Thoughts on Our Team’s 2021 Investment Outlook

Our investment team just published its 2021 investment outlook (available here). It’s a great overview of current market conditions and reasonable expectations for this year.

Heritage has a four person investment committee that works in consultation with a large independent investment consultant (DiMeo Schneider & Associates, LLC) to prepare annual capital market assumptions, asset allocation recommendations, select investments, and monitor the market and portfolios throughout the year for any necessary adjustments.

2020 was a year for the record books. Positioning your portfolio well for the long-term requires you to be thoughtful about what changed and what did not last year. Check out the outlook for the entire overview.

Important takeaways:

- Pent-up demand, government stimulus, easy monetary policy, and ongoing vaccinations mean the global economy is poised for strong year-over-year growth

- Inflation should remain subdued, but it’s worth watching signs of a pickup

- The dollar may continue its weaker trend, which should help international stocks

- We expect volatility along the way due to uneven vaccination efforts

- Stronger economic recovery should cause other areas of the market outside of large cap growth to do well. Small cap stocks, value stocks, and international stocks did outperformed to end 2020, and this could continue.

- Strong investment performance since the March, 2020 market bottom has caused most investors to lower their future return expectations

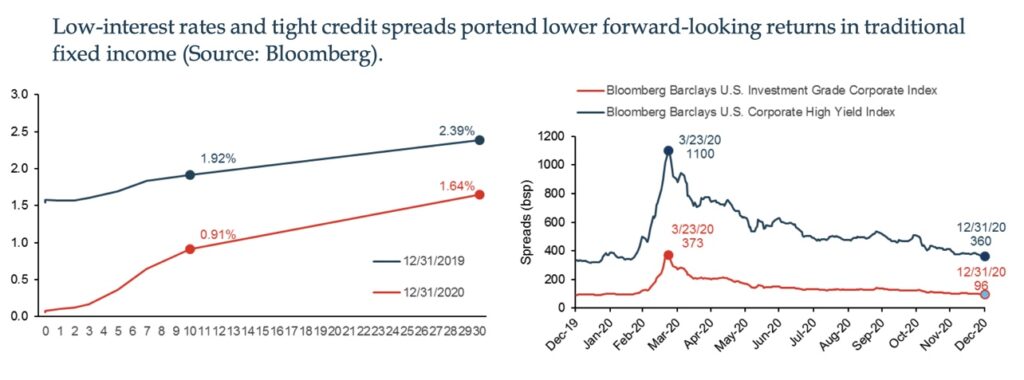

- Revisit your bond portfolio and consider alternative asset classes to combat low yields and tight credit spreads

Some of 2021 investment outlook themes are continuations from things we saw in the second half of last year that I covered in 5 Portfolio Changes to Consider Now, and some are new.

What both groups have in common is our belief that the price you pay for an investment matters, and you should only take risk when it makes sense to do so.

_____________________________________________________________________________________________________________

Suggested Further Reading:

Investment Winners Rotate…and they’re doing it again – for more on the recent market rotation

Minimizing Taxes Under Biden’s Proposed Tax Plan: Webinar Replay – keep more of what you earn with smart tax-savings strategies

Investment Mistakes to Avoid – list of things not to do when managing your money