Charts You Need to See – Q3 2021 Market Guide

Every quarter, J.P. Morgan Asset Management puts out their Guide to the Markets slide deck. It’s a great source of interesting and helpful information about the economy, markets, and investing. Here are the Q3 2021 market guide slides that stood out to me and how they may help you.

For a more thorough market overview, check out my team’s Q2 market commentary focused on inflation Four Tools to Protect Against Inflation.

The Charts

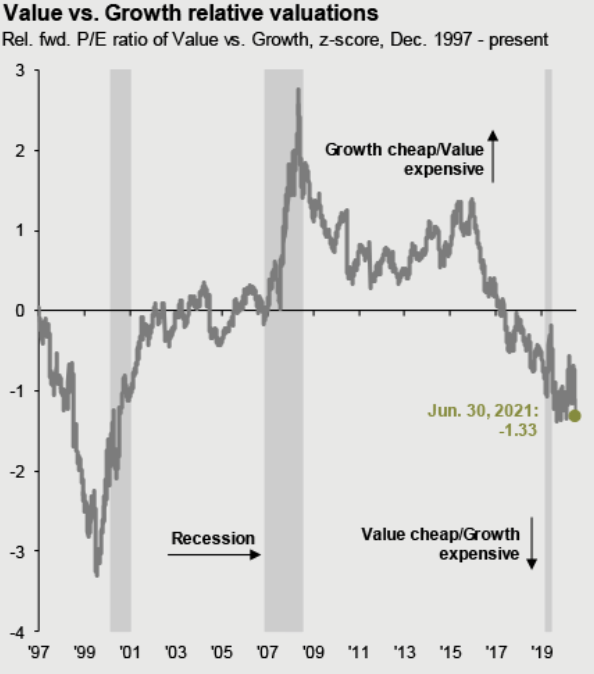

Growth outperformed value in the last bull market (2009 – 2020). This bull market which began on March 23, 2020 has seen value outperform. Despite this strong relative stretch over the last year, value is still cheap relative to growth.

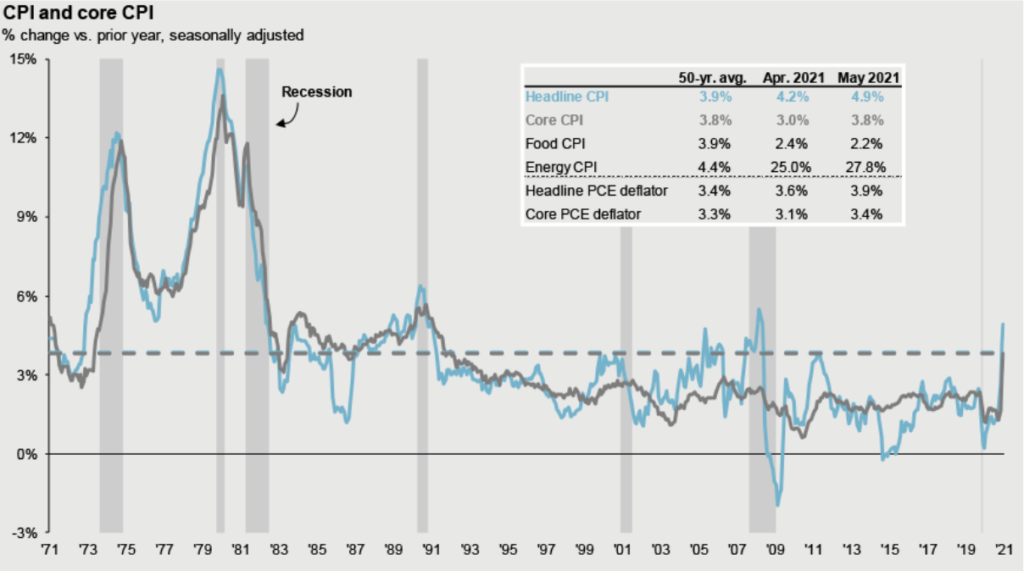

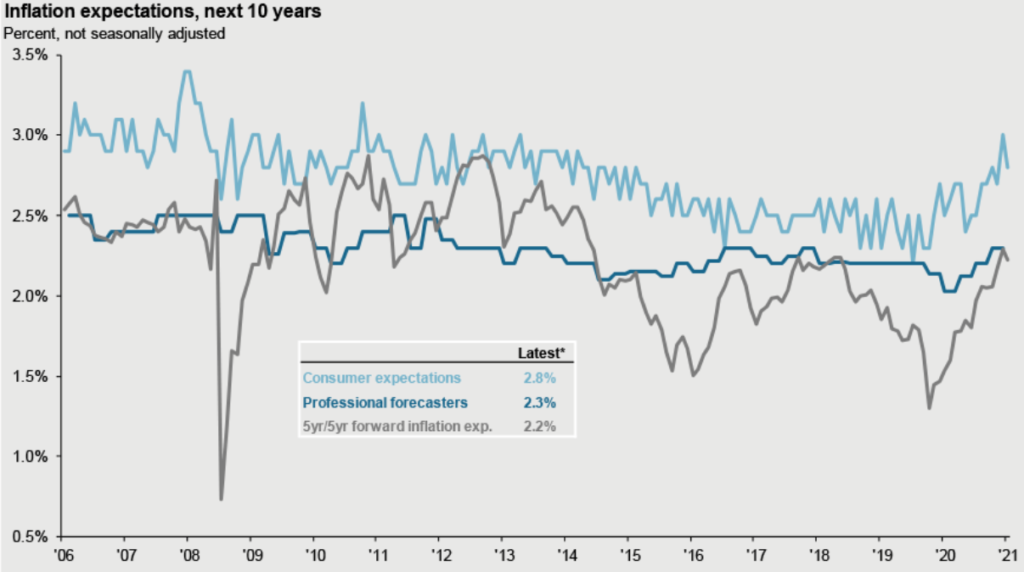

Inflation is in the news. The first chart shows the uptick. The second chart shows that inflation expectations are subdued going forward.

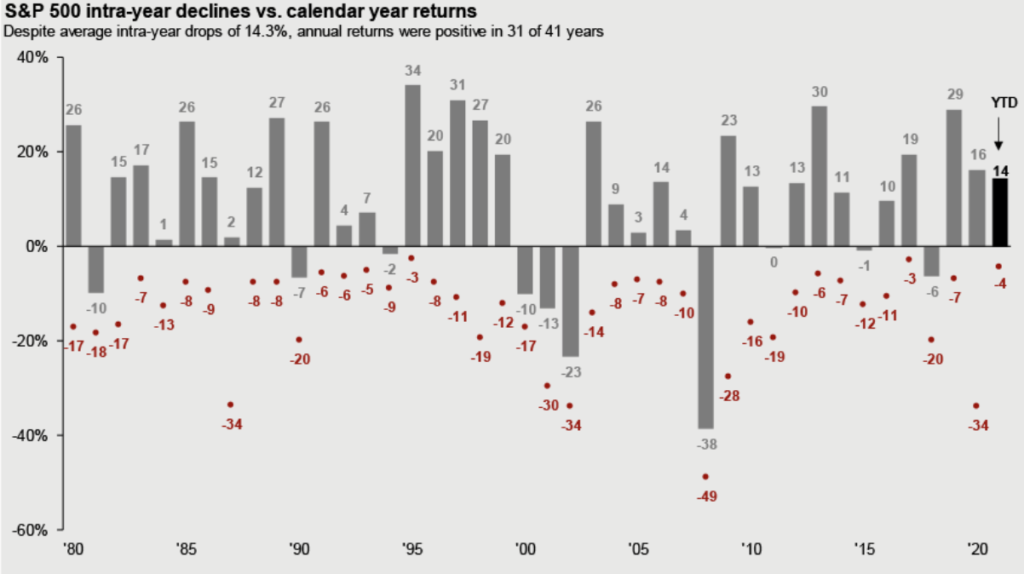

This is always one of my favorite slides in the deck. Over the last forty years, the market averages a 14.3% intra-year decline. You have to expect annual double digit corrections every year as a stock market investor and learn not to overreact to them.

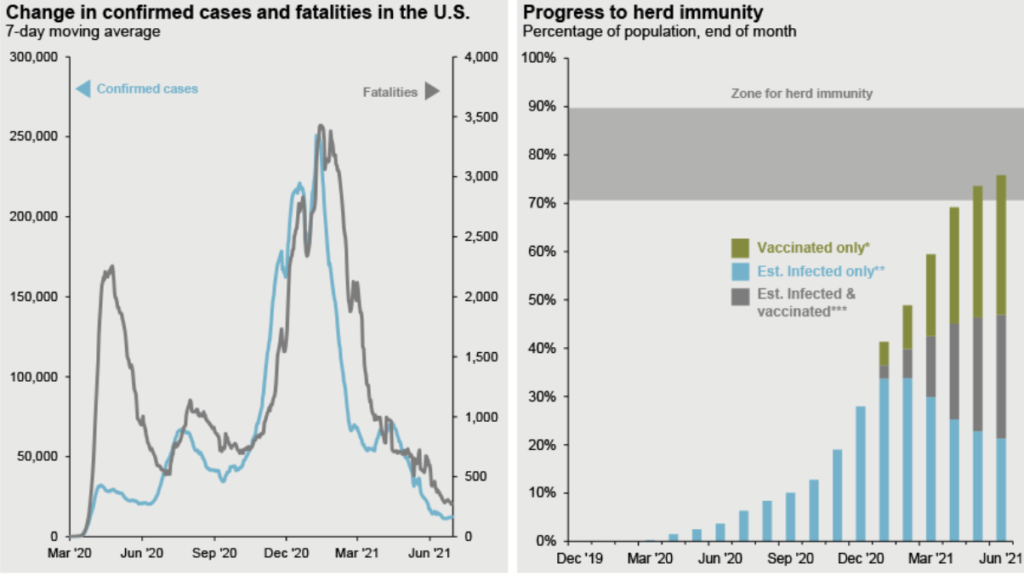

The progress to herd immunity chart and confirmed Covid cases and fatalities.

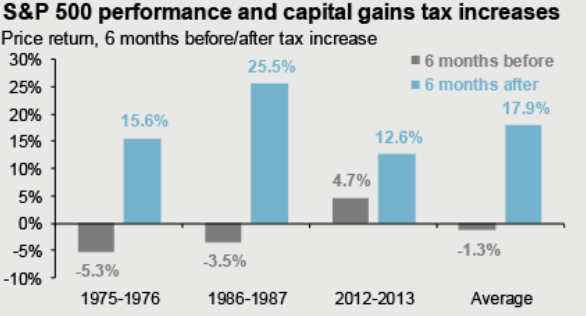

Capital gains taxes may increase. Here’s how prior increases have impacted the S&P 500.

Concerned? Check out this post on how to minimize taxes if proposed increases go through.

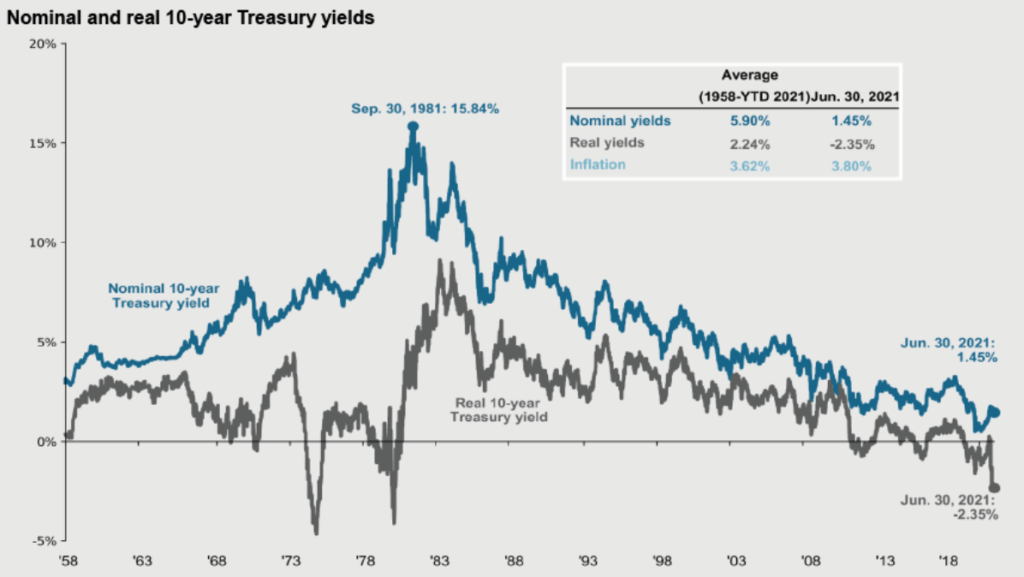

Treasury bonds are unattractive right now. Here’s a good chart from the Q3 2021 market guide showing why. Bond index funds own a lot of Treasuries, so even if you don’t think you own many, you may.

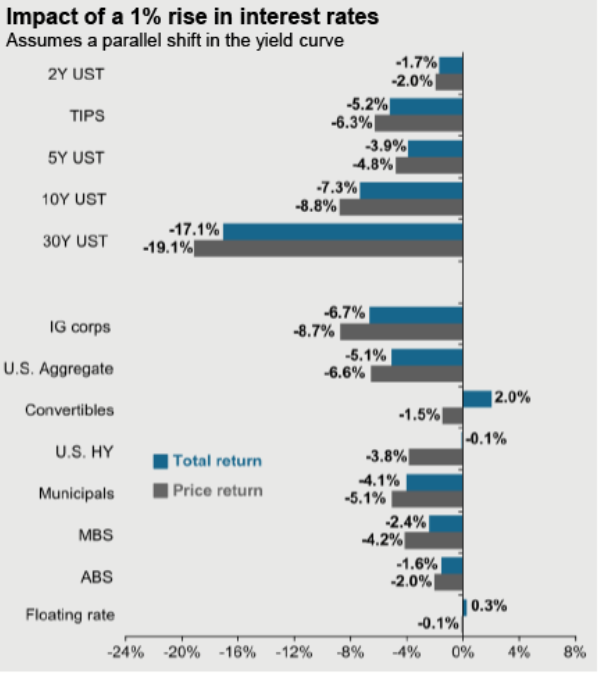

Long-term bonds are unattractive right now. If rates go up, they would be impacted the most.

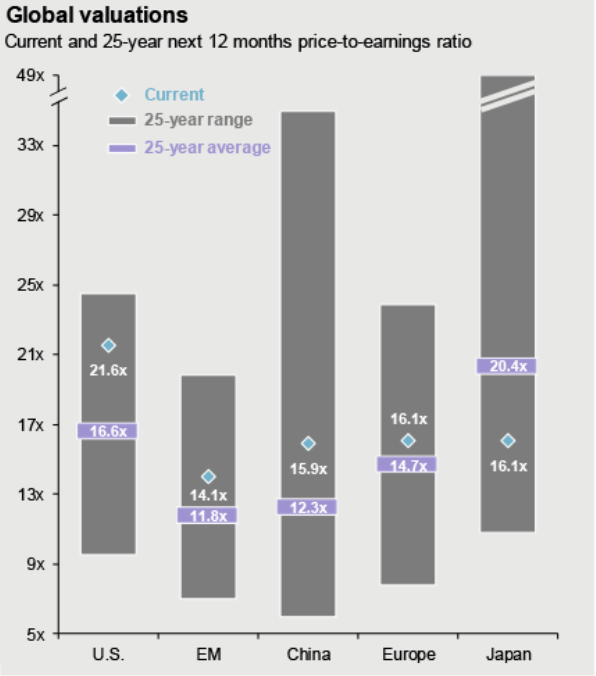

Consider some international diversification. The U.S. market is more expensive relative to its long-term average than many other markets.

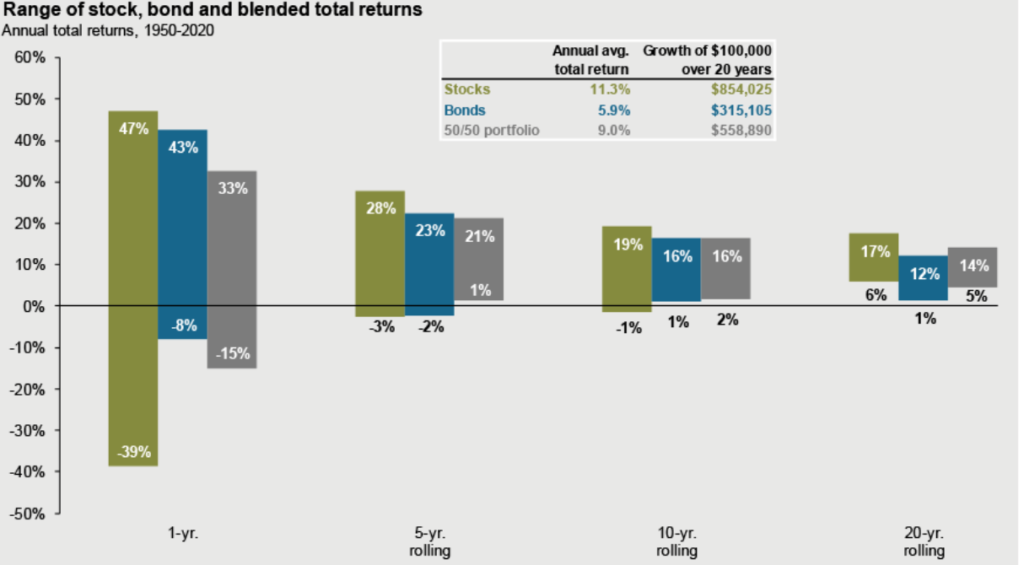

Another favorite. Don’t let short-term volatility shake you out of earning the market’s long-term returns.

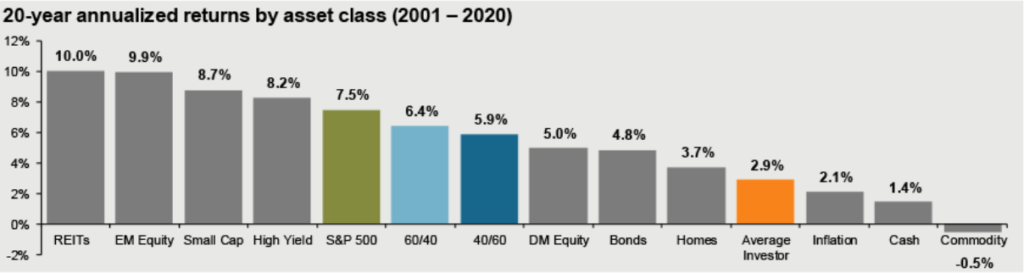

Patience continued…the average investor underperforms almost every type of investment by poor timing decisions and chasing winners.

Wondering how long to give an investment strategy so you don’t jump ship at the wrong time? Check out How Long to Give an Investment Strategy.

Need to make some portfolio changes?

Don’t go it alone