Charts You Need to See – Q1 2021 Market Guide

Every quarter, J.P. Morgan Asset Management puts out their Guide to the Markets slide deck. It’s a great source of interesting and helpful information about the economy, markets, and investing. Here are the Q1 2021 market guide slides that stood out to me and how they may help you.

For a more thorough market overview, check out my team’s First Quarter 2021 Review, And a Look Ahead.

The Charts

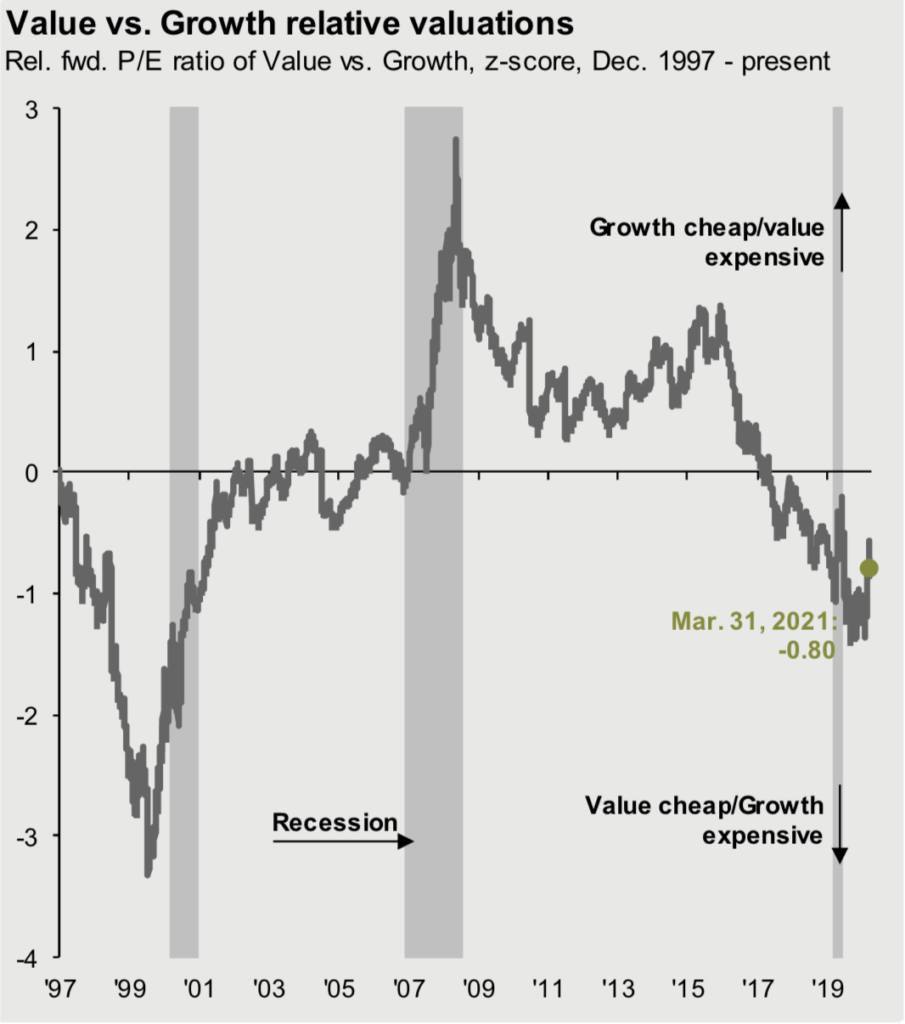

Growth outperformed value in the last bull market (2009 – 2020). This bull market which began on March 23, 2020 has seen value outperform. Despite this strong relative stretch over the last year, value is still cheap relative to growth.

Growth is represented by the Russell 1000 Growth Index and Value is represented by the Russell 1000 Value Index. Beta is calculated relative to the Russell 1000 Index.

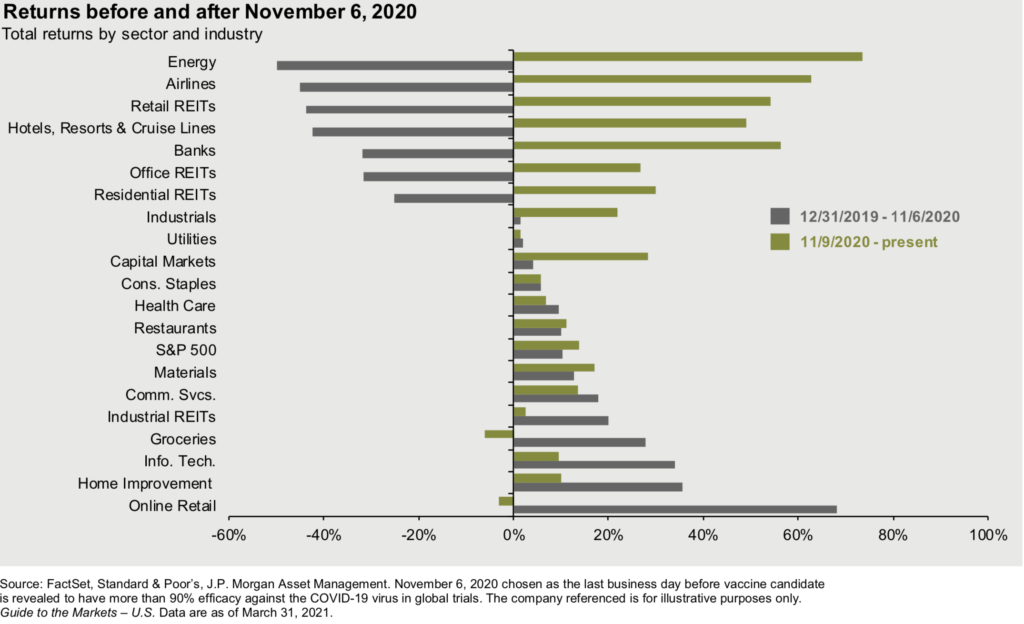

Additional evidence of the reopening trade as some of the hardest hit sectors/industries prior to the positive vaccine news from Pfizer have had the strongest performance since November 9, 2020 (day of Pfizer news).

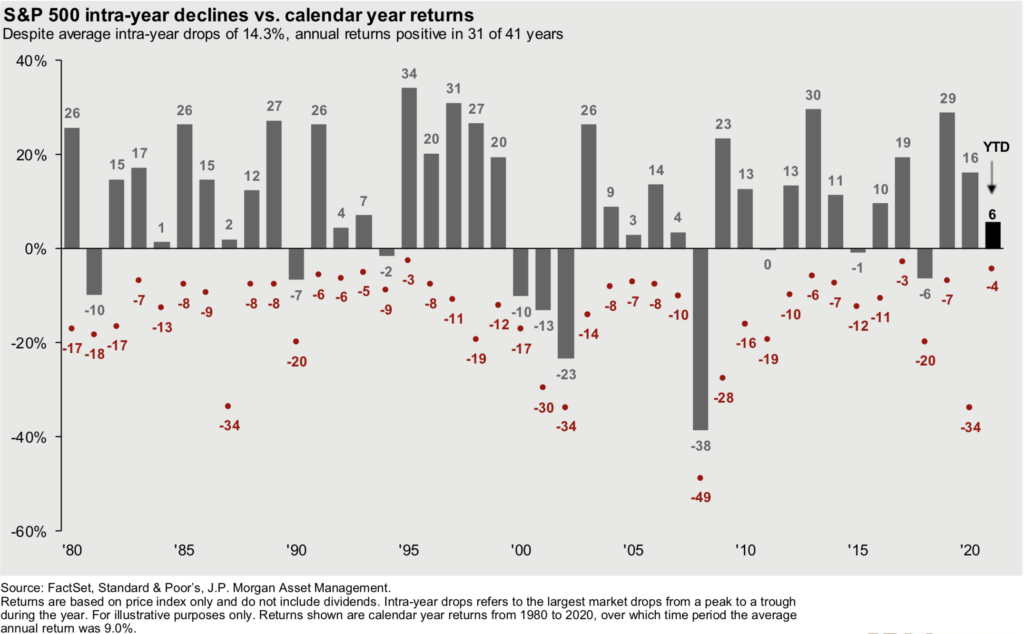

This is always one of my favorite slides in the deck. Over the last forty years, the market averages a 14.3% intra-year decline. You have to expect annual double digit corrections every year as a stock market investor and learn not to overreact to them.

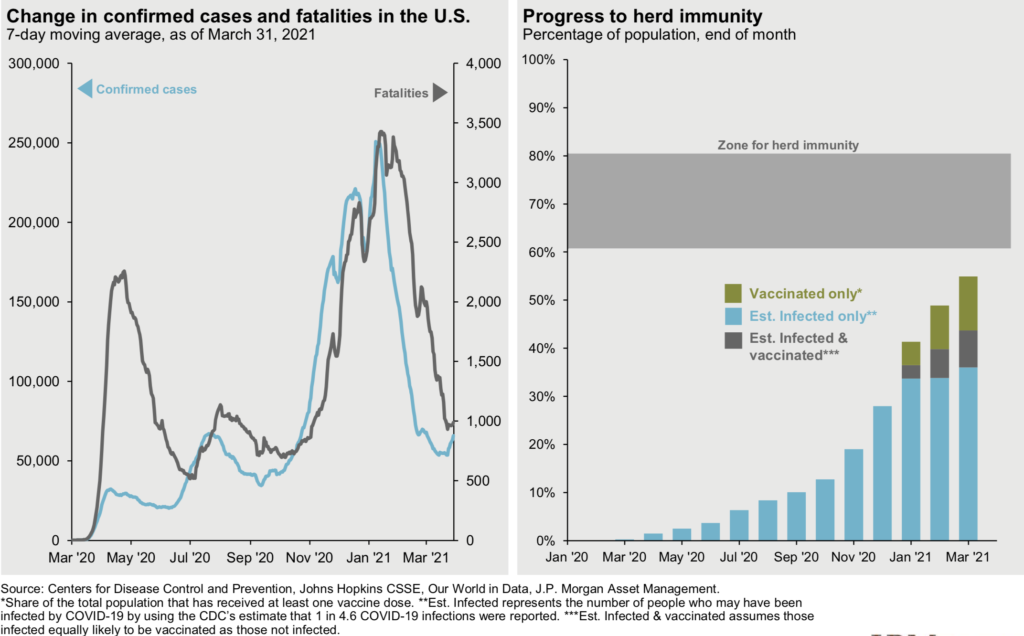

The progress to herd immunity chart on the right is one I haven’t seen before. With increased vaccinations since that came out at the end of March, hopefully we are even closer…

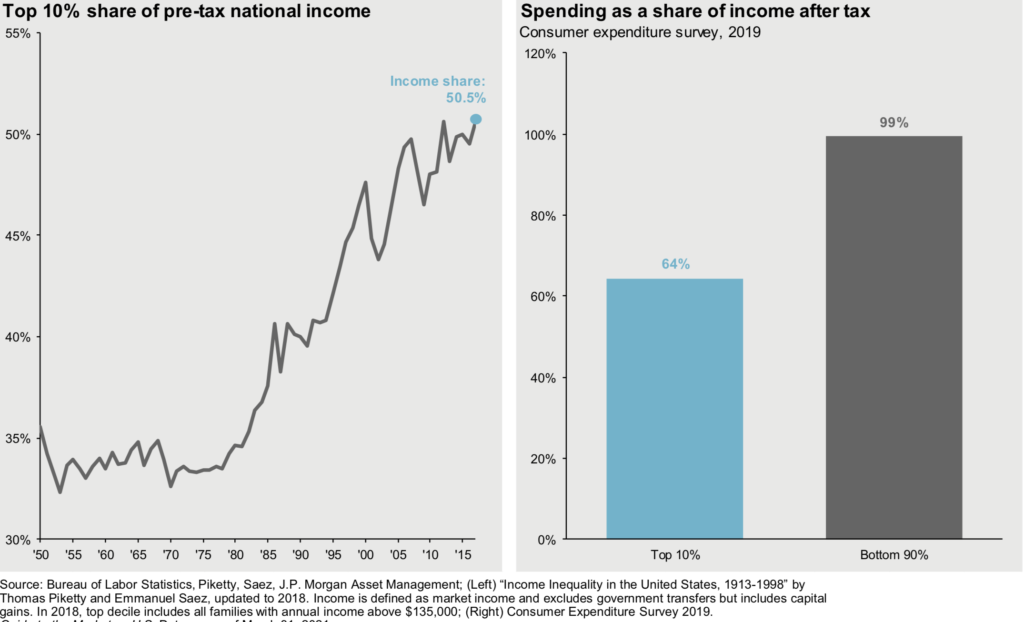

Income inequality in the U.S. is on the rise.

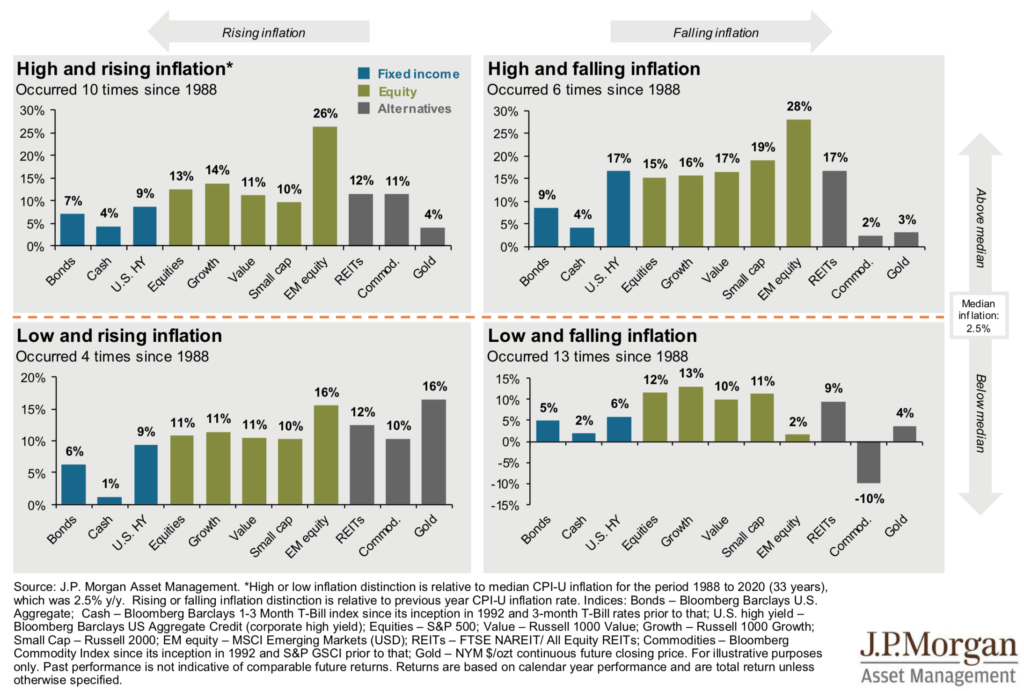

Worried about higher inflation? Check out the bottom left square showing how different investments perform when inflation is low and rising. Interesting to note that gold is struggling this year. I don’t think it’s a worthwhile investment. There are other asset classes that do well in low and rising inflation, notably stocks and real estate, with more consistent returns in other environments also do well in other environments.

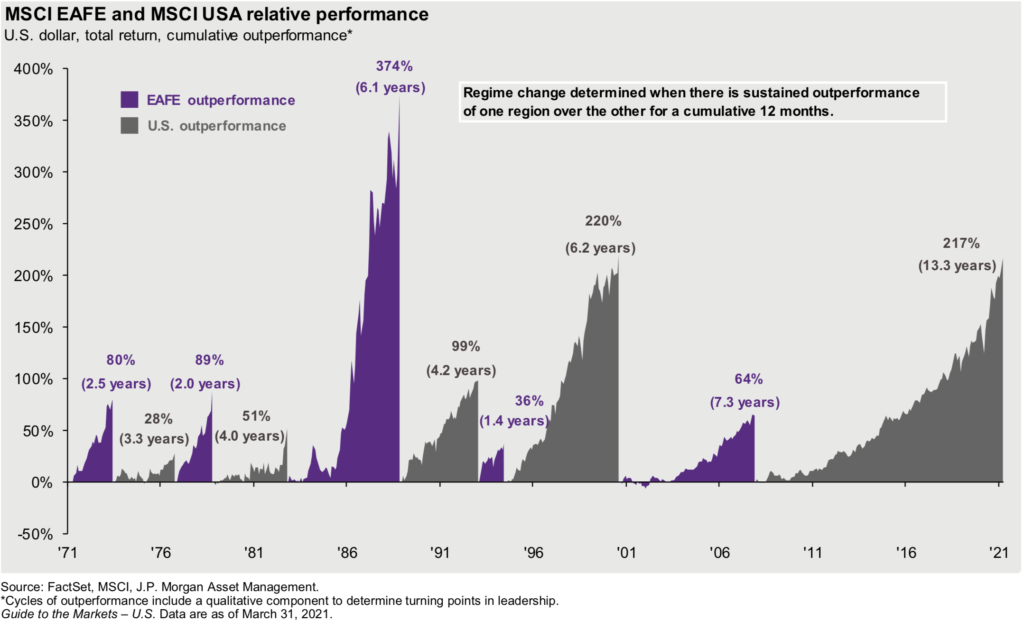

Showing that U.S. stocks and International stocks take turns outperforming.

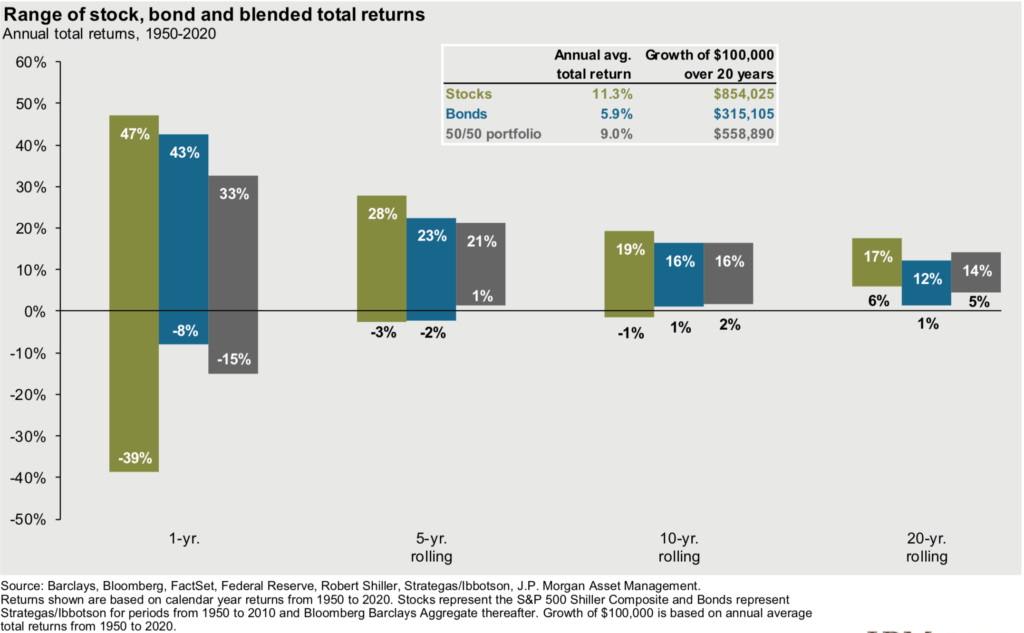

Another favorite. Don’t let short-term volatility shake you out of earning the market’s long-term returns.

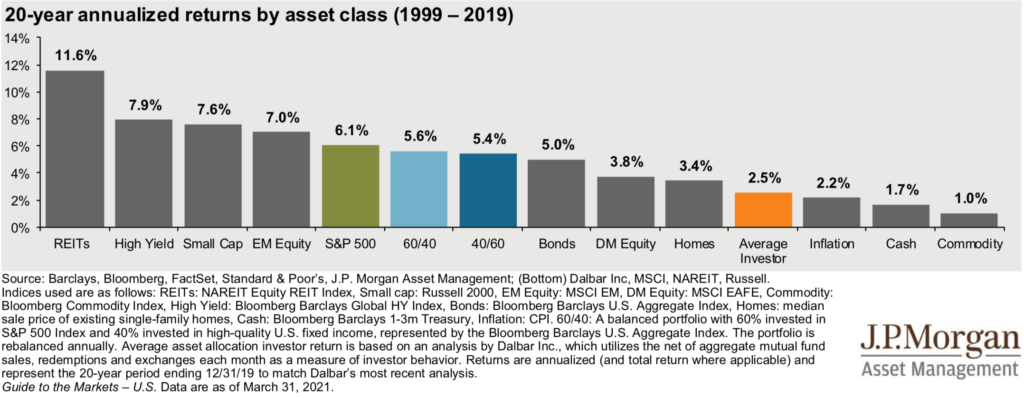

Patience continued…the average investor underperforms almost every type of investment by poor timing decisions and chasing winners.

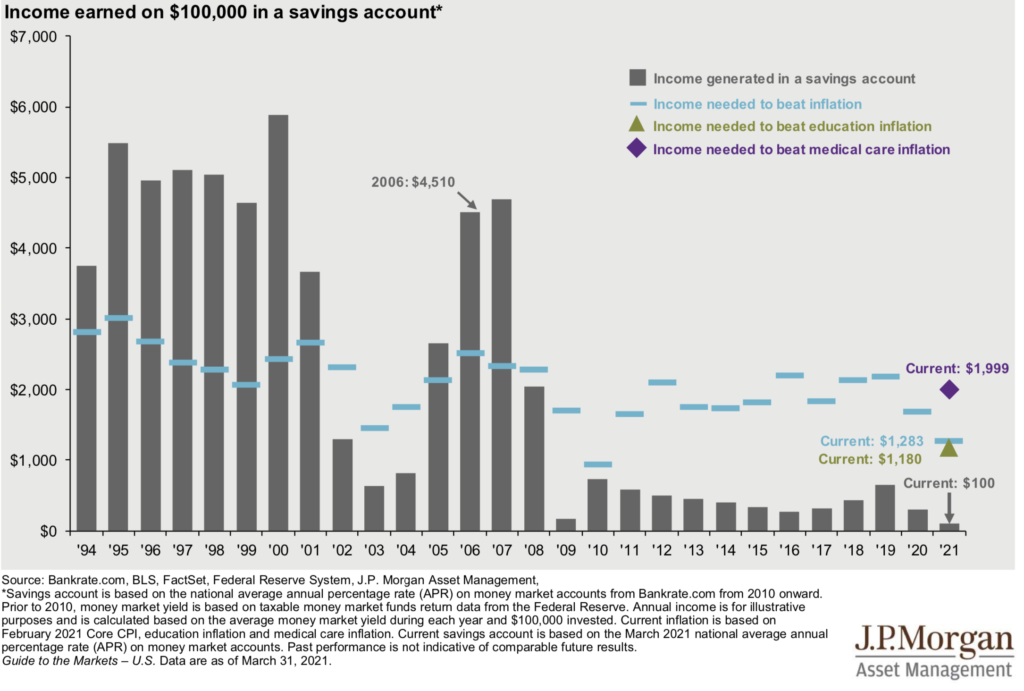

It’s been a long time since cash at least kept pace with inflation, and it’s really lagging now. Get that cash to work if it should be invested.

______________________________________________________________________________________________________________

Suggested Further Reading

Looking for more information on some of the Q1 2021 market guide topics, check out:

Investment Winners Rotate…and they’re doing it again