Investment Winners Rotate…and they’re doing it again

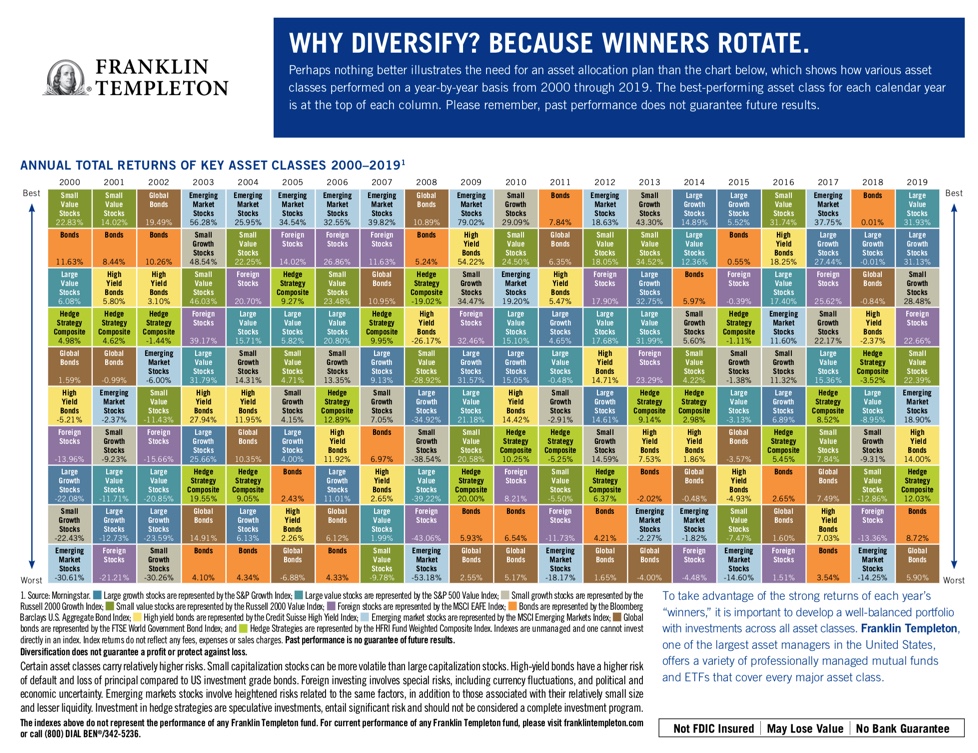

I love this Franklin Templeton chart. The colorful layout does a great job highlighting that investment winners rotate, so you should diversify instead of locking in on one asset class.

The annual look is interesting, but in a career that has now touched four bull markets, it’s amazing to see that not only do winners rotate annually, but that the leaders and laggards from one bull market to the next rotate as well. My career began just as the tech bubble bull market was ending.

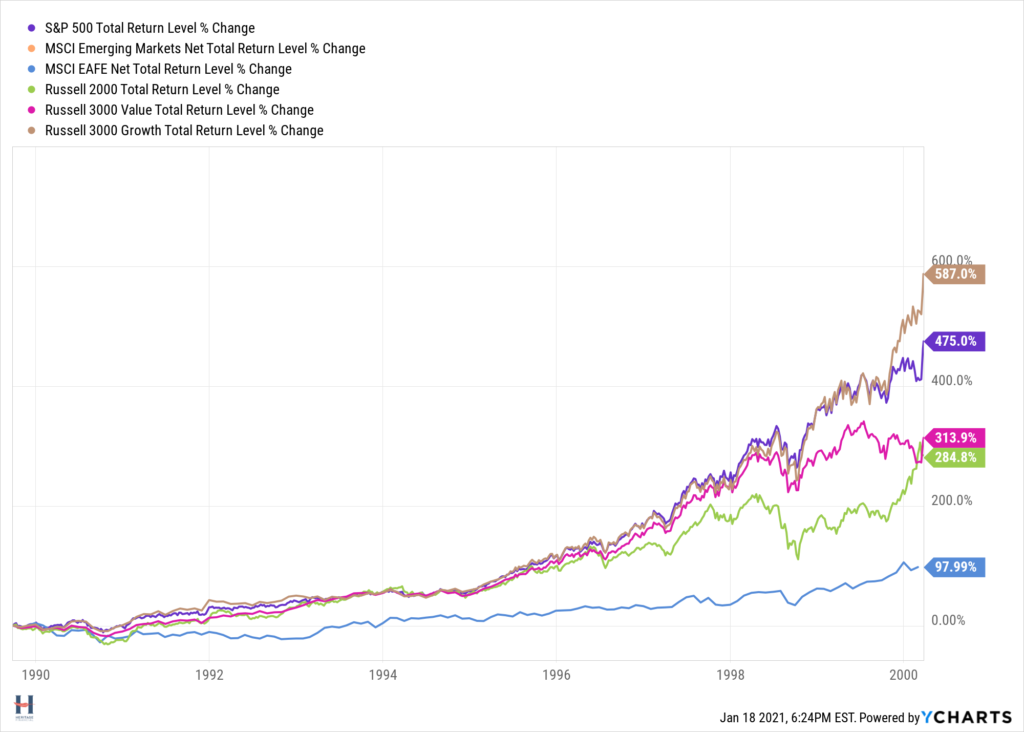

1987 – 2000 Bull Market

The winners in that bull market? Not surprisingly, US large cap stocks (S&P 500) at 475%, and US growth stocks (Russell 3000 Growth) at 587%.

Things changed in the next bull.

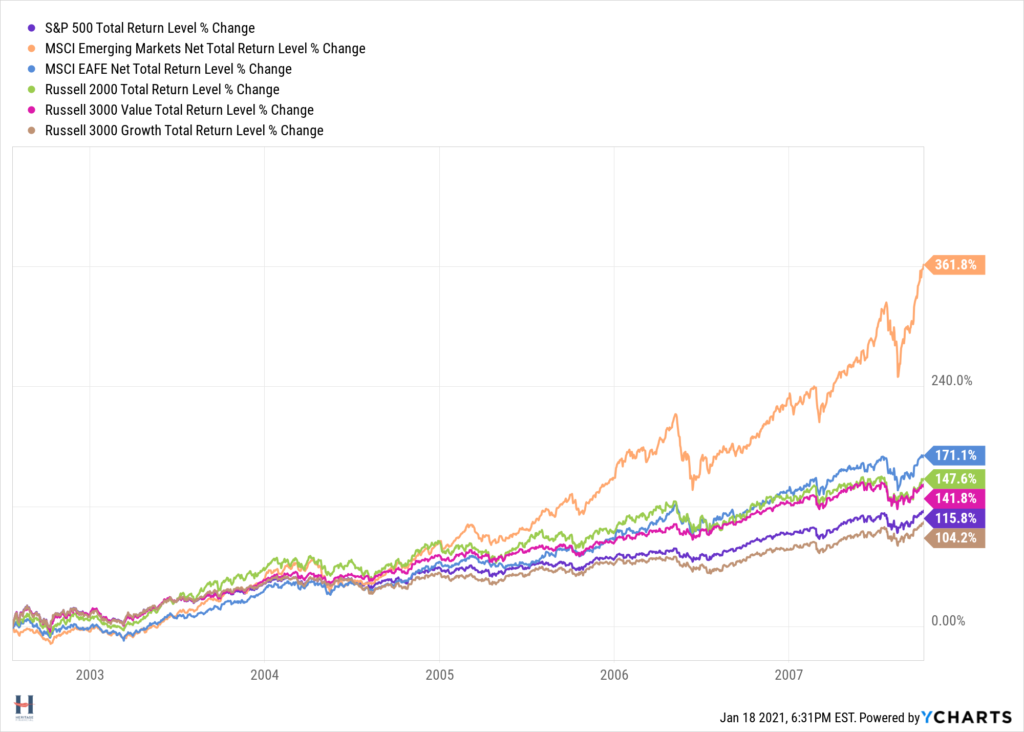

2002 – 2007 Bull Market

US large cap (S&P 500) and US growth (Russell 3000) still made you money, but they were the worst performers. The price you pay for an investment matters. There were cheaper things to invest in, and investment winners rotate.

US small company stocks (Russell 2000), Developed International stocks (MSCI EAFE), and Emerging Markets stocks (MSCI Emerging Markets) all did better. Value (Russell 3000 Value) outperformed growth (Russell 3000 Growth). The Emerging Markets index did not exist in 1987, which is why it’s not in the first chart.

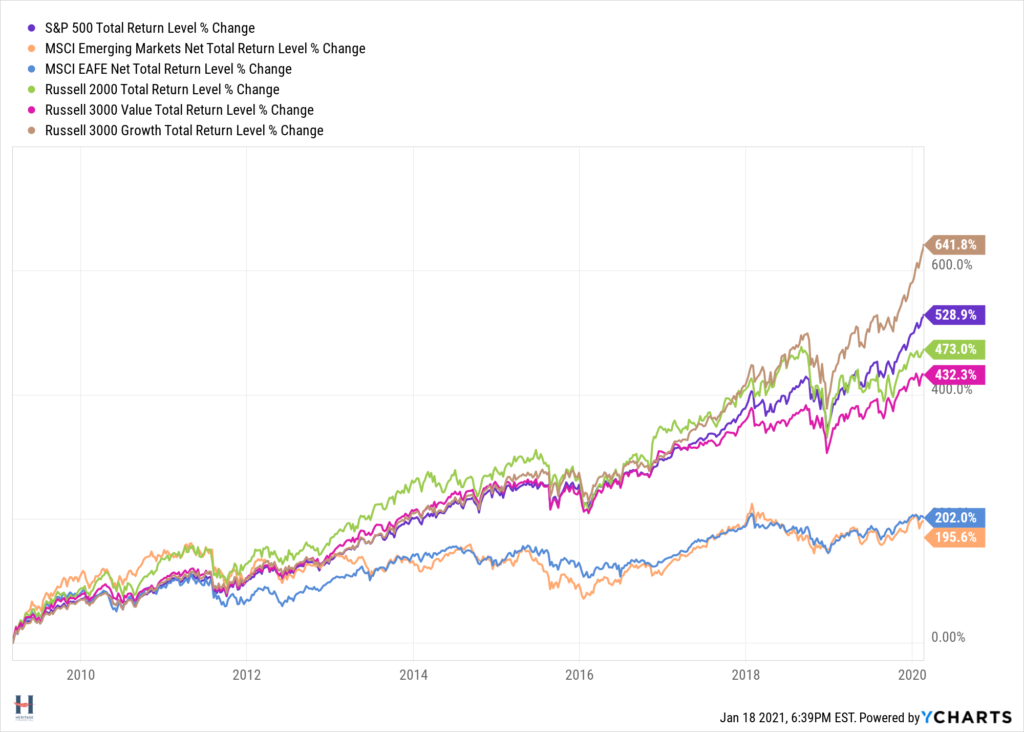

2009 – 2020 Bull Market

The next bull market began in 2009, and as a decade of weak returns for US large cap stocks ended, they were cheap and poised to deliver strong returns.

The top performers were US large cap (S&P 500) and US growth (Russell 3000 Growth). The laggards became the leaders and vice versa as Emerging Markets (MSCI Emerging Markets) went from being the top performer to the weakest one.

Current Bull Market

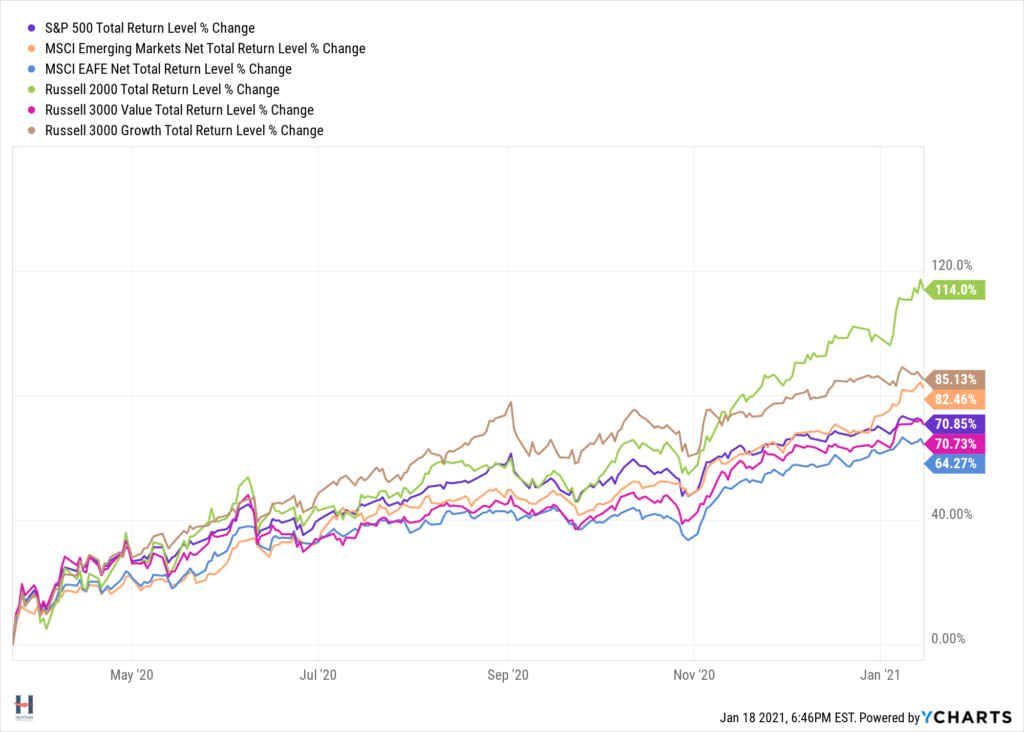

And, as of March 23, 2020, we’re in a new bull market and the investment winners are rotating again.

Small cap stocks (Russell 2000) are the top performers. US growth (Russell 3000 Growth) is still doing well, but look at its trajectory since November – somewhat flat as small caps have taken off with positive news regarding vaccines and economies reopening. Emerging Markets (MSCI Emerging Markets) has had a nice run as well since then.

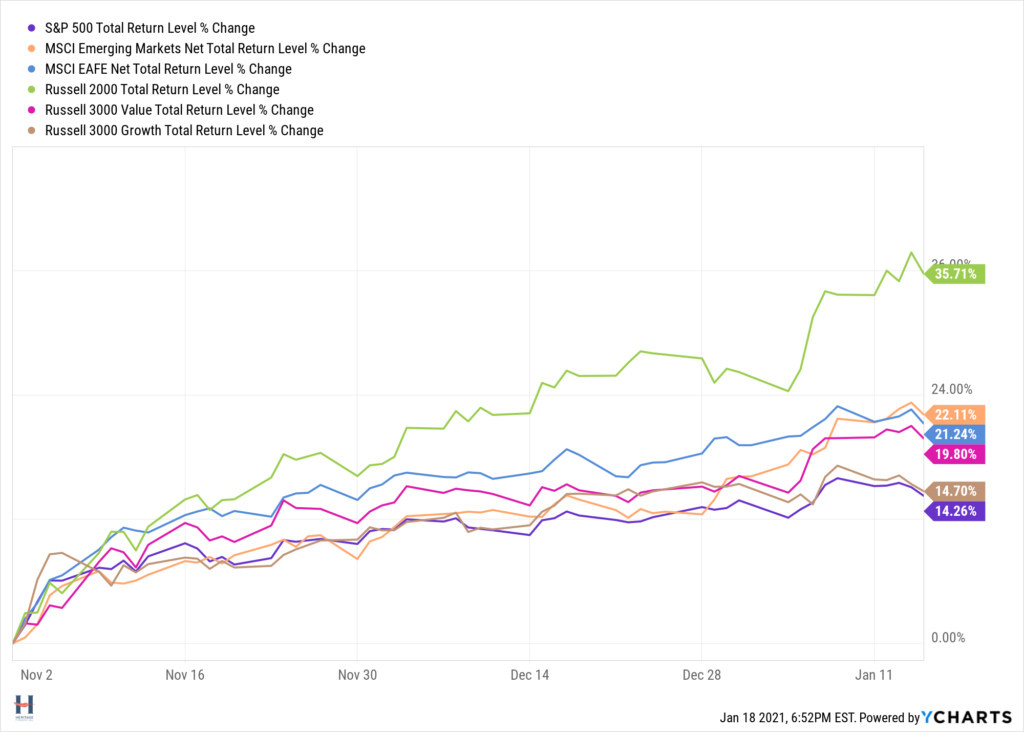

This chart brings this to life a bit better. Here’s how these markets have performed since November 1, 2020.

US large cap (S&P 500) and US growth (Russell 3000) are the laggards. US small cap (Russell 2000) is the clear leader, and the international markets (MSCI EAFE an MSCI Emerging Markets) and value (Russell 3000 Value) are doing better than in the past as beneficiaries of The Reopening Trade.

Investment Lessons

Investment winners rotate. So, what does this all mean for your portfolio? Allow me to share one more graph to explain.

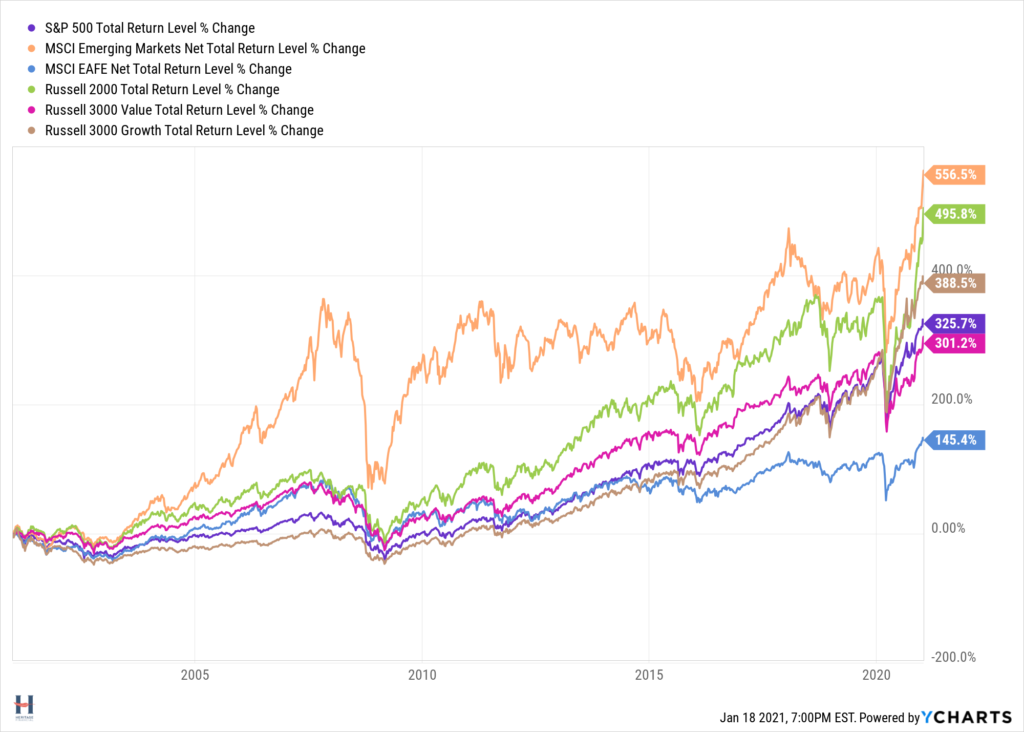

This captures all the time periods we reviewed – 3 complete bull markets, plus the 4th that started last year.

The top performers – Emerging Markets (MSCI Emerging Markets) and US small cap stocks (Russell 2000).

US large cap (S&P 500) and US large growth (Russell 3000 Growth) also did very well.

US value (Russell 3000 Value) was not far behind.

And that group all the way at the bottom Developed International (MSCI EAFE) – not sure what’s going on there, but I will try and figure that one out.

Meanwhile…some takeaways.

- Abandoning an investment style once it has disappointed you will hurt, unless you know in advance who the leaders will be in the next bull market. You won’t.

- Same with chasing winners.

- Emerging markets and US small cap are more volatile than US large cap stocks, but you need to own them in your portfolio if you’re focused on generating the best long-term returns. They have rewarded patient investors.

- Investment winners rotate, not just on an annual basis, which is too short an evaluation period anyway. But through market cycles as well, and the way to benefit from that rotation is to maintain a constant exposure to the different markets and let your time horizon work for you.

Further Reading:

5 Portfolio Changes to Make Now

Common Investment Mistakes to Avoid