6 Things I’m Not Worried About Financially

Don’t get me wrong. There’s a long list of things that keep me up at night researching articles for my Wednesday Reading Lists. We all have our worries. I’m fortunate enough to have a lot on my plate. A family of five, being the president of an amazing 37 person wealth management team that has 1,000 clients who have entrusted us with their life savings and financial future, and doing what’s best for our employees. But there’s also a lot that I’m fortunate enough to not be worried about financially, and in writing this post, I guess I’m saying that you shouldn’t have to worry too much about them either.

Stock Market Crash

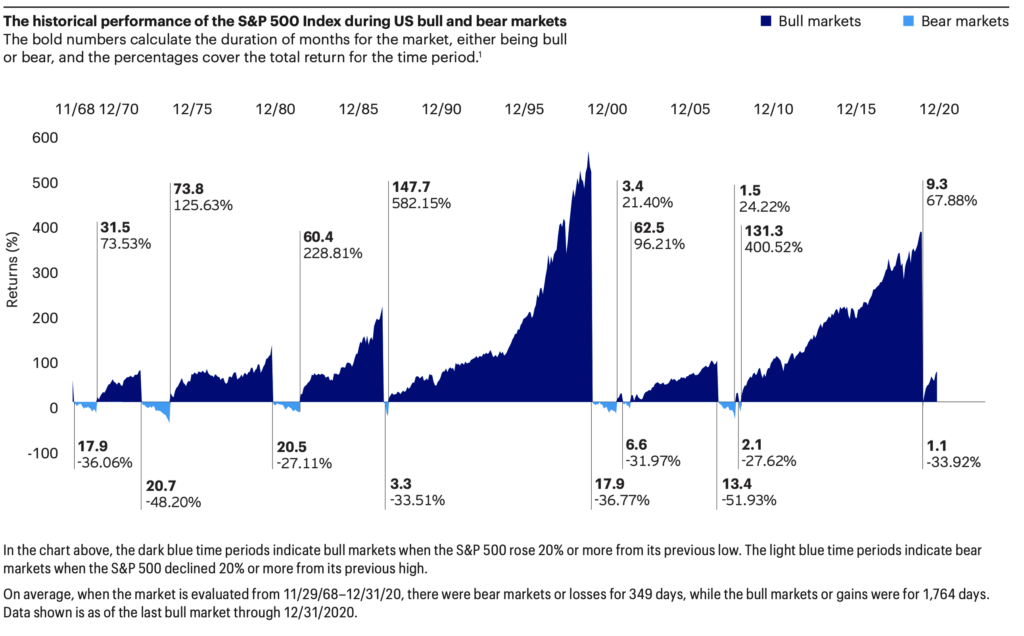

Historically, the stock market has averaged about a 10% return, allowing you to double your money every seven years or so.

Crashes happen. We just saw one in February – March of 2020. But the market recovers and enduring those bears is the price you pay for being able to double your money every seven years without any work.

If you set up your portfolio properly, you can survive bear markets, if not take advantage of them. Here’s how – Protecting Your Portfolio from a Bear Market.

Chasing Performance

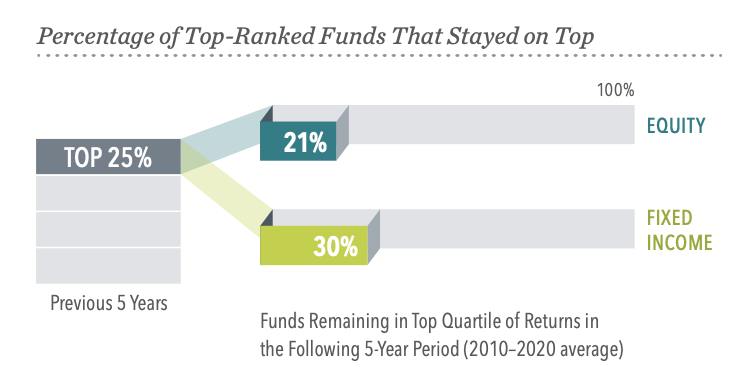

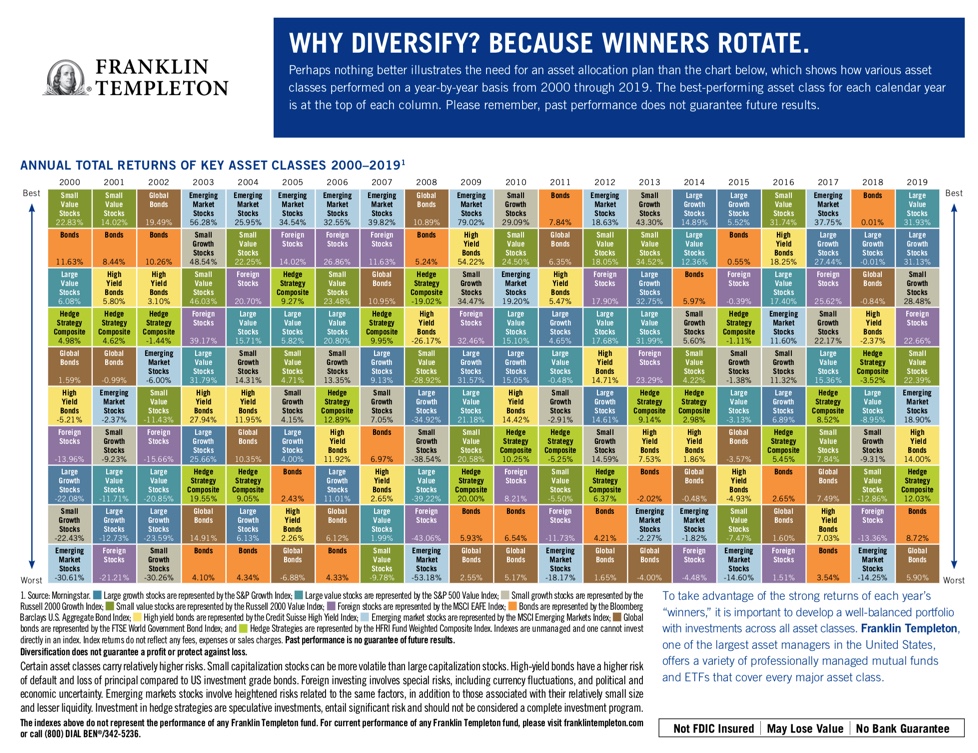

I need good long-term returns, not the best short-term returns. I’m not going to own the best performing stock or mutual fund in any given year unless it happens by accident. And I’m not going to switch my portfolio around chasing winners, since your odds of success doing that are quite low.

I’m also not going to concentrate my portfolio in an asset class that outperforms every other asset class. It can’t be done, and I don’t need to since winners rotate.

But I’m going to be fully invested, and over the years I will earn the money I need to make retirement as enjoyable as I want it to be and provide for my family along the way.

Missing Out on Crypto

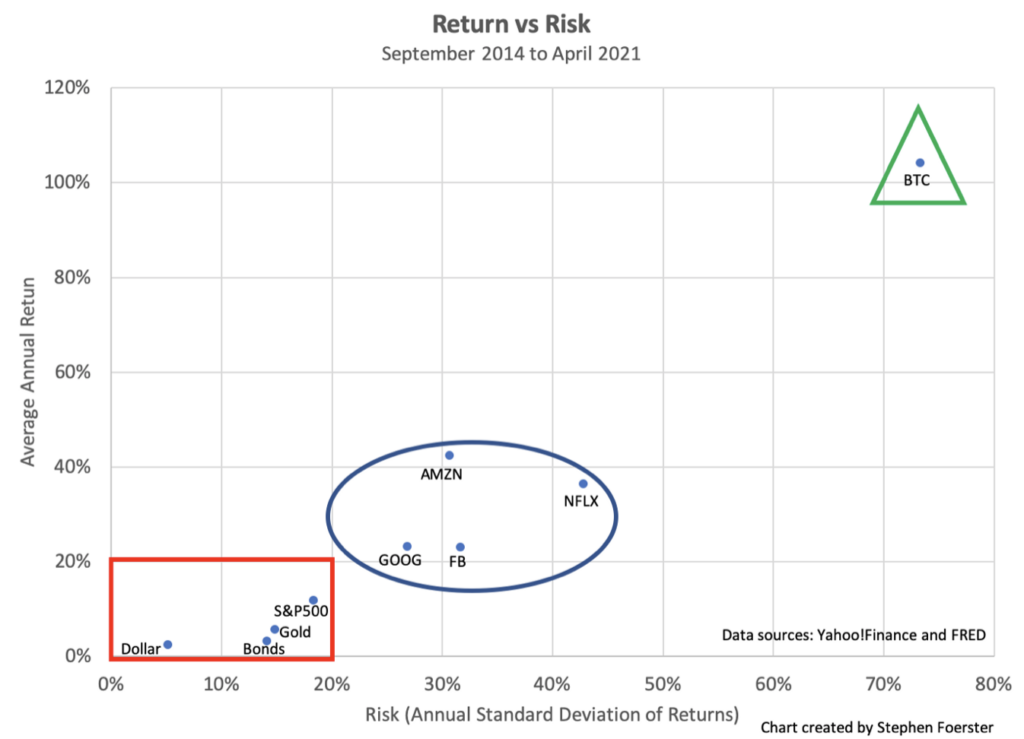

I’m not worried financially about missing out on crypto.

To get rich quick, you have to be willing to get broke quick, or at least lose a lot of money. I’m not willing to do that. You can’t recover from zero.

I also don’t fully understand crypto, and it’s never a good idea to invest in things you don’t understand. I can make money elsewhere.

Blockchain technology is impressive and has many uses. But cryptos are pseudo-currencies that trade like speculative investments. Returns that are literally almost off the charts are accompanied by volatility you can’t wrap your head around compared to other investments.

That’s Bitcoin.

There’s a bunch of cryptocurrencies. Who knows which will come out ahead and if they’re going to be derailed by regulation?

SEC Chair Gary Gensler recently made it clear what he thinks about crypto and that the SEC needs to act to protect investors.

Right now, we just don’t have enough investor protection in crypto. Frankly, at this time, it’s more like the Wild West. This asset class is rife with fraud, scams, and abuse in certain applications.

Remarks Before the Aspen Security Forum

The whole mining concept is goofy, confusing, and seems to hurt the environment which puts it up against another major trend (sustainability).

Paying Off Low Interest Debt and Borrowing at Low Rates

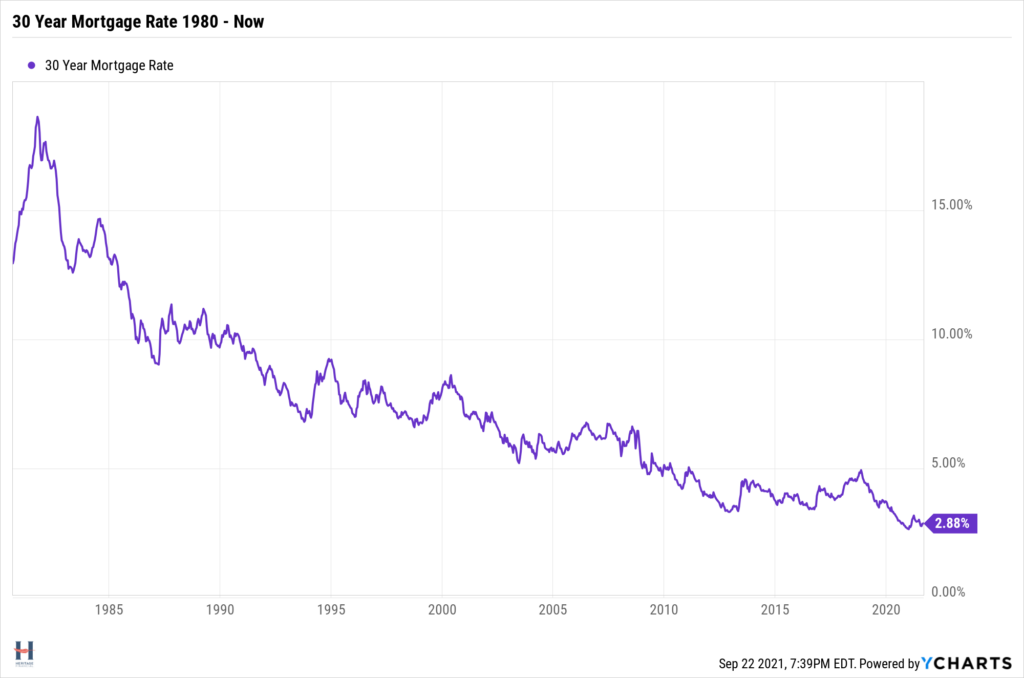

If I can borrow money at 2-3% to either make more money or take less out of my stocks, why wouldn’t I, and why would I be worried about paying it off soon?

These low rates are a historic opportunity. Learn how to take advantage in Using Debt Smartly to Build Wealth.

The Debt and the Deficit

I shared some thoughts on this in Reviewing “The Deficit Myth” and MMT. Deficit fears are way overblown and have been scaring investors out of making money for far too long. Same with debt fears. Yes, there are limits on what we can spend. No, we’re not near those limits and people telling you otherwise have been flat out wrong for a long time. That’s the polite way of saying it. Barry Ritholtz shared a stronger version if you’re interested. Worry about the country’s trajectory if you want, but don’t be worried about it financially.

Social Security Running Out

My lack of worry isn’t because I’m at least twenty years out from being able to claim it. It’s because Social Security’s funding gap is easily fixable. The funding gap technically doesn’t even exist since a program funded by a government that cannot run out of money can’t run out of money.

But beyond this, the retirement age can be gradually increased (as it has in the past), the income cap for Social Security taxes could be lifted, or they could change how they calculate cost of living increases.

Or some combo of all of the above. It’ll be fixed. Not for nothing is Social Security considered the third rail of politics. Politicians aren’t going to mess with it.