Carl Icahn Spoke, CNBC Didn’t Listen

Carl Icahn was on CNBC the other day. I like listening to Icahn. He’s an outspoken and interesting guy talking about the markets, which I find fascinating.

Scott Wapner opened up the conversation by asking Icahn about his bearishness for the past year, which was either a shot or holding him accountable for his on-air views since bearishness was a mistake.

The full clip is below. Icahn’s response was basically:

- One of his cardinal rules is not to try and predict the short and medium term market

- He made the mistake of straying from that rule in 2020 and paid the price

- “Fools give you reasons, wise men never try” – it wasn’t the first time he made that mistake

- He then went into a sales pitch about activist investing and his abilities (i.e., talking his own book)

If only he stopped there. CNBC would have had some great lessons for its viewers.

But, alas, Icahn dove into a macro spiel about inflation worries, the money supply, and “hitting the wall” – whatever that means.

And that became the story.

Carl Icahn says the market over the long run will certainly ‘hit the wall’ because of money printing

Here are the lessons CNBC should have profiled instead.

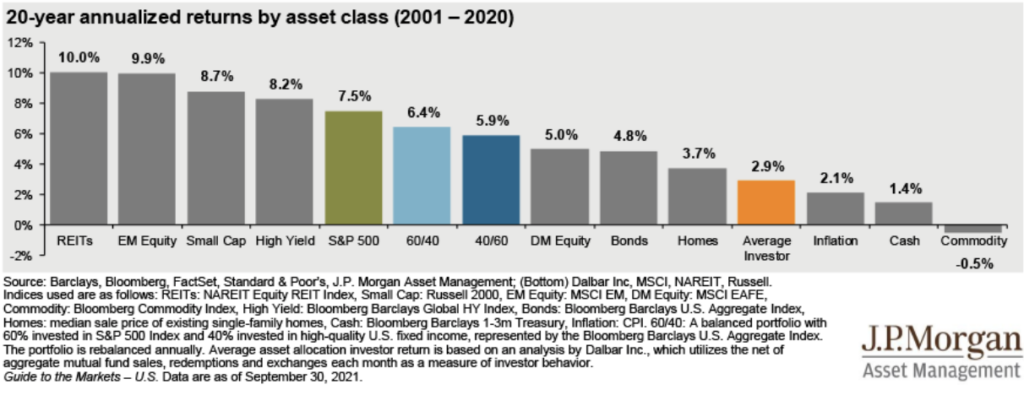

Investing is hard. Carl Icahn is a billionaire investor with 60 years of experience. He knows he shouldn’t market time, but the pull of fear and greed are hard to resist even for him. It’s why a chart like this exists.

Stick to your knitting. Buffett and Munger call this your circle of competence. Icahn made money as a stock broker, trader, and activist investor. That’s his circle of competence. He didn’t make it as a market timer, or macroeconomic forecaster.

‘If you don’t know who you are, the stock market is an expensive place to find out.”

Adam Smith

Maintain your discipline. Icahn knew what not to do, but he did it anyway. Going back to Munger, he advocates building out checklists to help you apply lessons learned. I’ve built a few and found them helpful. Before making a decision, check the checklists.

Beware of headlines. Carl Icahn on CNBC said what he said, so the content is out there. But the story became his macro call. A guy who said he shouldn’t make calls gets burned and they write a story about another one of his calls. Get your information wherever you want. Don’t get your advice from the financial news media.

Suggested Further Reading

6 Things I’m Not Worried About Financially – There’s plenty to be worried about, so don’t add unnecessary financial concerns to the list. Includes latest thoughts on a market crash, investing in crypto, the deficit, Social Security running out of money and more.

Protecting Your Portfolio From the News – Investors struggle to hold onto their investments during challenging times. The news typically doesn’t help. It’s important to remember that the news reports today’s events, and shouldn’t be misconstrued as investment advice.