Post-Surgery Market Check

I haven’t posted as often as usual lately because in October I tore my ACL and meniscus playing basketball for the last time. As my recovery continues (and maybe the market’s begins), it’s time to share some investment thoughts.

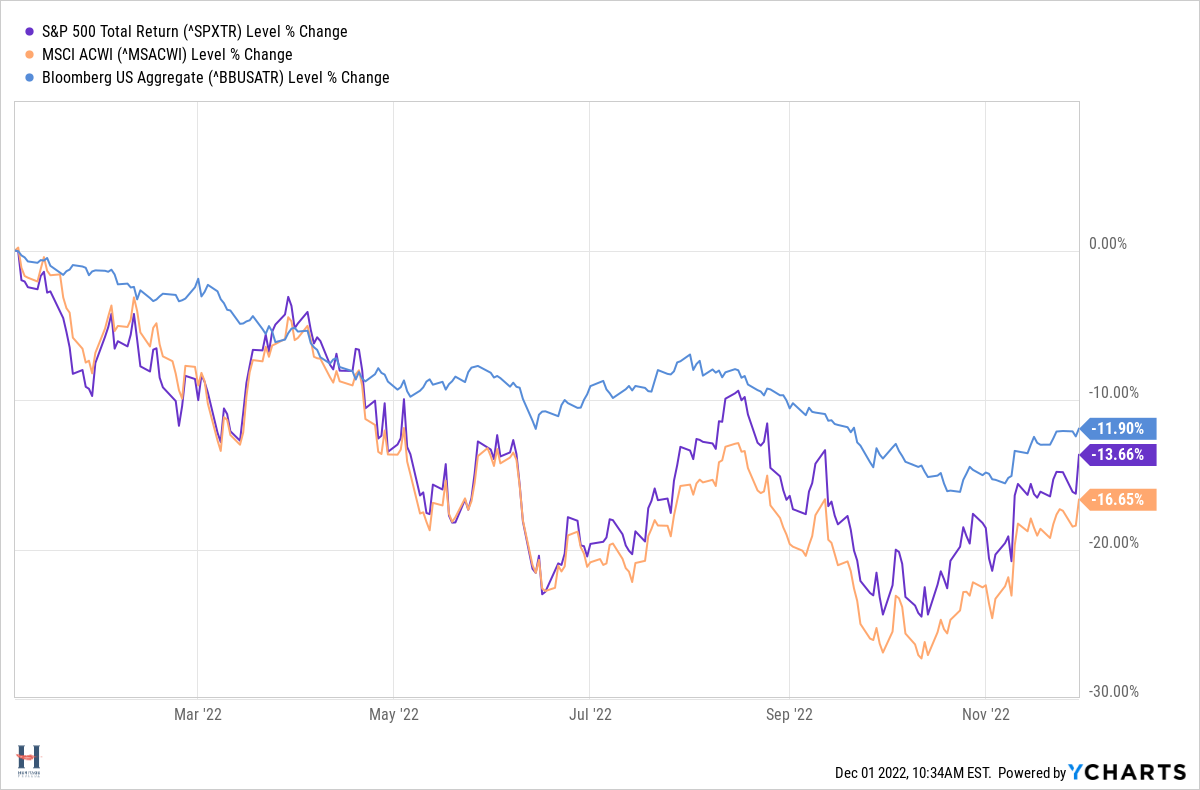

The bear market in U.S. and global stocks and U.S. bonds continues.

However, about when my left knee crumbled, those markets started performing better, and we’ve seen encouraging rebound signs.

Why a Market Recovery

What gives? We’ve explained this market (here, here, and here) as being driven by inflation and rate hike concerns. I’ve also been optimistic enough to believe that once we received good inflation news, the market would respond favorably.

Well, we’ve seen good news. October CPI was 7.7%, which doesn’t sound great until you compare it to June’s 9.1%. If inflation has peaked, then perhaps Fed rate hikes will slow down. Multiple Fed officials signaled this even before Powell got the market excited this week with these comments.

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Mr. Powell said, referencing the Dec. 13-14 gathering.

Powell Says Fed Could Slow Rate Increases at Next Meeting, The New York Times

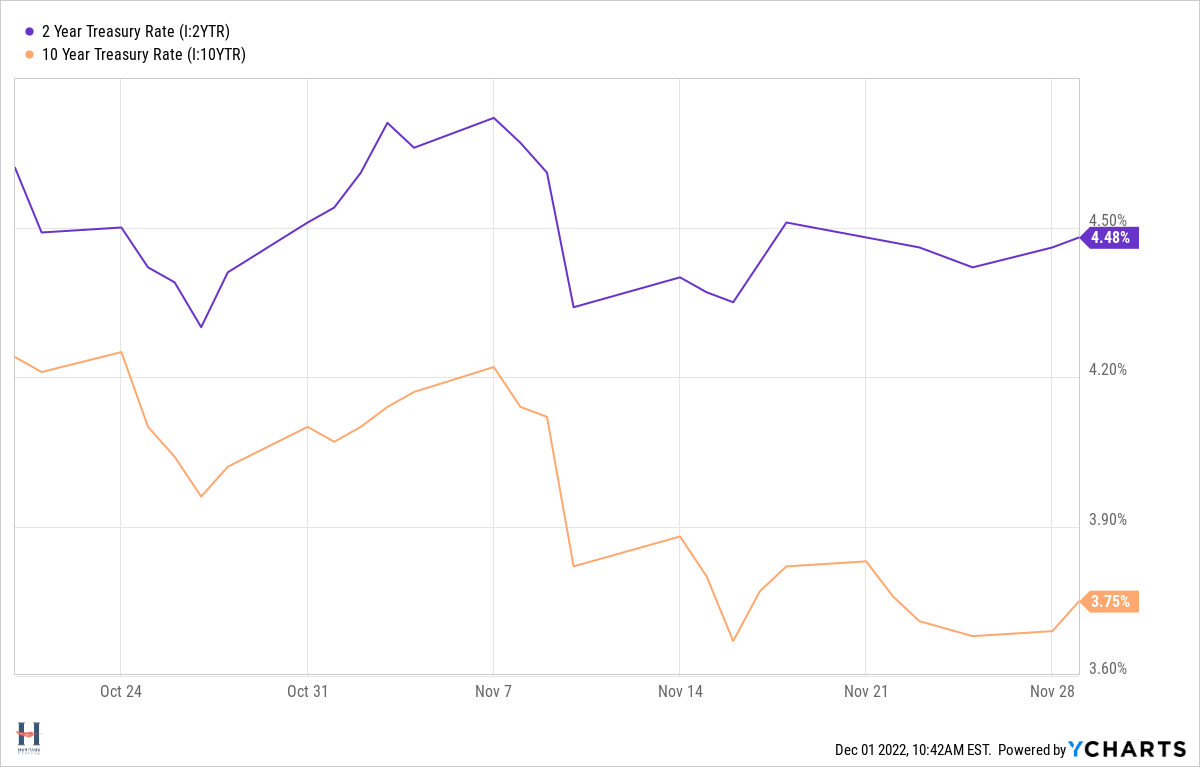

It also means interest rates may stop rising, and we’ve already seen the 2 year and 10 year back off.

Does this mean the market’s bottomed and it’s smooth sailing from here? DEFINITELY NOT. We had a summer head fake when the market got ahead of itself, only to see us later retest the lows. While this feels different, and lots of excess has been taken out of the market already, the market can always punish long-term optimism with short-term pain. (For a great look at where we are in this cycle, check out my team’s latest How do Bear Markets End?)

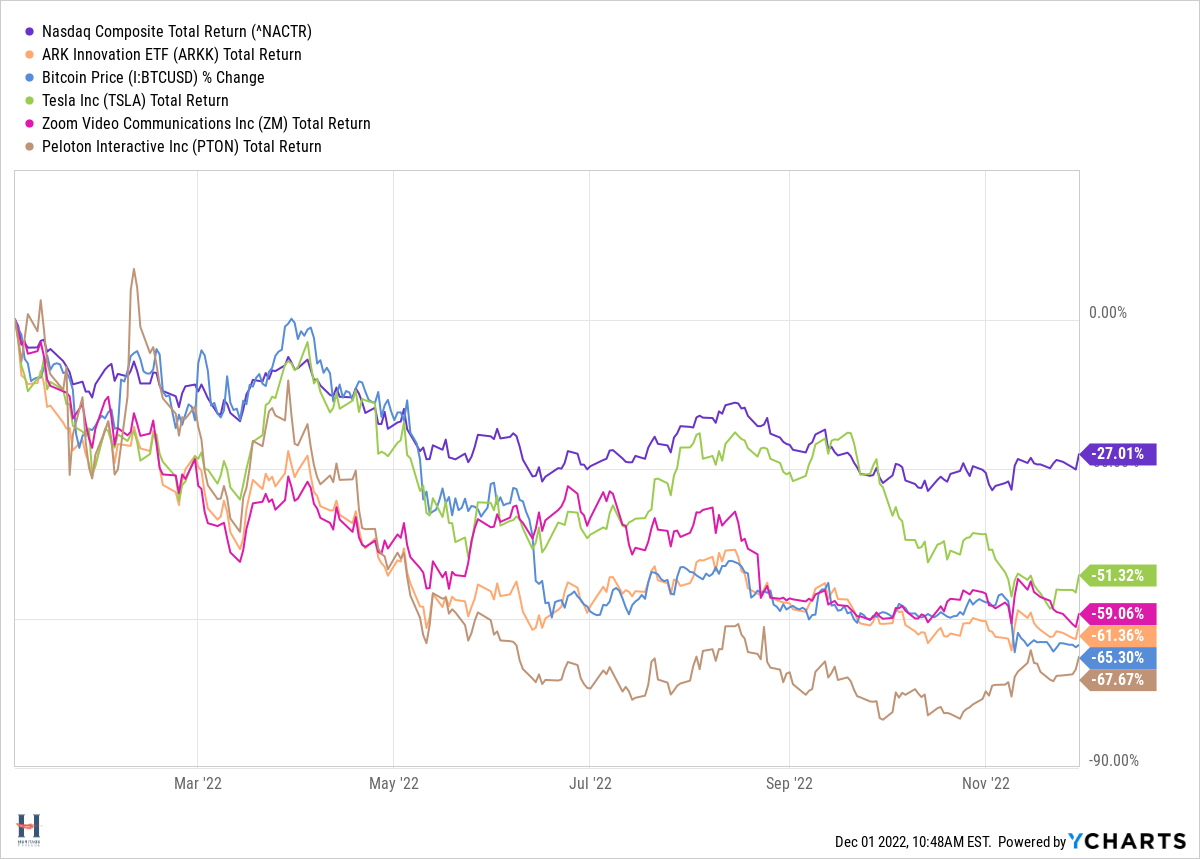

The tech-heavy Nasdaq is down more than the overall market. Cathie Wood’s ARK Innovation EFT, Bitcoin, and some early Covid-era darlings just to pick a few examples have been obliterated. Value stocks by comparison have held up really well, down only a few percent.

A Dangerous Time for Investors

Besides the potential head-fake risk, investors also need to protect themselves from the growing and unhelpful captain obvious crowd and headlines striking fear of an impending recession.

This market sell-off which began in January was signaling an eventual economic slowdown. Markets anticipate economic events because investors are forward-looking. For a while the market was going down while the economy remained strong, but eventually the economic slowdown the market signaled had to start. This isn’t a new event to worry over. It’s been coming. And just like the market led the economy down, it’ll recover before the economy does so we don’t have to start getting good economic news for stocks to do well.