How Long to Give an Investment Strategy

After the blockbuster James Harden trade from the Houston Rockets to Brooklyn Nets, Rockets General Manager Rafael Stone half-joked in a press conference that you couldn’t judge the trade until 2030 given the future draft capital the Rockets received. Stone and the Rockets made a long-term investment – exchanging James Harden for potentially valuable future assets. We won’t know how valuable for years. As someone who manages money, I enjoyed the answer because it’s similar to what I (also half-jokingly) want to say when anyone asks about investment patience with their own portfolio.

We build long-term portfolios using ten-year risk and return assumptions (with adjustments along the way). Ten years to evaluate a long-term strategy using ten-year inputs is reasonable.

And unrealistic. Just like giving a GM nine years to be judged on a trade.

No one will pay you for a decade without judging you.

But some investor time periods are also unrealistic. I’m talking a few weeks, or months, or even a couple of years.

So, let’s bridge the gap and figure out how long to give an investment strategy.

Why Investment Strategy Patience Matters

Let’s touch on why patience matters by seeing what investment impatience looks like and why you want to avoid it.

Investment impatience is moving from one strategy to another for short-term performance reasons.

It means selling investments, paying fees, paying capital gains taxes, and reinvesting lesser dollars somewhere else. Some investments will be in tax-deferred retirement accounts where capital gains aren’t an issue, but it’s rare for that to be your entire investment portfolio.

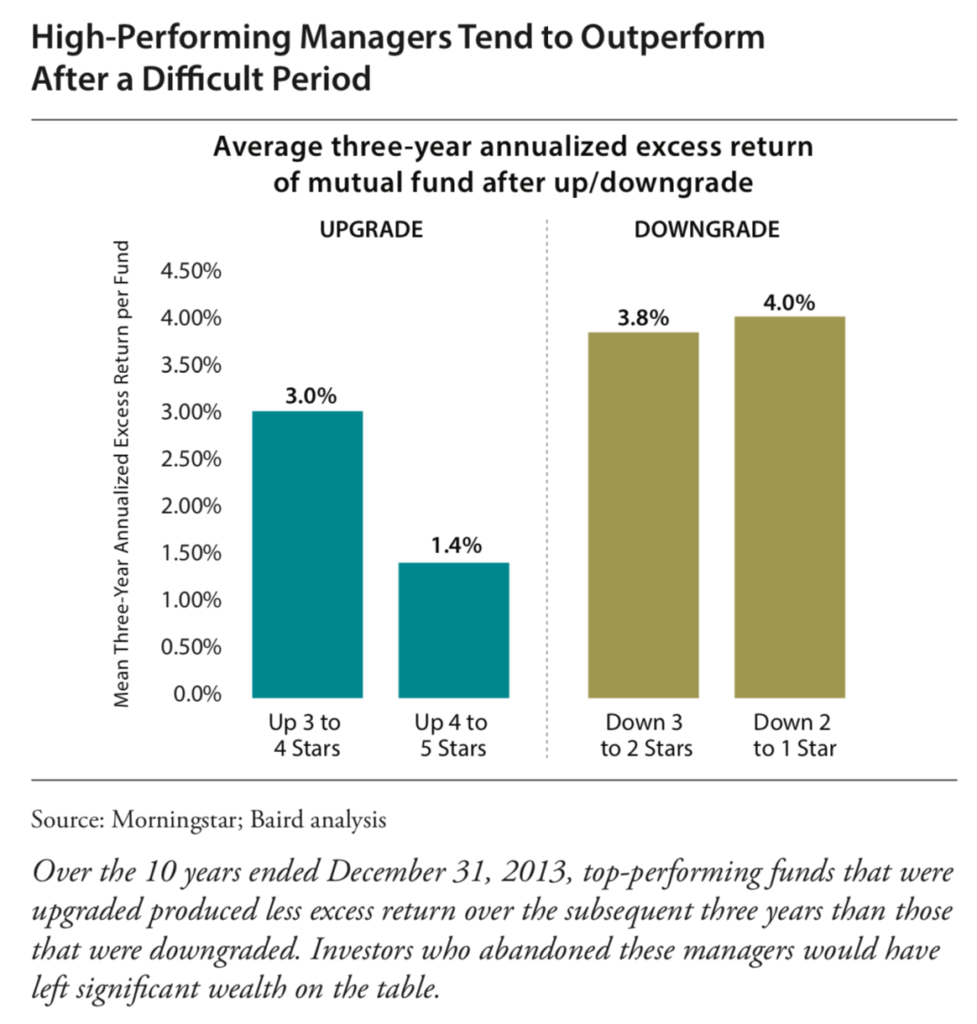

It also means abandoning an investment or a strategy and possibly missing a performance rebound. In a study referenced below, Baird’s Asset Manager Research team found that top performing mutual funds that had underperformed their peers subsequently when on to outperform after they received a performance based ratings downgrade from Morningstar.

“Most high performing managers can and do make up lost ground and add excess return following periods of weakness, particularly over an intermediate time period.”

So, you invested in some mutual funds because they had strong long-term track records. They hit a rough patch. You sell, which comes with fees and tax payments. You buy new mutual funds. Studies show the ones you left will do well after you lost investment patience with them.

First, Do You Really Need to Evaluate?

Your portfolio’s main purpose is turning savings into a bigger nest egg. So, your portfolio is doing its job if it’s providing you the returns needed to make your financial plan work. Beating an arbitrary benchmark created by some financial services committee should not be your main goal. Let’s say you wanted all your mutual funds to beat the S&P 500. That would have led to some head scratching past outcomes.

For the decade of 2000-2009, the S&P 500 lost 9%. Would you have been happy with a portfolio that beat it by 9%, but earned nothing for an entire decade? From 2010 – 2020, to beat the S&P 500, or even compete with it, you had to own only U.S. stocks and concentrate your portfolio in large growth companies. You could have earned great returns to make your financial plan work without the risk of concentrating in one investment type, but you wouldn’t have kept pace with the S&P 500.

Evaluating Your Investment Strategy

Nevertheless, it’s fair to wonder how your investments are performing compared to alternatives. In looking at how long to give an investment strategy, it makes sense to analyze top performing managers and see what we can learn.

Two studies deserve attention. They review how patient to be with a mutual fund and how top mutual fund managers perform against their peers. While not perfect proxies for a diversified portfolio that owns multiple asset classes, they’re instructive on the time periods that should and shouldn’t matter to an investor.

The Truth About Top-Performing Money Managers by Baird’s Asset Management Research.

The Next Chapter in the Active vs. Passive Debate by Fiducient Advisors.

Both concluded that top performing mutual funds experience persistent periods of poor relative performance despite compiling long-term strong track records.

Baird’s study reviewed more than 2,000 mutual funds over a ten year period and focused on funds that outperformed by one percent or more annualized for ten-years with less risk.

“97% of those top managers had at least one three-year period in which they underperformed by one percentage point or more…About half of them lagged their benchmark by three percentage points…and one-fifth of them fell five or more percentage points below the benchmark for at least a three year period.”

They didn’t just do this once, but had multiple three year underperformance spats .

Fiducient looked at the top performing mutual funds in different categories over ten years.

“83 percent of ten-year top quartile mutual funds [funds that performed in the top 25 percent of their category for ten years] were unable to avoid at least one three-year stretch in the bottom half of their peer groups.”

“54 percent of ten-year top quartile mutual funds were unable to avoid the bottom half during a five-year period.”

What Does This Tell Us?

Three years isn’t enough time to judge an investment, or investment strategy. Five years may not be either. Over half the time the top performers in the Fiducient study were in their peer group’s bottom half during a five-year period.

If three and five years aren’t enough, but going longer will have us sounding like a jokester NBA GM, what to do?

Actively evaluate circumstances besides relative investment performance. It’s fine for a top performing mutual fund to underperform for a few years. Likewise, a well thought out investment strategy can have similar struggles without needing to be changed.

Ask questions to figure out what’s going on. Focus on the following questions and examples related to investments and investment strategy.

- Has the team’s investment process or approach changed significantly? Ex. Did you hire a U.S. growth manager who is now investing in value stocks or international stocks? Or did the investment team that built your strategy change their philosophy and approach and are now pursuing a different path?

- Does the performance you are concerned about match the performance in other similar environments? Ex. does the investment always do poorly when markets are speculative? Or does the investment strategy typically underperform when large cap stocks are out of favor?

- Have there been personnel or organizational changes? Ex. did a mutual fund lose a star manager, or did the fund family get acquired? Or were there personnel changes at the firm that built your investment strategy?

- Has the manager taken on lots of new money that would make it hard to replicate their prior investment success? Ex. a manager whose track record was built investing in smaller companies that can no longer do so because they manage too much money to invest in those stocks without moving the market.

If the answers don’t add up, then the question of how long to give an investment strategy changes. Have less investment patience. But if things haven’t changed and the investment or strategy are just facing struggles, patience should be rewarded.

Related Reading

Investment Winners Rotate…and they’re doing it again.