Fixing Your 2 Biggest 401(k) Investing Mistakes

The average 401(k) balance was down 23% last year according to this recent report. Losing money in a year when stocks and bonds were both down is easy and expected. Losing 23% takes a bit of work given that:

- U.S. stocks were down 18.63% last year.

- Global stocks were down 18.19%

- U.S. bonds were down 12.30%.

No combination of those gets you to 23%.

So, what gives?

This blog post is brought to you by our good friends Fear and Greed.

Two fixable big 401(k) investing mistakes create a 23% loss, and even if you didn’t make them last year or don’t have a 401(k), you don’t want to make them in the future or in your other accounts.

- Selling out at the wrong time

- Chasing investment performance

What Is It FDR Said about Fear Again?

While stocks ended the year down about 18%, at their worst in 2022 they were down around 25%. Selling near the bottom would have caused you to underperform, possibly by more than the gap between -18% and -23% would indicate because your 401(k) may have owned bonds, and when you dollar cost average through regular payroll contributions into a down market your performance is better than the market for that year.

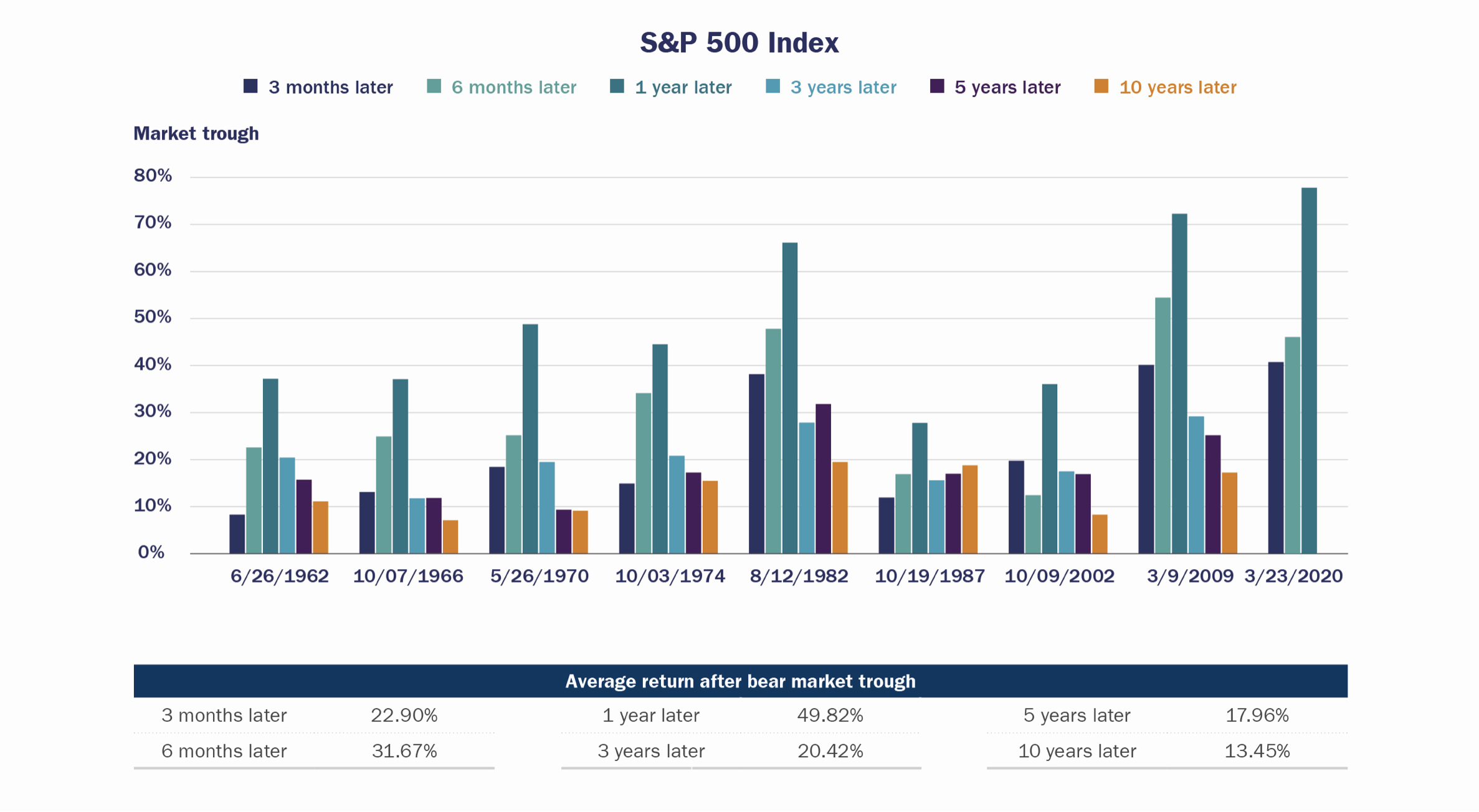

Fear causes investment mistakes. I get it. I make my own mistakes too. Giving into it isn’t a recipe for success. If you sold near the bottom last year your market timing formula is broken, and you don’t need to make moves like this to protect your portfolio. The market will do the work for you given time. It always has.

Gordon Gekko Was Wrong About Greed

It isn’t good.

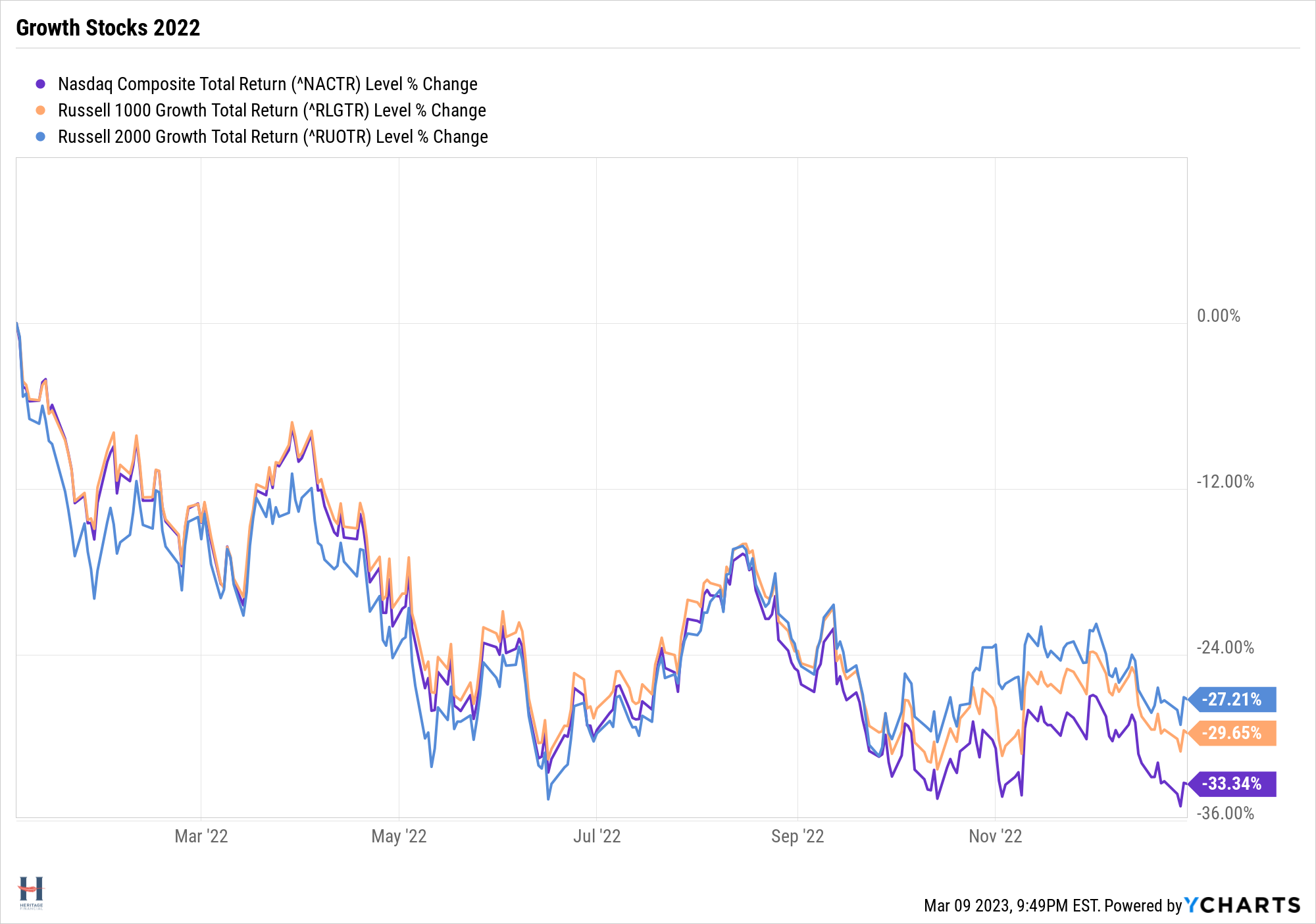

And when it causes you to chase investment performance, it’s downright awful. Some stocks dropped more than those numbers I showed you above. It’s the same ones that had been killing it for years.

Growth stocks, especially large growth stocks.

After years of believing in true diversification, you may have thrown in the towel and loaded up on the best performing funds in your 401(k). Then last year they underwhelmed in a down market.

You likely didn’t get the years of outperformance, which is why investors typically trail the performance of the funds they’re invested in.

We can’t call the cycles and winners and losers in advance.

Diversify and don’t chase past performance.