Wednesday Reading List

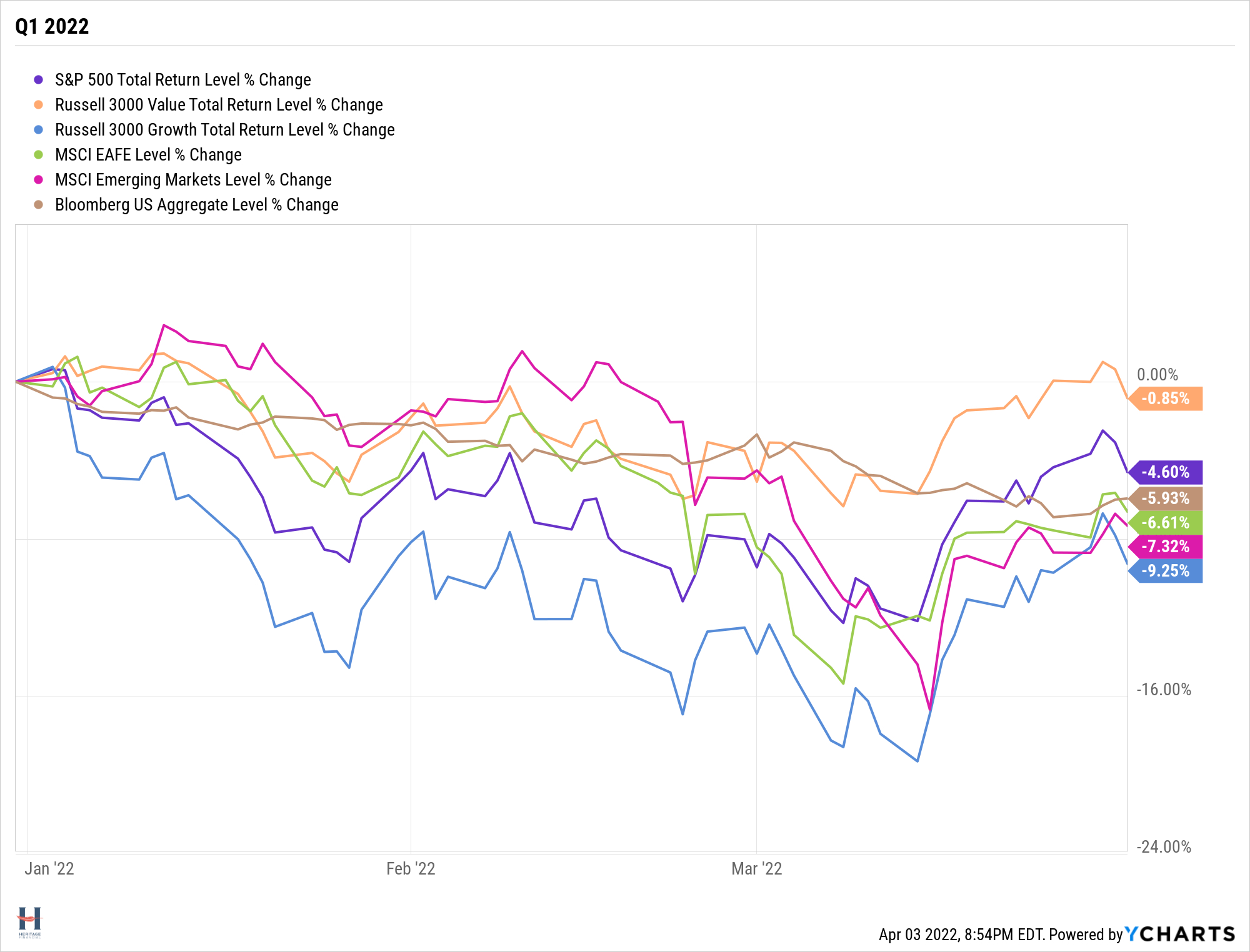

ICYMI: Q1 Market Recap & Q2 2022 Market Guide – Q2 2022 market guide recapping the first quarter and sharing helpful charts to learn from and think about the market going forward.

Will There be a Recession in 2022?

This seems to be the newest question on investors’ minds. There are many factors to consider, including things like jobs and inflation – both of which can impact consumer spending. The Fed is also a key player here, considering the role they have in interest rate policy. Here’s how the team is thinking about recession chances.

2-year Treasury yield tops 10-year rate, a ‘yield curve’ inversion that could signal a recession

The yield curve inverted. Considered by many a reliable recession indicator, what is an inversion and what might it mean?

What have they been thinking? Homebuyer behavior in hot and cold markets: A ten-year retrospect

Homebuyers’ emotions may partly explain soaring home prices during the COVID-19 pandemic but, at least so far, the run-up doesn’t look like a classic bubble, suggests a paper discussed at the Brookings Papers on Economic Activity (BPEA) conference on March 25, 2022.

Stocks have had two back-to-back downturns this year, followed by a relief rally. Leadership has flip-flopped, as has investor sentiment. Fed tightening and the war in Ukraine have been the dominant macro forces. The correction earlier this year was largely about higher inflation and rate hikes. More recently, the inversion in the yield spread between 10-year and 2-year Treasuries has heightened recession risk.

Five Things I Know about Investing

Investing legend Kenneth French with an essay sharing five principles he uses as the foundation for a holistic approach to portfolio design.

Artists and groups who first made their mark decades ago, including the Beatles, are winning the streaming wars

CDC, under fire for covid response, announces plans to revamp agency

The CDC hasn’t looked great lately, and the new director is aware. An outsider was named to conduct a one-month review with an eye toward modernizing.

Book Recommendation

Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger Lowenstein

A loyal reader recommended this book, and it did not disappoint. So much so that I added it to my Best Personal Finance Books list.

Before the Civil War, the government had no authority to raise taxes, no central bank, and no currency. To win the war, all these things were remedied (and more) and the greenback dollar was created.