The Market Isn’t Fighting the Fed

Don’t Fight the Fed. It’s an investing mantra I’ve written about before. And in this market environment where the Fed has raised rates a lot and will continue to do so, it means stock market investors should be bearish.

But they’re not.

The market is up 23% from its market low, 8% off its all-time high, and according to some definitions we’re in a new bull market – Are We In a Bull Market?.

So, are we fighting the Fed by being bullish right now, or is something else happening?

I think it’s the latter.

The market isn’t fighting the Fed, but believing in the Fed right now. Yes, the Fed bungled inflation badly for which it caught immense flak. But maybe the market thinks the Fed is on the right track now.

The numbers support that support.

Inflation is down a lot.

The economy is resilient.

The market is doing well.

Sure, some banks were broken along the way, but that hasn’t spilled over into a broader financial crisis and those banks could have managed their portfolios better. We were reminded how banks work and that holding excess cash isn’t ideal.

The market chugged forward.

Blissful permabull optimism? Maybe so. I am the guy who wrote Optimists Get Rich, Cynics Get Airtime.

Questioning the Good News Narrative

Doesn’t the Fed have to break the economy and crush employment to tackle high inflation?

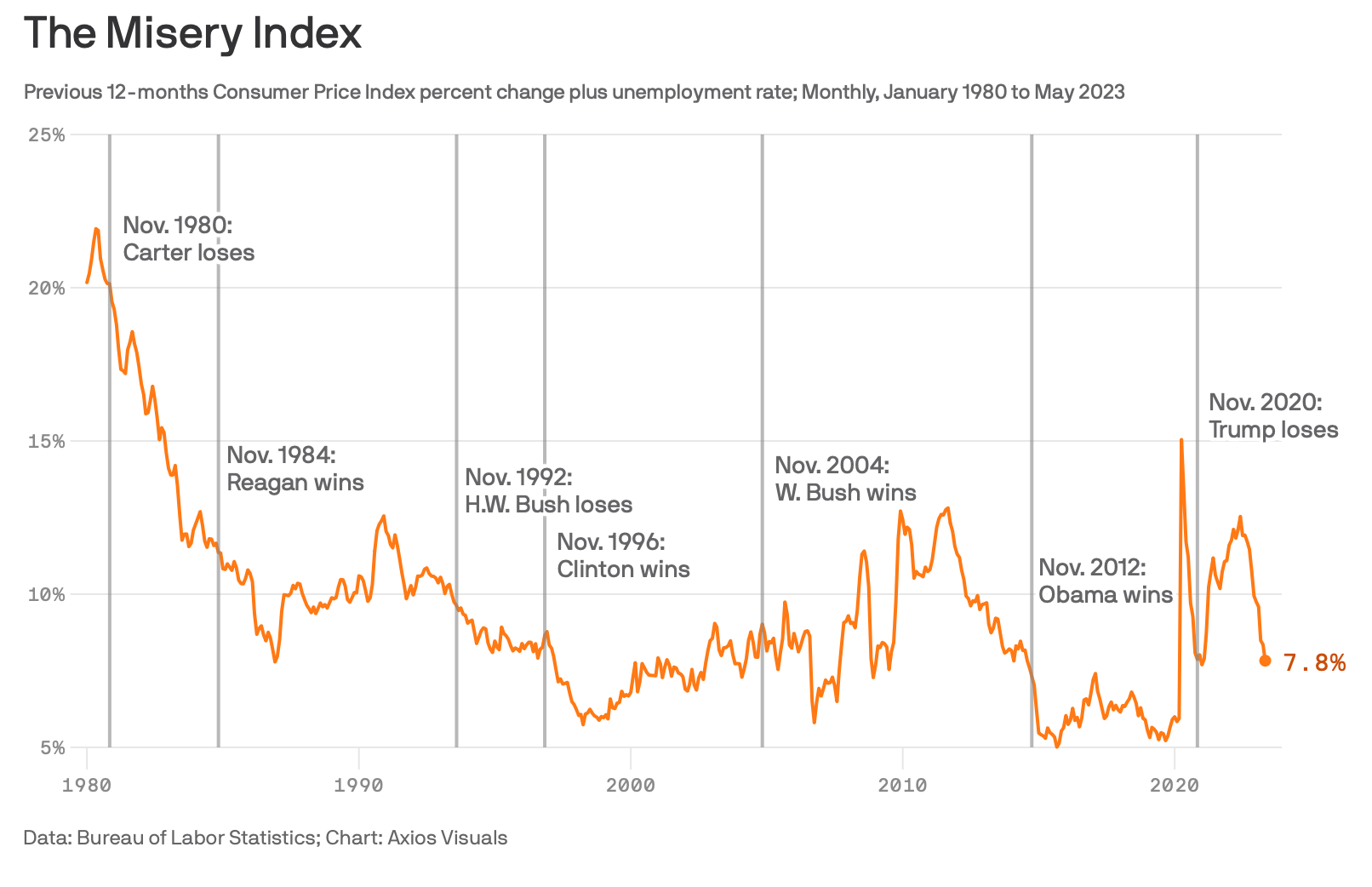

Maybe. But inflation is a lot lower, and the misery index is getting better.

And I’ve never understood why high inflation that wasn’t caused by a wage labor spike could only be solved by crushing employment.

Don’t we need to have this recession that’s been more hyped than Victor Wembanyama?

Well, we have had two quarters of negative economic growth already. I know that’s not the definition of a recession, but a slowdown happened. There’s also the rolling recession concept pushed by Liz Ann Sonders.

True, there’s some data that’s hard to ignore if you’re in the recession camp. The biggest being that leading economic indicators have been signaling a recession for a while. But as with everything in economics, there’s also another hand, which is explained well here.

It just feels like we’re too far into this Fed hiking cycle and market recovery to think the market is irrationally fighting the Fed versus believing in its current path.

Maybe I’m wrong. A recession is still a reasonable base case.

The good news is that little hinges on me being right. Long-term portfolios are built to withstand short-term events. Short-term money shouldn’t be exposed to much capital risk.

But I also spent the last 14 years hearing people whine about the Fed’s easy monetary policy and how it destroys accurate price discovery. Now that it’s reversed, why are the same people finding a new reason to complain about the Fed and panic about the market?

Because pessimism is easy and sounds smarter.

I’ll stick my head in the sand and enjoy the long-term trend.