2 Tesla Investment Lessons

Elon Musk is the the richest person in history after Tesla stock’s monster gains turned it into a trillion dollar company.

Tesla has been a controversial stock for years. Is it the cult stock of an unprofitable company or a way to profit on a transformational future?

I know great stock pickers who are short the stock.

I know people who don’t short or own it.

And I know folks who have owned some from time to time.

I don’t know anyone who rode it to riches like Musk.

But a story stock like Tesla helps illustrate two investment lessons:

- The S&P 500 is not a passive investment strategy. It’s an actively managed index, and its committees’ decisions caused investors in S&P 500 index funds to miss Tesla’s monster run.

- The way the S&P 500 is constructed can cause you to buy high on an investment.

The Background

The S&P 500 is an index of large publicly traded American stocks.

People consider it the stock market.

It’s market-cap weighted, which means that as a stock’s total market value increases (shares outstanding times the share price) it becomes a bigger index component.

Tesla went public on June 29, 2010. It was added to the S&P 500 on December 21, 2020.

Tesla Investment Lesson One

The S&P 500 index isn’t as passive an investment strategy as you’ve been led to believe.

Sometimes that is to index investors’ benefit, and sometimes it’s not. With Tesla it was not.

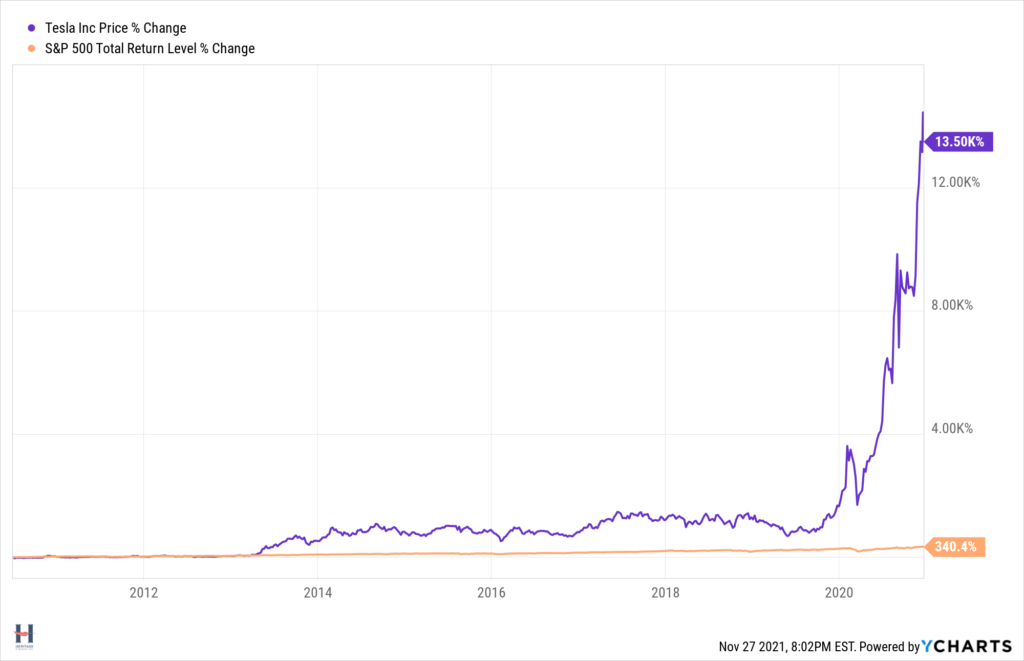

From June 29, 2010 through December 21, 2020, when S&P 500 investors didn’t own Tesla it annihilated the S&P 500.

13,500% to 340%.

$10,000 invested in Tesla would have grown to $1.36 million versus $44,000 in the S&P 500.

You missed that growth if you expected your S&P 500 index fund to provide you passive exposure to the largest 500 U.S. companies.

But the index doesn’t work that way. Standard & Poor’s has a 48 page selection methodology for its indexes.

For the S&P 500, you have to be large enough (which Tesla was back in 2013), profitable for four quarters (it wasn’t until 2020), have enough share liquidity, and meet certain governance criteria.

So, Tesla didn’t get in until 2020. It could have been in seven months earlier, but concerns over its strong run caused the committee to delay. That delay hurt index investors since during those months it outperformed the S%P 500 210.4% to 19.99%.

“Some might think – incorrectly – that S&P methodology for index inclusion is based solely on meeting specific quantifiable benchmarks. But human decision-making – with its nuances and biases – are part of the process sometimes as well.”

Why Tesla took so long to get into the S&P 500 — and what that means for other companies by Ethan Wolff-Mann

Tesla Behaving Badly

Now don’t get me wrong, there were good reasons not to own Tesla.

It didn’t have the financial performance to justify its wild run and was valued more than the next nine largest automakers combined at one point.

Tesla’s market cap tops the 9 largest automakers combined — Experts disagree about if that can last.

Musk himself talked down the stock.

And Musk is kind of bonkers with a penchant for earning negative attention.

Analysis: Elon Musk is hurting Tesla with his bizarre behavior

The 16 most bizarre things Elon Musk has said he believes

Elon Musk’s Increasingly Erratic Behavior Comes at a Price for Tesla Shareholders

But in this instance, the active selection criteria for the index and then the active human decisions temporarily overriding that criteria hurt index investors.

Tesla Investment Lesson Two

The S&P 500 committee didn’t buy low on Tesla. But eventually they added the stock because it met the criteria and the delayed addition raised questions.

And because the index is market cap weighted, it started as a top ten position. It will be great for S&P 500 index investors if the stock continues to outperform, or at least match the market’s performance.

But it also rode an incredible momentum driven wave to get where it is, somewhat divorced from the company’s fundamentals. I’m not trying critique Tesla stock since it’s done well for its investors and understanding how the index works is more my point, but it’s fair to highlight that the top ten holding you were forced to buy high in your index fund has a P/E ratio of 362. That means you are paying $362 for $1 of earnings in the company stock. That makes it twelve and half times more expensive than the S&P 500 index as a whole.

In this situation, I don’t think the committee’s approach and entry point helped index investors out.

Suggested Further Reading

The Easiest Way to Increase Your Investment Returns