The Reopening Trade Continues

U.S. large cap growth stocks dominated the 2009 – 2020 bull market. They outperformed small caps, value, and international stocks. That performance gap continued for most of 2020 as the “stay-at-home” growth stocks’ benefited from our Covid isolation. However, since the Pfizer vaccine news on November 9, 2020 we’ve seen evidence of the so-called reopening trade. The reopening trade means buying cheap stocks that will benefit from an open economy and rotating into international stocks.

Check out R.I.P. 2009 - 2020 Bull Market & Lessons Learned and Thoughts on Our Team’s 2021 Investment Outlook for more relevant investing insight.

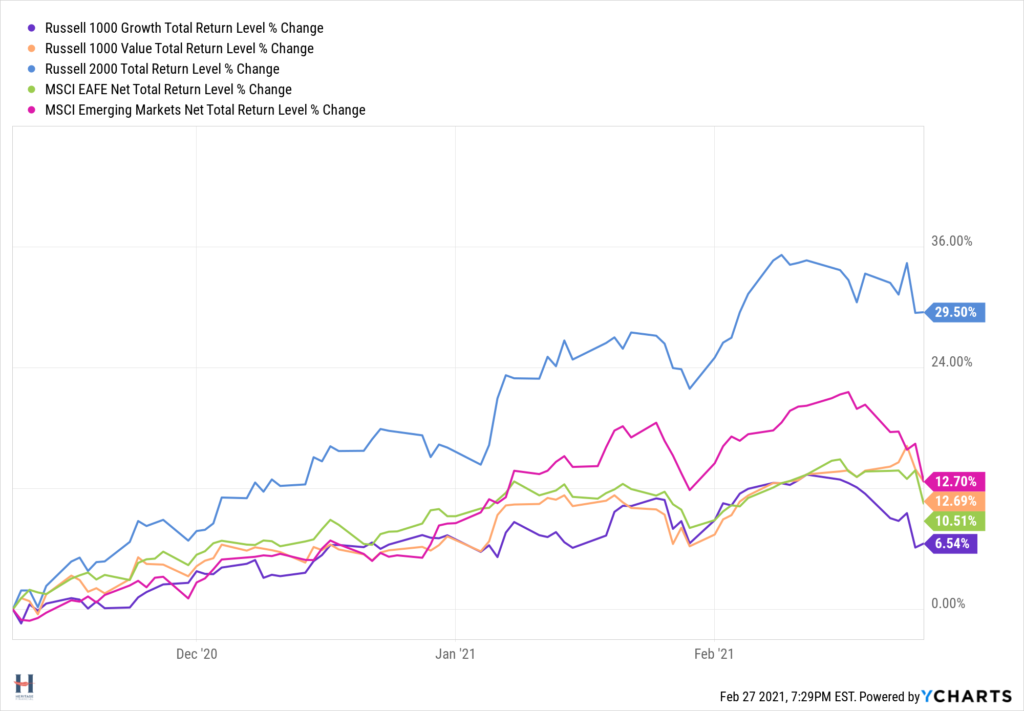

This chart shows that from November 9th, 2020 through February 26, 2021 U.S. large cap growth did well, but underperformed U.S. large cap value, U.S. small caps, developed international, and emerging market stocks by substantial margins.

Market Winners Rotate

That market leadership is changing in this new bull market is interesting, but not surprising. As I recently wrote about in Investment Winners Rotate, new bull markets bring new market leaders. Winners rotate. Sometimes it’s emerging markets leading the way. Other times it’s U.S. small cap and U.S. value. Sometimes it’s U.S. large cap. You need to own them all in a diversified portfolio unless you have a crystal ball that is going to tell you which will do best when.

In this instance, it looks like U.S. large cap growth became too expensive, and investors shopped elsewhere. They call it the reopening trade. I think it’s just good investing.

Regression to the mean is the most powerful law in financial physics. Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance.

The Intelligent Investor: Saving Investors From Themselves by Jason Zweig

If the example of prior bull markets continues, it makes sense to be sure you have enough exposure to the current leaders in this environment. We’re not that far away from a decade (2000 – 2009) when U.S. large cap stocks lost money. Given how well they’ve performed since then, you may be too heavily concentrated in them now.

_______________________________________________________________________________________________________________

Suggested Further Reading

Webinar Replay: 5 Portfolio Changes to Consider Now – Webinar sharing a few major recent changes to the investment landscape and what portfolio updates to consider to help build your 2021 investment strategy