Should You Pay Off Debt Now?

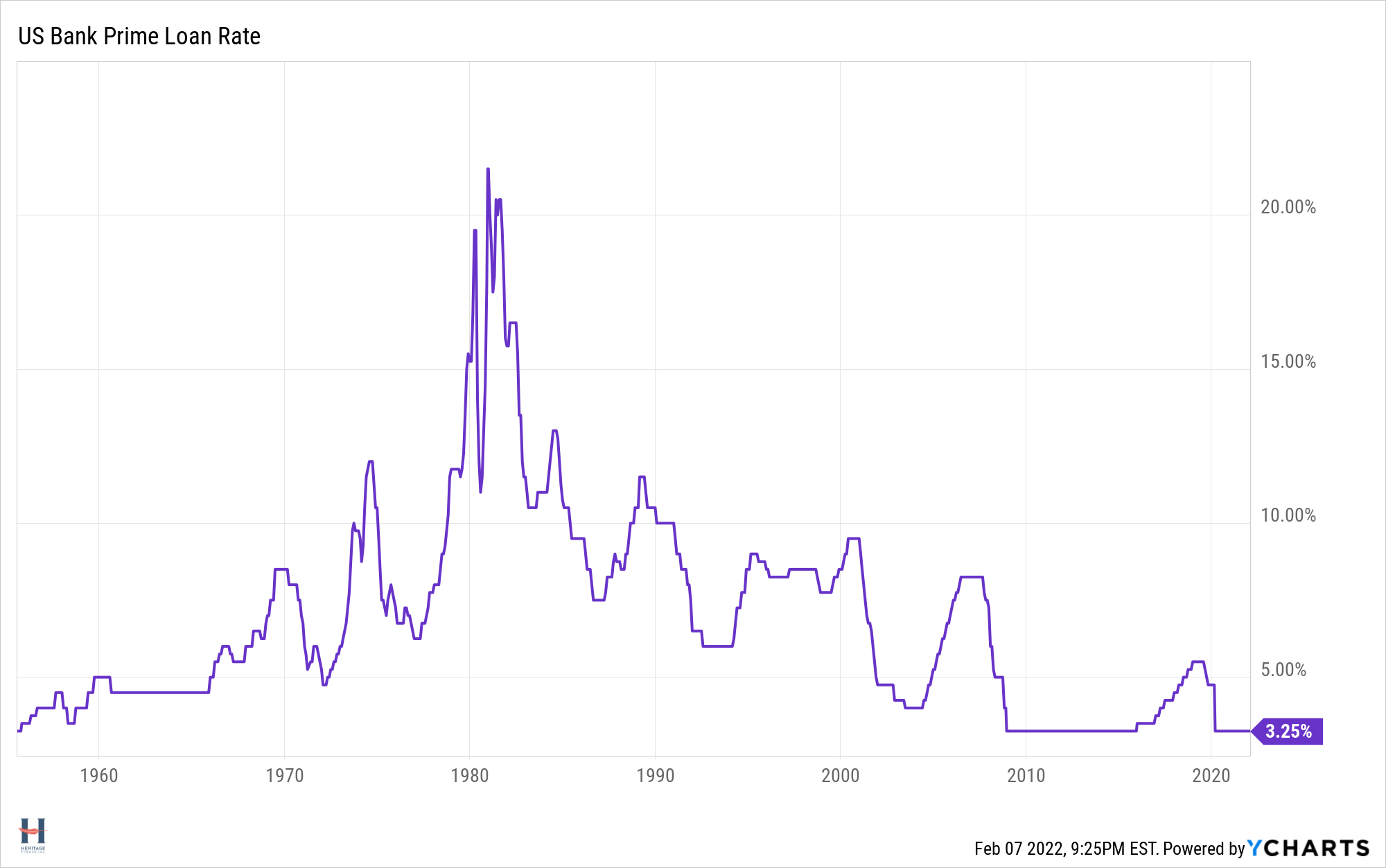

Rates are low. The prime rate, an interest rate used by lenders to determine the rates they’ll charge customers is at 3.25%. It hasn’t been that low since the 50’s. And they’ve been low for a while. This has allowed people to use leverage to make money, something I went into in detail in Using Debt Smartly to Build Wealth.

It makes sense to take advantage of low rates. If you can borrow money at 3.25% and your investments are earning 9% – 10%, you’re coming out ahead. I know the analysis is more complicated. But the borrowing advantage won’t change at those spreads even if you factor in taxes and other considerations.

But now the Fed has announced that it’ll raise interest rates in March to slow inflation. Market watchers are expecting four or more rate hikes in 2022. What does that mean for borrowers? Should you pay off debt now that rates will go up?

Well, with your existing fixed rate loans at low rates, raising rates shouldn’t have you rushing to pay off debt.

But your variable rate loans deserve some analysis. If the Fed raises rates four times at 25 basis points each, the interest rate on those loans will be 1% higher. Coming off a low base, the rates may still be attractive, but let’s dig in.

Paying Off Variable Rate Loans

I’ll use myself as an example. I have a HELOC (Home Equity Line of Credit), a common type of variable rate loan. The rate is 4.25%. An extra 1% would take that to 5.25%.

If my choice is between paying it down or buying stocks in a brokerage account, I need to know what return to expect from the stocks, how much I’ll lose of that return to taxes, and how that compares to 5.25%.

My firm recently shared its 2022 Investment Outlook, which included ten-year return expectations for different asset classes, including stocks. Given how expensive pockets of the U.S. market have become, we have a 7% return expectation for the global stock market.

The Math

Let’s say 2% of that return comes from qualified dividends and that your qualified dividend tax rate is 20%. (Note: your qualified dividends could either be taxed at 0%, 15%, or 20% at the Federal level, with the possibility that you would also pay the Net Investment Income Tax of 3.8% if your income is high enough. Your state may tax dividends as well).

.4% of that return is lost to taxes. So, we’re at 6.6%.

Let’s also assume for the sake of an effective blog post that you lose .28% of that return to long-term capital gains. For the engineers, I’m assuming a 20% portfolio turnover and a 20% tax rate on the capital gains generated by that portfolio turnover. (See the note above as the same rates apply to your long-term capital gains).

6.6% minus .28% is 6.32%.

Still higher than your 5.25% HELOC rate, although it’s getting tight.

Now, I’m simplifying again because your HELOC interest may be tax-deductible if you are itemizing deductions and using the HELOC for home improvement. However, I can’t plug this into the formula because your exact tax savings depends on your interest rate and amount borrowed. Just know there might be more to the story on the side favoring borrowing.

Takeaways on Whether To Pay Off Variable Debt Now

So, where does that leave you in terms of whether to pay off debt now? A few thoughts:

I like the spread between 3.25% and 9% a lot better than 6.32% vs. 5.25%. This is no longer a no-brainer. If your current variable rate is higher than 4.25%, I would consider paying off that debt now. If it’s lower than 4.25%, I think you can still expect a healthy spread. Lucky for me, I’m right on the borderline. If my wife reads this post, I’ll let her decide since she hates debt. If she doesn’t read it, well…

The Fed may raise rates more than four times. At least one bank is predicting seven rate hikes.

You don’t know where rates will go from there. The Fed could continue to raise and completely wipe out your spread, or the rate hikes could do their job and the next direction is rate cuts which would make keeping your loan more attractive.

Return expectations could be higher or lower than this for your portfolio. If your portfolio isn’t 100% stocks, your expected return would likely be less. Also, 7% is a lot less than what stocks have returned historically.