Why to Watch (and not fight) the Fed

Don’t fight the Fed. It’s an investing mantra that should be an investment guideline. Don’t fight the fed means that investors should be bullish on stocks when the Fed has an easy monetary policy and bearish on stocks when the Fed is tightening the money supply through higher rates and other means.

You ignore this at your peril, and if you know anyone who has been bearish since the last recovery started in 2009, you’ve probably heard them mutter that if it wasn’t for the damn Fed manipulating interest rates and pumping money into the system all their pessimism would have been rewarded. They’d be rationalizing as stocks were a great buy in 2009, and the system will try and heal itself creatively, but asset prices were helped by the system’s cheap money.

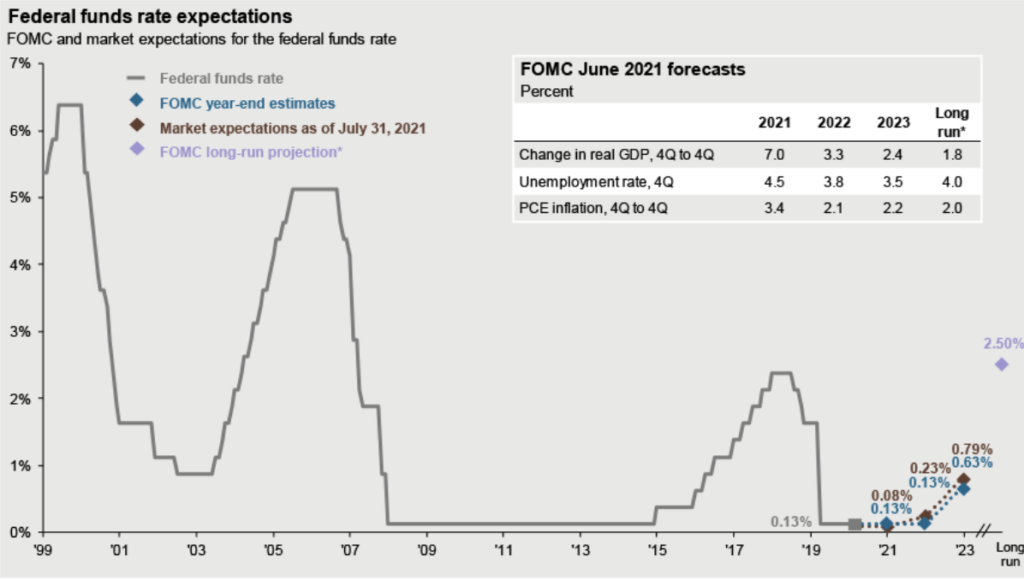

Right now, the Fed has an easy monetary policy because of COVID-19. (Supported in this by the Treasury and Congressional stimulus and bailout packages). Rates are near zero, and the Fed is buying $120 billion worth of government and mortgage-backed bonds a month.

Those who have not fought the Fed are happy.

Stocks, real estate, and private business valuations are up.

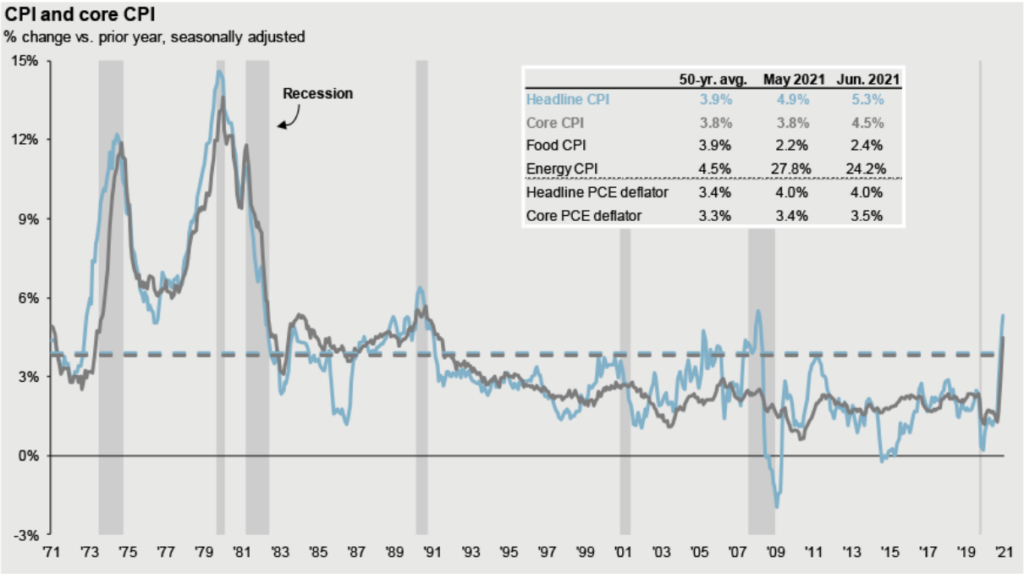

Inflation is also up.

And investors are stalking the numbers because if if’s not a transitory uptick, the Fed may tighten the money supply by stopping the bond purchases and raising interest rates. Tightening the money supply slows down an overheating economy to combat inflation. This in turn would hurt asset prices. (And you thought we had a free market…)

However, if the inflation uptick is transitory, the easy money party can continue.

Implications for your portfolio

What does this mean for your portfolio, and what you should do about it?

“I consider it reasonable for investors to give a nod to the possibility of higher inflation, but not to significantly invert asset allocations in response to macro expectations that may or may not prove accurate.”

Howard Marks in Thinking About Macro

First, understanding it is helpful because as Howard Marks observed in his recent memo (Thinking About Macro), it feels like since the Great Financial Crisis the market has reacted to what the Fed and Treasury are doing. It makes sense to understand what moves markets. That knowledge can make sticking to your strategy easier if we get market volatility and will help manage investment expectations.

Second, you can prepare your portfolio for different potential outcomes, including higher inflation. Worrying About Inflation shares some ideas.

Don’t try and time the market based on your inflation prediction. It’s a fool’s game. The Fed doesn’t know what will happen. The stock market and bond market have been telling us opposite things about inflation expectations. Brilliant investors are lined up on both sides of the debate with excellent points to support them.