Sustainable Investing Thoughts

Something I’ve been thinking about and researching more lately is sustainable investing (learn more here).

There are a few reasons why:

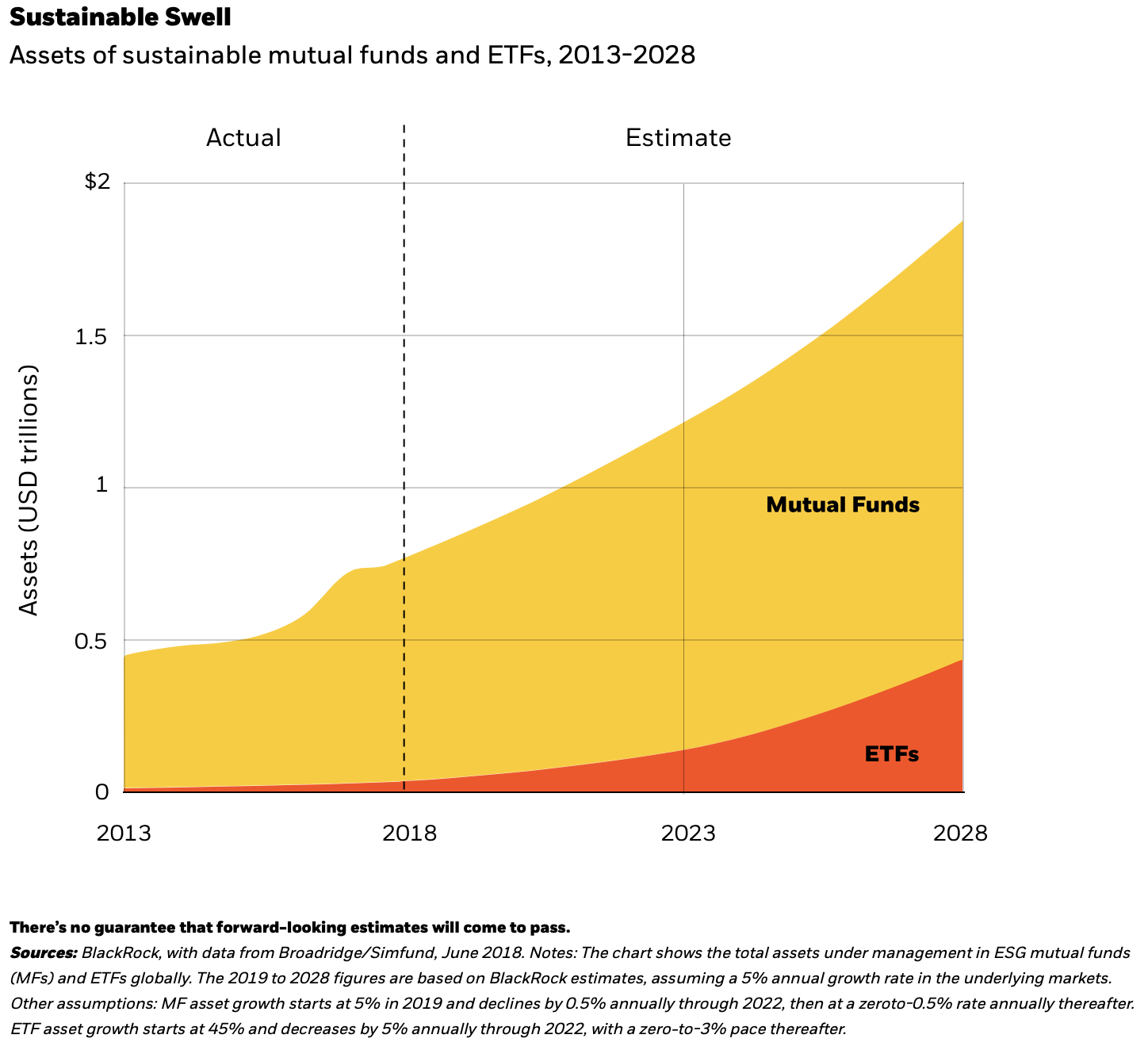

- Interest in sustainable investing has grown dramatically over the past few years.

- Sustainable investing products and strategies are stronger and more customizable now.

- It’s always been a piece of my practice, but not a focal point.

- I’m personally intrigued by my industry’s ability to drive positive long-term change.

Please allow me to dive deeper into that last reason.

Investing as a Change Catalyst

I don’t think it’s a particularly controversial statement to say that there are things going on in the world that I wish would improve.

And I also don’t cling to the notion that one party or candidate can fix things if only they would win enough elections. In my humble opinion, our political system has two flaws preventing the right things from happening.

- The middle has been swallowed up whole and the compromises most Americans want can’t happen.

- No one is incentivized to address long-term problems.

And so problems go unsolved. There’s a long list. And my list is different than yours and different from someone else you know. The point isn’t about what’s on our lists. The point is thinking of a new way to drive change.

As I thought about it, I realized there was an opportunity to marry my career as an investment advisor with my desire to see things improve.

The same concern by others drove the rise of sustainable investing over the years.

A goal to see real change, better align your investment decisions with your values, and contribute in some small way to a brighter future. Take one of the strengths of investing, that when done best it’s a long-term exercise, and hope it can help fix long-term problems that are being ignored.

Naive? Maybe. As simple as it sounds? Definitely not. Sustainable investing is a complex topic. It means different things to different people, the products and solutions vary widely in their approaches and quality, and the field is growing rapidly.

Sustainable Investing Topics to Explore

So, I’ve decided to dive deeper into it and share with you what I find.

First, by looking at whether sustainable investing helps or hurt returns, which I did in Does Sustainable Investing Hurt Returns?

How investors can drive change through which companies they invest in and how, which was the focus of Understanding Sustainable Investing.

What types of changes people focus on and how different investments target those changes. As an example, Investing to Fight Climate Change.

And many more things I haven’t contemplated yet.

I know not all of my readers will want to follow along on all aspects of this journey. That’s fine. It won’t be all I write about. I started The Boston Advisor blog to help take your money smarts to the next level by sharing personal finance articles with a few key themes that are not changing.

- Good decision-making with your capital and resources can build wealth. Here’s a personal Wealth Management Checklist to start.

- You can get rich through disciplined investing in stocks and avoiding the behavioral traps that keep us from earning our fair share of stock market returns. Learn more about Investment Mistakes to Avoid.

- You can make a difference with your investing.

- Lifelong learning is imperative to financial well-being. It adds expertise to boost career earnings, builds financial acumen, and broadens your perspective to improve decision-making.

But for me at least, it’s time to spend more time on that third point.