive. I turned the TV off. You should do the same.

The market is not going to turn around just because we’re watching. Most investor mistakes happen in periods like this after watching too much. For your own sanity and to avoid an emotional investment mistake – Just Don’t Watch.

Do something else that you find entertaining or productive. Bear markets suck, and they’re not worth watching anyway. You don’t need to sweat the small stuff. I know it seems insane to suggest that a bear market that has taken stocks down 25% or so is small stuff. But that’s the reality. It’s a normal part of investing. Your portfolio will make it through to the other side.

Just Don’t Watch in the meantime.

Further Reading

R.I.P. 2009 – 2020 Bull Market & Lessons Learned

Investment Winners Rotate…and they’re doing it again