The New England Economy

We’ve focused on the economy and the inflation fight that could lead to a “hard landing” on the podcast. Lost in the conversation has been how things are doing locally.

I’m hearing from certain clients (including business owners and corporate execs) that some sectors are cooling off and inflation’s a major issue.

So, what do the numbers say?

The Federal Reserve Bank of Boston released a detailed report on the New England economy that we can dig into.

Employment

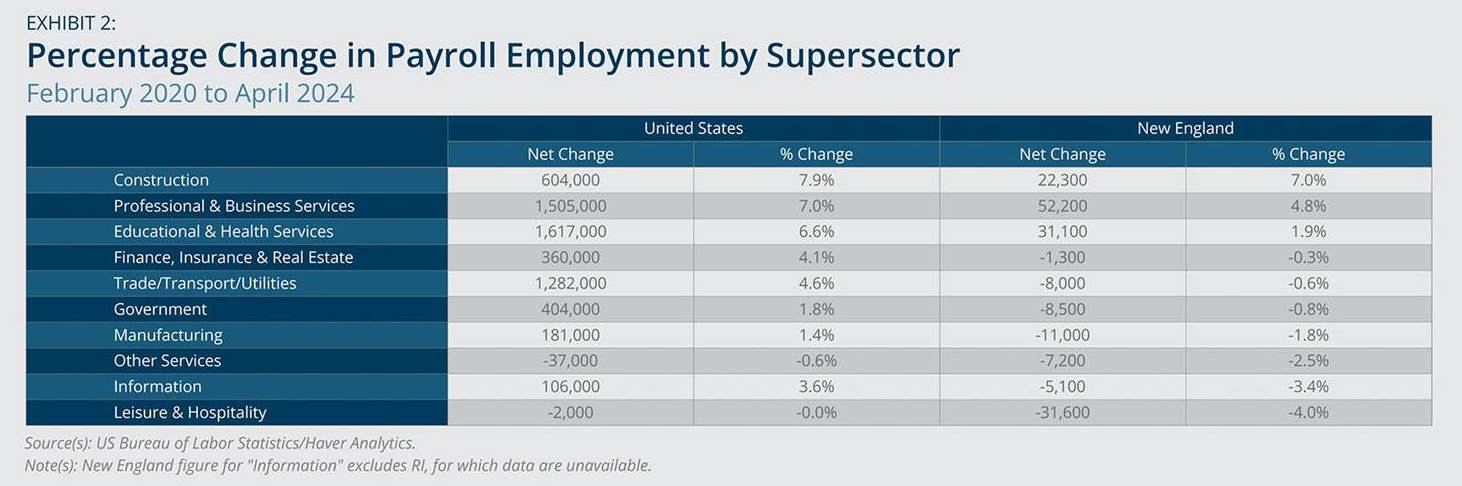

Employment in New England is flat since February, 2020, but the job market during that time is lopsided according to the report. “Only three sectors have experienced net job growth since February 2020 – construction, professional and business services, and education and health services.” Every other sector has fewer jobs since before the pandemic.

We’ve seen a broader based recovery in jobs nationally over the same time frame.

More recently, employment growth is slower in New England than the U.S. in the last year, although this year jobs surged in Vermont and increased modestly in Rhode Island.

Layoffs locally are declining steeply compared to national averages, but only Massachusetts has avoided higher year-over-year unemployment.

So, unemployment is up, but it’s due to increased labor force participation.

Inflation

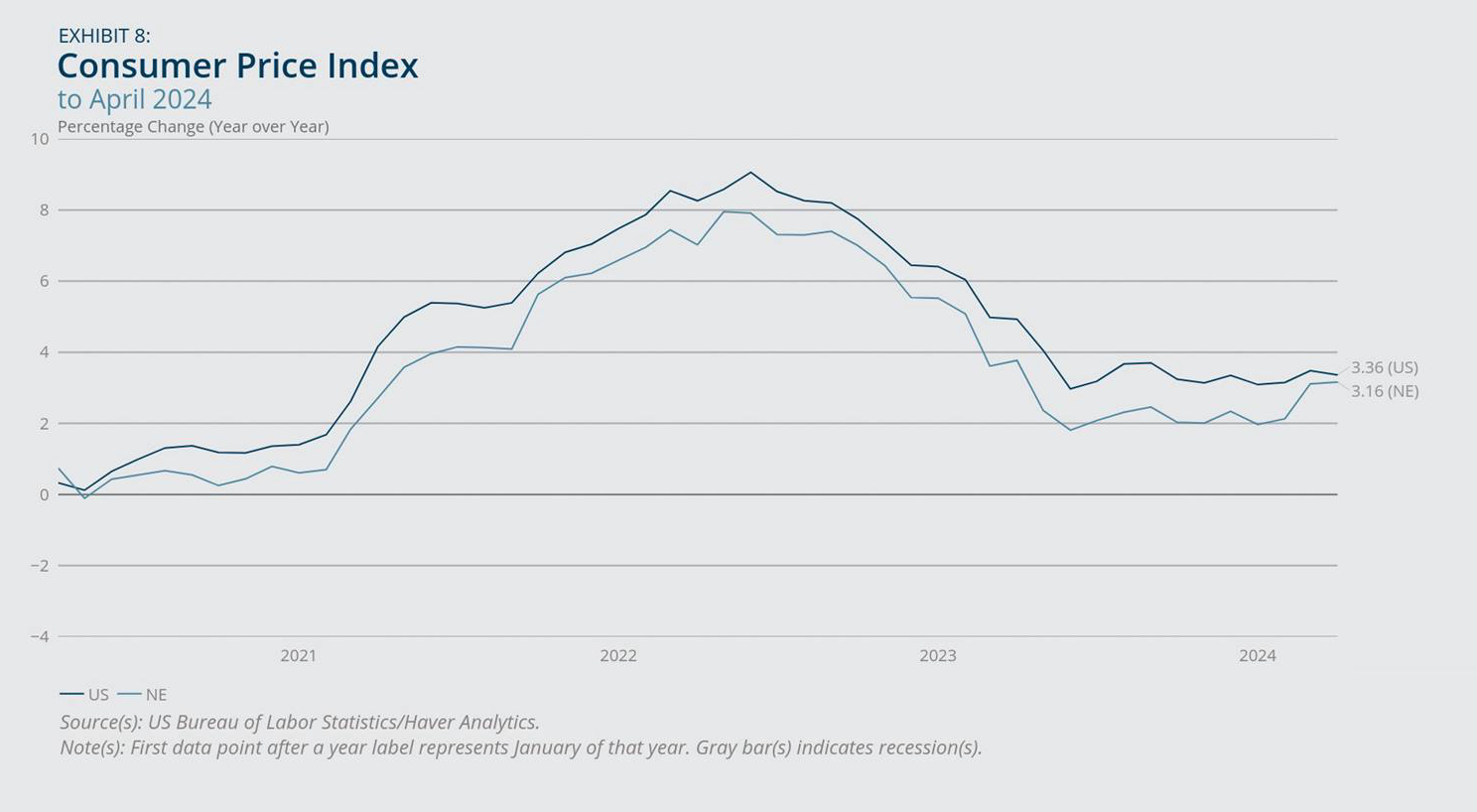

We’ve had better inflation luck in New England than the country, but the stall lower we’ve seen nationally the past few months has also taken place here.

Breaking it down further, Shelter and Medical in New England have seen bigger cost jumps than the national average, but we’ve seen a small drop in Education and a large drop in Fuel & Utilities.

Locally and nationally gas prices increased a lot between March and April which caused a correspondingly large increase in transportation costs.

Boston area rents have increased more than the national average since late 2022.

Housing

To use a technical term, housing seems nuts right now. We saw a 10.5% year-over-year increase in prices in February, 2024, driven by a severe inventory shortage. And while housing permits are up nationally, they’re down in New England and Massachusetts.

Concerning.

High real estate prices, low inventory, and new construction slowing could hurt one of the economy’s bright spots and won’t improve pricing unless something else happens to increase inventory. This could be lower mortgage rates spurring more people to list and move, but that’s a theory not everyone likes.

Perhaps builders feel lower rates are close so it’s a temporary slowdown, but anecdotally we’re hearing larger slowdown fears.

Final Thoughts on the New England Economy

Overall, it’s been an uneven recovery here since Covid-19, with just a few sectors doing well and most registering job losses. The inflation story here is essentially the same nationally. Finally, there are reasons to be concerned with housing. Prices are increasing faster than the national averages and housing permits are down, which impacts affordability and those segments of the economy dependent on construction.

Suggested Reads

A Real Estate Slowdown and a Pricey Stock Market